KGI DAILY MARKET MOVERS – 17 August 2021

Market Movers | Trading Dashboard

Market Movers

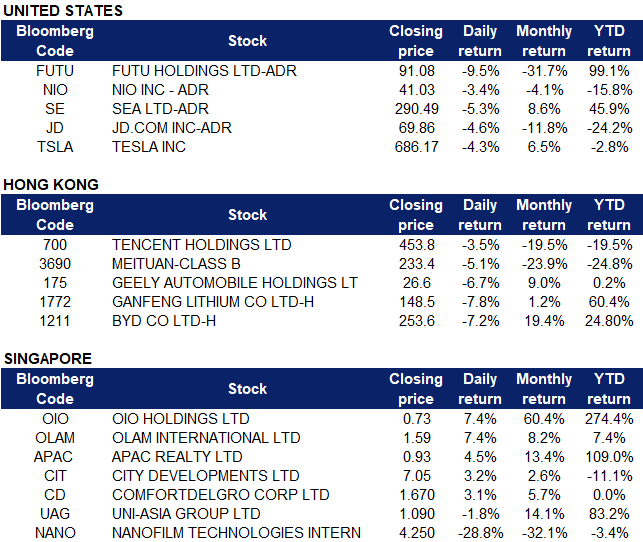

United States

- Tesla (TSLA US) shares closed 4.32% lower on Monday after the National Highway Traffic Safety Administration (NHTSA) said that it had launched a formal safety probe into Tesla’s Autopilo hands-free driving system after a series of crashes involving emergency vehicles. The regulator has opened at least 30 special crash investigations involving Tesla cars that it suspected were linked to Autopilot, with the pace of probes picking up under the Biden administration.

- Futu Holdings (FUTU US) stocks dropped 9.46% to $91.08 as Chinese companies listed on U.S. exchanges continue to face considerable regulatory risks. There was no company specific news. Futu is set to report second quarter financial results on Tuesday, 31 August 2021.

- NIO (NIO US) stocks were down 5.87% after news of two fatal accidents involving Nio vehicles drew the attention of the Chinese government. Securities Times, a state-owned business newspaper ran an editorial on the two incidents, hinting that additional regulation of “smart electric vehicles” may be forthcoming if EV companies do not “focus more on essential work involving personal safety”.

- Sea Limited (SE US) stocks dropped 5.29% on Monday, despite positive company related news. Investment firm Tiger Global added more than 600,000 shares to its stake in the company, while Cowen analysts maintained their outperform rating and raised their target price from $280 to $345. Sea Limited is set to release second quarter earnings on 17 August; analysts are expecting 50% revenue growth to $1.93 billion and per-share loss to narrow to $0.52.

- JD.com (JD US). Shares of China’s largest online retailer were down 4.57% on Monday. China’s retail sales grew by 8.5% YOY in July, which was below the 11.5% growth that analysts had expected. Additionally, China’s online sales grew by only 4.4%, a significant difference from the 21% the e-commerce industry had enjoyed over the past few years, signalling that JD.com’s expansion pace might be decelerating. JD.com is set to release earnings on Monday, 23 August 2021.

Singapore

- Uni-Asia Group (UAG SP). UAG reported a 1H2021 profit of US$7.0mn, reversing from the US$3.9mn loss in 1H2020. The reversal was mainly on the back of the 49% YoY surge in charter income. Its balance sheet continues to improve, such that UAG was able to declare a 2.0 Sing cents dividend for 1H2021 (vs no interim dividend last year). Valuations are attractive amid the stronger-than-expected bulk carrier upcycle. Thus, we maintain our Outperform rating and raise our TP to S$1.56 (from S$1.42 previously). Our TP implies a 0.7x FY2021F P/B, which is still a conservative 30% discount to international peers who are trading above 1.0x P/B. Read the full report here.

- OIO Holdings Limited (OIO SP). Shares rose by 7.4% yesterday and closed at an all-time high. The company announced its 1H21 results last Thursday, 12 August. Even though losses widened by 68.7% YoY to S$638k, revenue surged by 142% YOY to S$1.6mn, backed by a 276% jump in blockchain business revenue. Gross profit margins also increased from 59.4% to 75.3% in 1H21. Losses were mainly attributable to promotional expenses, non-cash impairment due to the weaker crypto market in June and higher staff related costs. Investors could have a positive outlook on the company, given that Moonstake was only acquired on 31 May 2021, but has already added S$1.2mn (recurring and non-recurring) to OIO’s 1H21 revenue. In addition, Bitcoin has been on an uptrend since mid-July, which could also have boosted investors’ confidence in the company’s potential in the quarters ahead.

- Olam International Limited (OLAM SP). Shares continued to rise from last Friday after the company announced positive 1H21 earnings results. Revenue increased by 33.7% YoY to S$22.8bn in 1H21, while operating PATMI surged by 116.0% YoY to S$436.6mn, its highest since inception. Read the full results here. In addition to the outstanding results, the company also announced that Olam Food Ingredients intends to seek primary listing on the London Stock Exchange, with concurrent listing in Singapore, and is on track for an IPO in 1H22. The company declared an interim dividend of 4.0 Sing cents per share, an increase from 1H20’s dividend of 3.5 Sing cents. As Ex-Date is scheduled to be on 20 August, investors are likely buying in to enjoy the dividend payout, which is expected to be on 30 August.

- APAC Realty Limited (APAC SP). Shares continued to rise from last Friday after the company announced positive 1H21 earnings results on Thursday, 12 August. Revenue increased to S$358.4mn in 1H21, a YoY increase of 107.4%, while profit surged by 120.2% to S$17mn. Strong revenue growth was underpinned by the strong demand from local buyers in a buoyant Singapore residential property market, where the private residential resale market recorded sales of 10,090 units in 1H2021, an increase of 228.6% from 3,071 units in 1H2020, while the HDB resale market grew 57.1% to 14,644 units in 1H2021 from 9,319 units in 1H2020. Read the full results here. The Edge also featured APAC Realty yesterday, where CGS-CIMB Research Analyst, Lock Mun Yee is maintaining ADD on the company, with a raised TP of 96 Sing cents, up from 94 Sing cents previously. DBS Group Research Analyst Ling Lee Keng is also maintaining BUY on APAC Realty, with a higher TP of S$1.05 from 74 Sing cents previously. In addition, the company declared an interim dividend of 3.5 Sing cents per share and a special dividend of 3.0 Sing cents per share. As Ex-Date is scheduled to be on 30 August, investors are likely buying in to enjoy the dividend payout, which is expected to be on 9 September.

- City Developments Limited (CIT SP). Shares rose by 3.2% yesterday and closed at a one-month high. Even though the company reported losses of S$32.1mn last Thursday (12 August), revenue increased by 11.1% to S$1.2bn in 1H21. Losses were largely due to higher tax expenses as there was an absence of a substantial deferred tax credit of S$17.6mn recognised in 1H 2020, which was part of the New Zealand government’s COVID-19 Business Continuity Package. In addition, negative goodwill of S$35.6mn was recognised after the company’s acquisition of an 84.6% equity interest in Shenzhen Tusincere Technology Park Development Co. Ltd in February 2021. The Edge featured City Development last Friday where Macquarie Research kept its OUTPERFORM call with a higher TP of S$9.55. Similarly, Daiwa Capital Markets, and UBS Global Research kept their BUY calls with higher TP of S$9.35 and S$9.70 respectively. Several of the analysts believe that the worst is over for CDL, with stronger performance expected in 2H21. The analysts also view CDL’s share price as undervalued. Unpacking the company’s results, investors might still be hopeful for a second-half rebound.

- ComfortDelgro Corporation Limited (CD SP) Shares rose by 3.2% yesterday and closed at a one-month high. The company announced positive 1H21 earnings results on Thursday, 12 August, where revenue increased by 13.6% YoY to S$1.74bn as global economic activity gradually resumed amidst the ongoing global pandemic. Excluding the various Government relief packages, the group turned in an operating profit of S$77.4mn in 1H21 compared to a loss of $76.5mn in 1H20. Read the full results here. In addition, the company declared an interim dividend of 2.1 Sing cents. As Ex-Date is scheduled to be on 20 August, investors are likely buying in to enjoy the dividend payout, which is expected to be on 2 September. Comfortdelgro also announced yesterday that it is pursuing an IPO on the Australian Securities Exchange for its wholly-owned subsidiary, ComfortDelGro Corporation Australia Pty Ltd (CDC).

- Trading Dashboard: Add Innotek (INNOT SP) at S$0.85. Remove Don Agro International (DAG SP) at S$0.395 and Silverlake Axis (SILV SP) at S$0.265. Cut loss on Rex International (REXI SP) at S$0.20.

Hong Kong

Hong Kong listed stocks dropped amid concerns that the resurgence of COVID-19 cases in mainland China will dent investor’s appetite for risk. The emergence of government reports on Monday signalled that the Chinese economy will continue to face an unstable course, and lose even more momentum.

- Chinese automobile manufacturers led the decline with BYD (1211 HK) dropping 7.2% and Geely Auto (175 HK) dropping 6.7% to $26.55. Car production slumped in the first ten days of August 2021, said the China Association of Automobile Manufacturers citing the pandemic and bad weather for factory disruptions.

- Tencent (700 HK) dropped 3.49% to $453.80. There was no company specific news today; however, the company is still suffering from media commentary taking stabs at tech companies. Tencent is expected to release its earnings on Wednesday. Analysts are expecting the company’s net income for the second quarter to fall 7.8% YoY.

- Meituan (3690 HK) dropped 5.14% to $221.40. The stock saw HK$851mn of Southbound Trading outflows and short-selling ratio of 8%. There was no company specific news that drove the selling pressure but investors are likely staying on the sidelines to see what the impact of the policy crackdown will have on revenue guidance for companies like Meituan.

- Ganfeng Lithium (1772 HK) dropped 7.76% to $148.50. The chip shortage impacting the auto sector continues to deteriorate, made worse by companies in China that are hoarding and inflating prices. There are media reports stating that the average price of auto chips have soared between 10 and 20 times. Bloomberg reports that the global chip shortage is expected to cut car sales by around 3.9mn units in 2021.

Trading Dashboard

Related Posts: