KGI Daily Market Movers – 18 February 2021

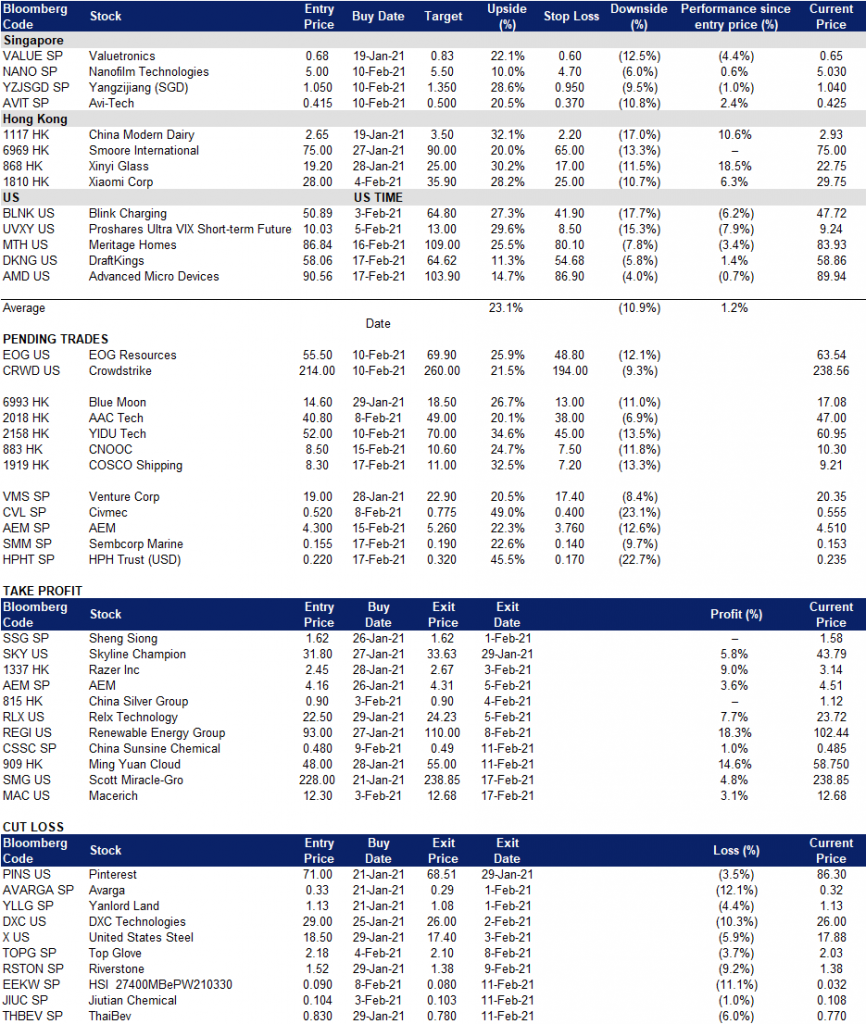

Cryptocurrency – Bitcoin Futures

Bitcoin (XBTUSD/BTC): Institutional Interest Rising

- Following Tesla’s US$1.5 bn investment into BTC, Blackrock – the world’s largest asset manager with US$8.7 trillion in AUM (as of end-2020) – has started to dabble in bitcoin.

- BTC is now trading above US$52,000 and has a total market capitalisation of more than US$950 billion (as of 18 February 2021), which is 6x more than what it was in the prior-year period.

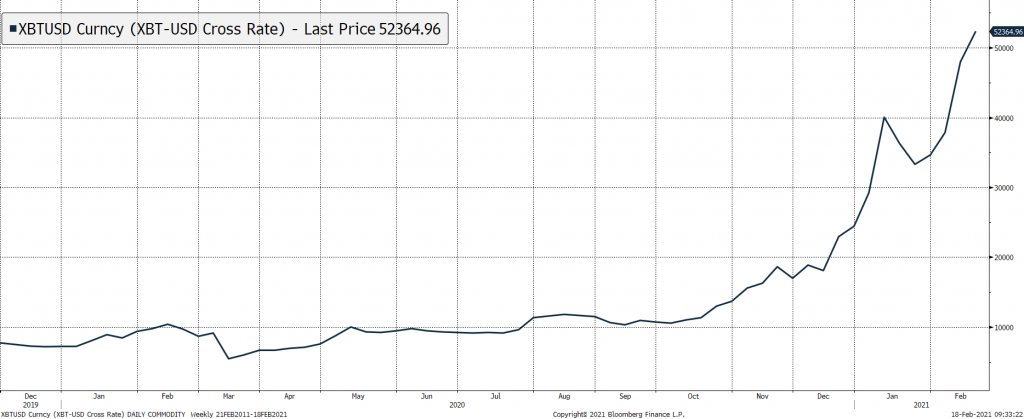

Commodities – Copper

Copper prices are at its highest level since 2012, and is reinforcing the macro reflation trade that is lifting prices across many other commodities. Increasing demand is evident among other industrial (iron ore) and soft (palm oil and soybeans) commodities where prices are reaching 5-10 year highs.

Products to trade: Shanghai International Energy Exchange (INE) International Copper Futures

Market Movers – What’s Hot

United States

- Cryptocurrency-linked stocks extend gains as Bitcoin touches the US$52,000 mark, with Riot Blockchain (RIOT US) and Marathon Patent (MARA US) at new highs.

- Quantumscape (QS US) +31.4% closing at US$66.52 after earnings results where the company announced plans to build a battery plant in California.

- Warren Buffett’s purchases saw gains in a choppy day of trading, with Verizon (VZ US) +5.2% closing at US$56.99 and Chevron (CVX US) +3% closing at US$95.92.

- Trading Dashboard: We take profit on Scotts Miracle-Gro (SMG US) and Macerich (MAC US) to make room for DraftKings and AMD. We lower stop loss on UVXY to 8.5

- Earnings watch: Thu 18 Feb – WMT/AMAT/ROKU/TRP/WM/MAR/TTD/GOLD/ANET/EPAM/APPN/FVRR/DBX/RDFN/TRIP

Hong Kong

- New IPO Performance – New Horizon Health Ltd (6606 HK): IPO was priced at HK$26.66. In early morning trade today, the stock opened at HK$76, traded to a high of HK$79.6, low of HK$70, and currently at HK$75.

- Yeahka Ltd (9923 HK) +26.44%, closing at US$121. China Youzan Ltd (8083 HK) +15.38%, closing at US$4.5, Yidu Tech Inc (2158 HK) +7.63%, closing at HK$62.35. The SaaS sector continues to attract fund flows. Citi Group issued a China e-commerce sector report that states a bullish view on SaaS companies.

- HengTen Networks Group Ltd (136 HK) +8.27%, closing at HK$16.5.The bullish momentum continues as investors believe the southbound funds will chase when China-Hong Kong connect resumes on Thursday, 18 Feb.

- ZhongAn Online P & C Insurance Co Ltd (6060 HK) +7.43%, closing at HK$78.8. The bullish momentum continues as investors believe the southbound funds will chase when China-Hong Kong connect resumes on Thursday, 18 Feb.

Singapore

- Lion-OCBC Securities Hang Seng Tech ETF (HSS SP) +2.7% to S$1.823 on strong performance of Hong Kong technology companies. The ETF has gained 8% over the last five days as constituent stocks such as Tencent, Alibaba and JD.Com have risen in the post-CNY rally. Other constituent stocks include Sunny Optical, Meituan Dianping, Xiaomi and SMIC. Launched in July 2020, the ETF tracks the largest 30 tech-related companies listed in Hong Kong, and only allows an 8% maximum weighting for each stock.

- Bukit Sembawang (BS SP) +4.2% to S$4.49 on increased research coverage of the stock. Two research houses have initiated BUY recommendations on the stock over the last four months, with target prices in the range of S$5.44 – S$5.57. The key investment thesis banks on the undervaluation of the company’s land bank, which it will eventually monetise through property development.

- Other market movers (as of 17 Feb close): HPH Trust (HPHT SP; -7.8%; US$0.235) after ex-div of 7.7 HK cents, Raffles Medical (RFMD SP; -3.0%; S$0.97); Sarine Tech (SARINE SP; -6.3%; S$0.595)

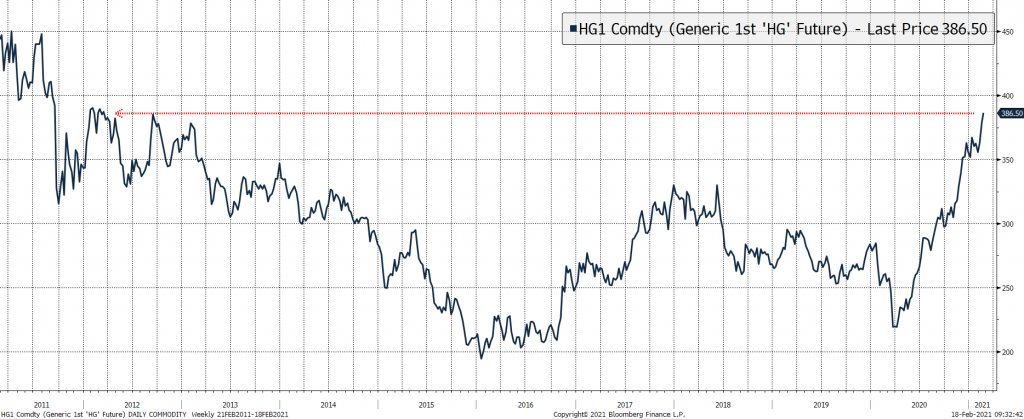

Trading Dashboard