KGI DAILY MARKET MOVERS – 16 September 2021

Market Movers | Trading Dashboard

Market Movers

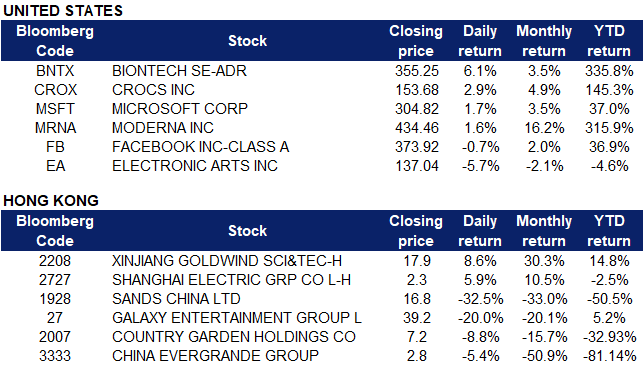

United States

- Electronic Arts (EA US) stocks dropped 5.73% after rumors emerged that the company has delayed the launch of the game Battlefield 2042. Battlefield 2042 is the latest game to be delayed in part due to difficulties created by the pandemic. “We’ve made the decision to shift the launch of Battlefield 2042,” said the company in a tweet to address the rumors. “The game will now be released worldwide on November 19, 2021.” The stock rose 2.79% in postmarket trading following this news.

- Microsoft (MSFT US) stocks climbed 1.68% after the company announced a $60 billion share repurchase plan, days after two U.S. Senate Democrats unveiled a proposal to tax corporate stock buybacks to help fund President Joe Biden’s $3.5 trillion investment plan. The company also announced an 11% dividend hike, raising its quarterly payout to 62 cents per share from 56 cents. Microsoft shares have soared about 35% this year, making it the second most valuable company in the world with market capitalization of $2.25 trillion.

- Facebook (FB US) shares dropped 2.1% before closing 0.69% lower at $373.92 on Thursday. There was no company specific news. The Wall Street Journal released a multipart expose “The Facebook Files”. The expose investigated “XCheck,” a program initially designed to serve as “a quality-control measure for high-profile accounts” but one that has morphed into a sort of “whitelist,” or blank-check permission that “shields millions of VIPs from the company’s normal enforcement” procedures when they make abusive postings on the social network. High-profile users protected by the program include former President Donald Trump, Donald Trump Jr., Senator Elizabeth Warren, and Candace Owens, according to the report, and users are usually unaware that they’re being given special treatment. WSJ also described that the story is part of a “series” of unknown length, indicating that more dirty laundry about the social media company will be aired over time, potentially damaging the company’s business.

- Crocs (CROX US) added another 2.88% on Wednesday following Tuesday’s gains after the company outlined its long-term strategy and key initiatives to deliver sustainable growth in its Investor Day presentation. The shoemaker expects to generate revenues of more than $5 billion by 2026, equivalent to an approximate annual growth rate (CAGR) of more than 17% in the next five years.

- COVID-19 vaccine stocks BioNTech (BNTX) and Moderna (MRNA US) climbed 6.08% and 1.578% respectively after Moderna released more clinical data that supports the push for the wide use of vaccine booster shots. The data suggests a lower risk of breakthrough infection 8 months after the first dose compared to 13 months after the first dose. The data is not yet peer-reviewed, but has been submitted, said Moderna. The timeline matches the Biden administration’s initial announcement of targeting 8 months after the initial course starting September 20.

Singapore

- Frencken Group Limited (FRKN SP) shares surged 6.9% after UOB Kay Hian analyst Clement Ho maintained his BUY call on the company, and raised his target price from $2.52 to $2.62, citing the company’s $14 million acquisition of aerospace and semiconductor company Avimac. Ho believes that the acquisition will “help ramp up capacity expansion, particularly in the semiconductor segment, as well as help the group gain access to new technologies and competencies.” The deal is aimed at expanding the business and will be carried out via Frencken’s wholly-owned subsidiary ETLA Limited, said the group last week.

- iFAST Corp Ltd (IFAST SP) shares rose 6.45% on Wednesday. There was no company specific news. In a response to a SGX query regarding unusual stock movement, the company cited its announcement on 31 July 2021 regarding the finalization of a prime subcontractor contract for a Hong Kong pension project. The company believes that investors are anticipating that the overall growth of the Group may be significantly boosted in the years ahead given potential strong growth from Hong Kong.

- Genting Singapore Ltd (GENS SP) stocks fell 1.3% following news of officials in Macau unveiling plans for a crackdown that would tighten their grip on the industry. The Macau government announced a 45-day public consultation that included a proposal for direct supervision over the gambling industry, which has faced increasing scrutiny from authorities in recent years.

- Spackman Entertainment (SEG SP) shares rose 50% in early morning trading yesterday before closing flat, after the company announced that it was selling its entire Zip Cinema business to South Korean Internet giant Kakao Corp for S$19.8 million. In its latest regulatory filing on Tuesday, Spackman said the sale will be subject to shareholder approval at an extraordinary general meeting (EGM) to be announced in due course. Spackman intends to use proceeds from the sale for business diversification and expansion into other businesses, such as co-producing and financing U.S. films, which it believes to be potentially more profitable than Korean films due to a wider international audience base.

- Grand Venture Technology (GVTL SP) shares rebounded and rose 4.72% higher, after the company announced on Tuesday the completion of the proposed placement of up to 25,000,000 new shares and up to 10,000,000 vendor shares at the placement price of S$1.14 per share. The new shares are expected to be listed on Catalist with effect from 16 September.

Hong Kong

- Xinjiang Goldwind Science & Tech Co Ltd (2208 HK), Shanghai Electric Group Co Ltd (2727 HK) shares rose 8.6% and 5.9% respectively. Power equipment stocks rose collectively as Xi Jinping stressed a green and low-carbon development path for the country’s energy industry during an inspection tour to a major clean coal production base in Northwest China’s Shaanxi Province on Monday. Experts noted that the visit sends an important message that the country will take a green path in its formulated roadmap for achieving carbon neutrality.

- Sands China Ltd (1928 HK), Galaxy Entertainment Group Ltd (0027 HK). Gaming sector shares plummeted yesterday, with large cap stocks Sands China and Galaxy Entertainment declining 32.5% and 20.0% respectively. The last low for Sands China was in October 2011 and Galaxy Entertainment’s last recorded low was in October 2020. Chinese officials unveiled plans yesterday for a crackdown on the gambling industry in Macau. The Macau government is looking to put its representatives in licensed casino operators’ boards to oversee their operations and criminalize underground banking in the industry.

- China Evergrande Group (3333 HK) shares declined 5.4% yesterday, extending its losses over the last few months after the company announced liquidity and debt issues. China’s Ministry of Housing and Urban-Rural Development told major banks yesterday that Evergrande will not be able to make loan interest payments due September, indicating a possibility that there would be no government backing for Evergrande. Additionally Evergrande announced on Monday that it expects a “significant” continued decline in sales this month. The company has been trying to sell some assets to ease its liquidity crunch, but said those efforts haven’t yielded anything yet. Evergrande also warned that its escalating troubles could also lead to broader default risks. Subsidiaries China Evergrande New Vehicle Group Ltd (708 HK) shares increased 2.6% yesterday while Evergrande Property Group (6666 HK) shares increased 5.5%, which could be due to short covering.

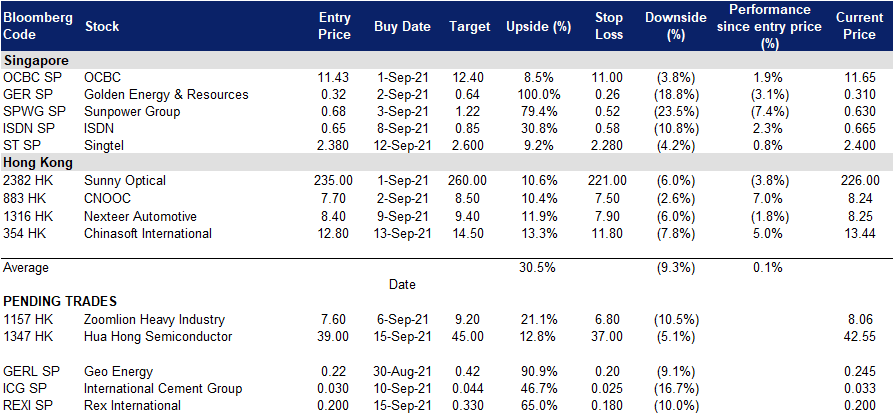

Trading Dashboard

Related Posts: