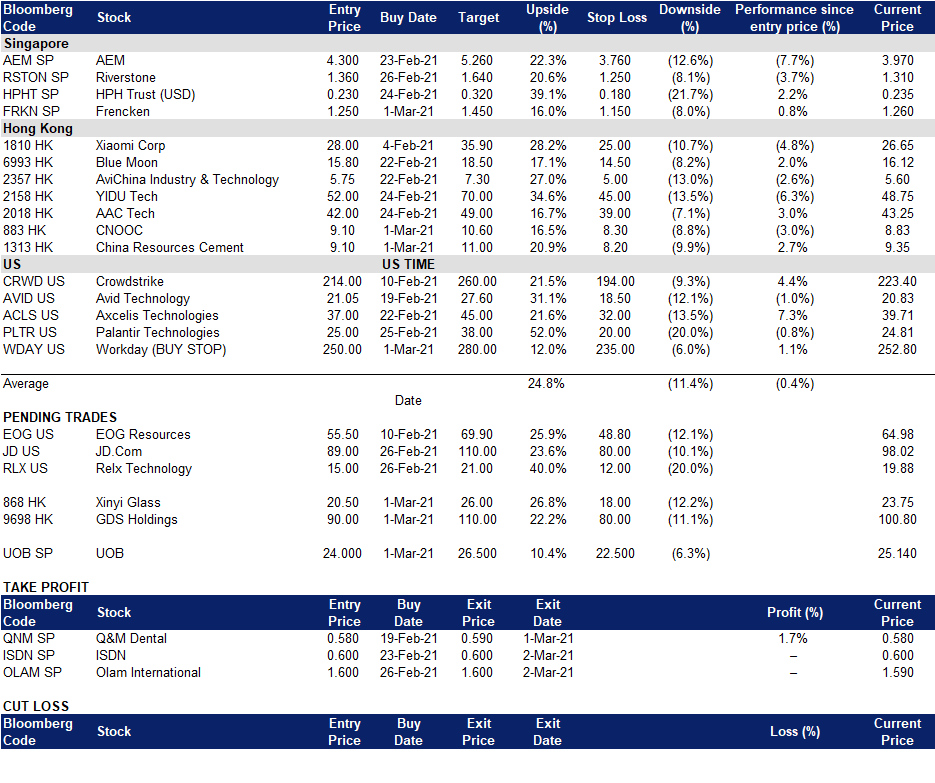

KGI DAILY MARKET MOVERS – 2 March 2021

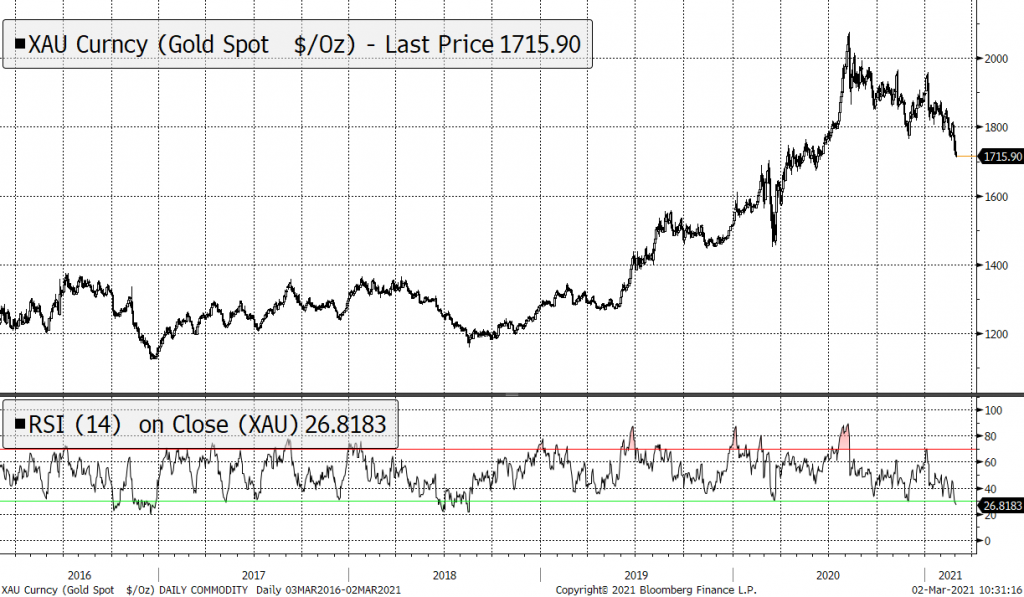

Commodity Movers – Gold Futures

Gold prices have fallen for a sixth straight session on Tuesday, dropping to an eight-month low of US$1,715. It ended last week lower by 2.7%, following a drop of 2.5% in the prior week, and finishing February down by 6.6%. That would make last month the worst month since November 2016.

The technical picture has not been positive, with gold making lower highs and lower lows since hitting a high of US$2,063 in early August 2020. However, price momentum and relative strength indicators have declined from overbought conditions to oversold readings at the end of February 2021.

Market Movers – What’s Hot

United States

- Riot Blockchain (RIOT US) +22.5% to close at US$53.58. Bitcoin (BTC) rose 6% on Monday to US$48,000 on the recovery of risk assets and following a report from Citi considering that BTC is now at a tipping point that could make it the preferred currency for international trade.

- Zoom (ZM US) +9.7% to close at US$409.66 after a 4Q20 earnings beat and positive 1Q21 guidance that indicated that the work from home tailwinds will continue into 2021. ZM reported 4Q20 EPS of US$1.22, above street estimates of US$0.79.

- Boeing (BA US) +5.8%, closing at US$224.39, as the travel and leisure sector benefits on positive news from the vaccine front. Airlines such as United Airlines (UAL) have recently said it was adding 25 planes to its order for BA’s 737 MAX jet and speeding up delivery schedules in order to position itself ahead of the recovery in travel. Saudi Arabian Airlines also plans to order 70 planes from BA and Airbus, according to local media sources.

- Apple (AAPL US) +5.4%, closing at US$127.83 on news that it will reopen all its 270 US retail stores for the first time since March 2020, an indicator of improving retail sentiments.

- Palantir (PLTR US) +3.8% to close at US$24.81. Cathie Wood’s ARK Innovation ETF bought 2.5mn shares and ARK Next Generation Internet ETF acquired around 0.9mn shares last Friday. Shares have been under selling pressure last week following the expiry of the lockup period where it released 80% of insider shares for trading.

Earnings Watch: Target (2 Mar), Hewlett Packard (2 Mar), Kohls Corp (2 Mar), Trip.com (3 Mar), Broadcom (4 Mar), Costco (4 Mar), Kroger (4 Mar).

Hong Kong

- Hua Hong Semiconductor Ltd (1347 HK) +10.85%, closing at HK$52.6. Shares were trading higher due to a technical rebound after dropping for seven consecutive days. The two sessions, Chinese People’s Political Consultative Conference (CPPCC) on 4 March and the 13th National People’s Congress (NPC) which will be held the following day, are expected to reveal further support for the domestic semiconductor industry. Investors are confident that the company is one of the few listed companies benefiting from both capital and technology support.

- Ganfeng Lithium Co., Ltd. (1772 HK) +10.69%, closing at HK$110.3. The company announced FY20 full year results where revenues grew by 3.4% YoY to RMB5.5bn, and net profits grew by 175% YoY to RMB985mn. The phenomenal growth was due mainly to the increase in production and sales volume of the lithium salt products and gain on change in the fair value of financial assets.

- Fuyao Glass Industry Group Co Ltd (3606 HK) +10.29%, closing at HK$52.5. Shares corrected from the new high of HK$68.9 to the last closing of HK$47.6 over the past two weeks. The jump is a technical rebound as the fundamentals are still sound. Float glass prices remain buoyant in China.

- Pop Mart International Group Ltd (9992 HK) +8.4 %, closing at HK$97.45. The stock will be included in the Hang Seng Composite Index in March, and inclusion in China-Hong Kong connect is expected soon.

- BYD Co Ltd (1211 HK) +8.01%, closing at HK$213. In the latest Berkshire Hathaway’s letter to shareholders, Warren Buffett owned 8.2% stake in BYD. The past two weeks’ correction has wiped out YTD gains.

Singapore

- Nanofilm (NANO SP) +3.7% to S$5.04 in early morning trade today following the release of strong full-year results last Friday. FY2020 earnings surged 61% YoY to S$57.6mn as management maintained a positive outlook. The group’s second plant in Shanghai commenced operations in February 2021. Consensus has maintained an overweight/outperform rating on Nano, with Macquarie upgrading its latest target price to S$5.90 from S$5.40 previously.

- Avarga (AVARGA SP) +3.1% to S$0.335 this morning on potential bargain hunting after the release of strong full-year earnings. FY2020 profits rose 68% YoY to S$54.8mn. We also note that AVARGA’s Canadian-listed subsidiary, Taiga Building Materials (TBL CN), is trading at all-time highs, which should lend support to AVARGA’s share price. AVARGA announced a final dividend of 0.78 Sing cents, up from 0.50 Sing cents in FY2019.

- ISDN (ISDN SP) +7.1% to S$0.60 this morning after it reported that 2H2020 profits increased 64% YoY to S$9.6mn. The company saw broad-based demand across all markets for its industrial automation solutions. ISDN has proposed a final dividend of 0.8 Sing cents per share, an increase from 0.4 Sing cents in 2019.

- SPH (SPH SP) -8.6% to close back at S$1.28 yesterday, giving up most of the gains from Last Friday. Shares of SPH had surged by 9% last Friday on media reports that it could potentially see strong returns from its investment in South Korean e-Commerce firm Coupang. However, it was later clarified that its indirect stake in Coupang is estimated at only 0.1% and that it had invested US$3.9mn in 2014 via a special purpose vehicle. On a potential valuation of US$50 bn for Coupang, SPH’s stake would be worth US$50mn.

Trading Dashboard