KGI DAILY MARKET MOVERS – 2 September 2021

Market Movers | Trading Dashboard

Market Movers

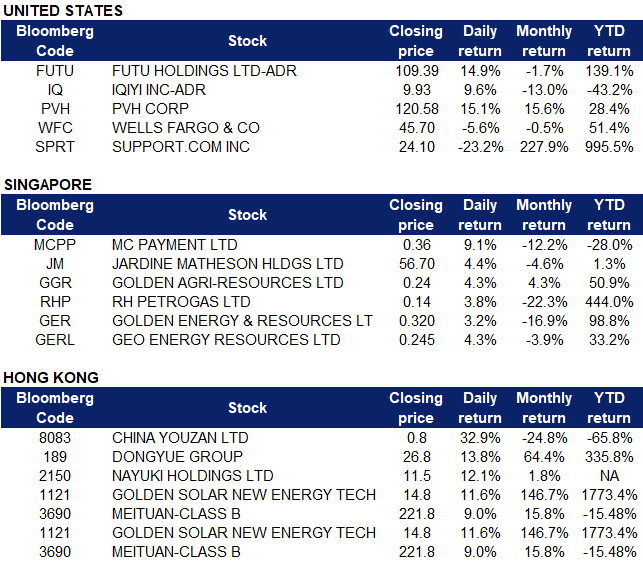

United States

- Futu Holdings (FUTU US) shares were up 14.92% at closing on Wednesday following the online stock-trading platform company’s release of second quarter results on Tuesday. Revenue of $203.1 million in the quarter was a 129.3% increase from a year ago, making this the sixth straight quarter the company posted triple digit sales growth. Futu’s meteoric rise saw total trading volume grew by 104.3%, as the trading app surpassed 15 million users, particularly in Singapore and Hong Kong.

- iQiyi (IQ US) shares surged 9.6% to close at $9.93 on news regarding a piece of new hardware by the Chinese tech company. iQiyi unveiled its latest virtual reality (VR) headset, the QIYU 3 in a live streamed event. The device’s iQUT feature cinema provides a 2,000-inch screen that can match the collective display of 20 80-inch televisions. Additionally, the QIYU 3 can run video standards such as 4K, 3D and 8K at 60 fps. The QIYU 3 will be available starting 3 September on Chinese e-commerce websites JD.com and Tmall.com.

- PVH Corp (PVH US) shares surged 7.8% in the premarket before closing 15.07% higher at $120.58 after the parent company to brands Tommy Hilfiger and Calvin Klein reported quarterly earnings, with a $182 million profit, compared to losses of $15.7 million last year. Adjusted quarterly earnings per share were at $2.72, above estimates of $1.20. The company also raised its full-year revenue forecast. CEO Stef Larsson said that consumers’ new demand for mixing casual and going-out clothing styles has given PVH a tailwind.

- Wells Fargo (WFC US) extended their losses from Tuesday, falling another 4.92% as scandals from five years ago continue to plague the company. Bloomberg reported on Tuesday that the U.S. Office of the Comptroller (OCC) of the Currency and the Consumer Financial Protection Bureau (CFPB) have warned Wells Fargo that new sanctions may be put in place as they were not satisfied with the slow pace at which the bank is working to compensate victims. Examiners at the OCC are among those expected to testify against former Wells executives later this month.

- Support.com (SPRT). The stock recently achieved its “meme stock” status, and was down 23.15% at closing on Wednesday, following its double-digit decline in Tuesday’s trading. There was no company specific news. Despite the sharp pullback in the past few days, the stock is still up roughly 990% YTD.

Singapore

- MC Payment Limited (MCPP SP) Shares rose by 9.1% yesterday, even though there was no company specific news. Shares could have risen due to the overall positive sentiment on digital banking and payment. The Business Times published yesterday that Singapore fintech FOMO Pay had obtained new licenses from the Monetary Authority of Singapore (MAS) to operate three new regulated activities. Merchants will be able to leverage FOMO Pay’s services to accept and process payment transactions. FOMO Pay will also be able to carry out local money transfer services in Singapore for its clients, as well as facilitate transactions with digital payment tokens – including cryptocurrency and the central bank digital currency (CBDC). As of yesterday’s closing price, shares have risen 12.9% from its all-time low of S$0.32 in mid-June.

- Jardine Matheson Holdings Limited (JM SP) Shares rose by 4.4% yesterday after the heavy sell-off the previous day due to the MSCI Singapore Index rebalancing. The rise in share price was likely due to a technical rebound, as RSI dipped below 30 in the last 2 weeks of August. Shares of Jardine, which gets more than half of its annual revenue from Southeast Asia, dropped 8.6% last month, ranking it among the worst performers in the Straits Times Index. Concerns over the delta variant have punctuated a stark turnaround for the stock, which surged 25% in March on a restructuring plan.

- RH Petrogas Limited (RHP SP) shares rose by 3.8%. There was no company specific news, however the rise in share price could have been in tandem with the recent rebound in oil prices as Hurricane Ida disrupted US oil production and gasoline supplies. Analysts expect that the storm could result in a 5% to 10% increase in gasoline prices for some consumers ahead of Labor Day weekend with the market weighing the impact of the hurricane on supplies of both oil and gasoline.

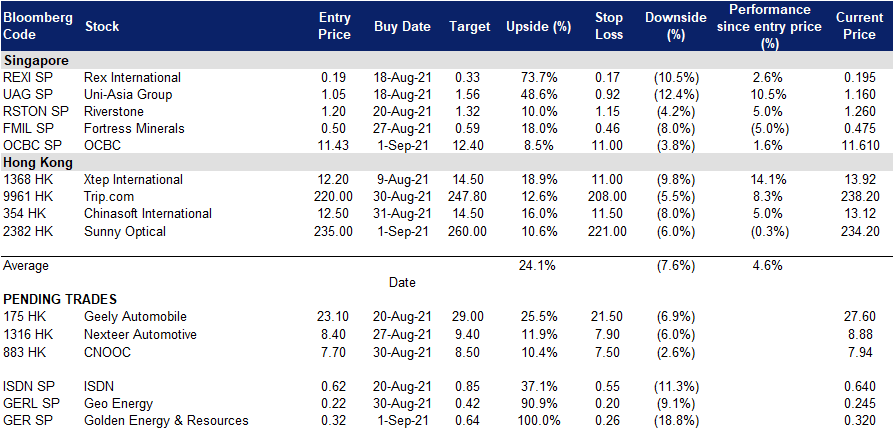

- Golden Energy & Resources Limited (GER SP), Geo Energy Resources Limited (GERL SP) Golden Energy’s shares rose by 3.2% yesterday, while Geo Energy’s shares rose by 4.3%. There was no company specific news, however the rise in share price could be due to the rise in coal prices. ICI 4 (4,200 GAR) Indonesian Coal Index Futures traded higher amid soaring electricity demand, infrastructure woes and a surge in global gas prices. We currently have an OUTPERFORM recommendation on Golden Energy & Resources and a DCF-backed TP of S$0.64, representing an upside of 100% from yesterday’s closing price of S$0.32. This week, we also upgraded Geo Energy to OUTPERFORM as we raised our TP to S$0.42, representing an upside of 71.4% from yesterday’s closing price of S$0.245. Read our company update here.

- Trading Dashboard: Add OCBC (OCBC SP) at S$11.43

Hong Kong

- Legend Holdings Corp (3396 HK) Shares closed at a 52-week high. The company announced 1H21 interim results. Revenue increased by 24% YoY to RMB228.6bn. Net profit attributable to equity holders of the company jumped by 636% YoY to RMB4.7bn. The stellar growth was due to the increase in the profit margin of the IT segment and better returns from investments. HSBC raised TP to HK$16.8 from HK$15.7 and maintained a BUY rating.

- Yihai International Holding Ltd (1579 HK) Shares rebounded from the 52-week low. There was no company-specific news. Previously, the company announced 1H21 interim results. Revenue increased by 18.6% YoY to RMB2.6bn. Gross profit dropped by 2.1% YoY to RMB864mn. Net profit attributable to the owners of the company dropped by 12.6% YoY to RMB348.8mn.

- XD Inc (2400 HK) Gaming sector jumped. This could be a technical rebound as the whole sector was sold-off due to the latest regulations which restricted the gaming time for minors. Previously, the company announced 1H21 interim results. Revenue dipped by 4.3% YoY to RMB1.4bn. Gross profit dropped by 18.1% YoY to RMB676.7mn. Loss profit attributable to the owners of the company was RMB325.1mn compared to a net profit of RMB206.5mn during the same period last year.

- Haier Smart Home Co Ltd (6690 HK) Shares closed at a two-month high. The company announced 1H21 interim results. Revenue increased by 16.6% YoY to RMB111.6bn. Net profit attributable to equity holders of the company jumped by 146.4% YoY to RMB6.9bn.

- Flat Glass Group Co Ltd (6865 HK) Shares corrected from the 52-week high. Photovoltaic sector corrected. Funds rotated back to the value sector after China released the August Manufacturing PMI which was below expectation.

Trading Dashboard

Related Posts: