KGI DAILY MARKET MOVERS – 15 April 2021

Play the potential correction in the S&P 500 Index

While April has historically been the best month over the past 20 years, the next 1-2 weeks present a shorting opportunity.

The recent market performance has been quite divided since the US$2.25tn infrastructural and tax hike plan was announced at the end of March.

The S&P 500 index increased by 3.82% MTD to a new high of 4,151.

S&P 500 Index

IPO PERFORMANCE REVIEW

TRIP.COM (TCOM US / 9961 HK): IPO pricing at HK$268

- The dual listing in Hong Kong is priced at HK$268, 19.52% discount to the initial price of HK$333.

- The public tranche subscription rate is 16x.

- Shares will start trading on Monday, 19 April.

Coinbase (COIN US): Pops nearly 72% intraday on trading debut

- COIN’s highly anticipated direct listing saw its shares spike to a high of US$429 in the first 10 minutes before turning lower.

- The stock closed at US$328.28, up slightly more than 30% from its US$250 share price reference. The closing price gives COIN a market cap of around US$86bn.

- While valuations are elevated when comparing Coinbase to other well-known listed financial exchanges, the continued momentum in cryptocurrency is likely to keep Coinbase’s share price in an uptrend. Price / consensus 2021 Sales of Coinbase is now close to 15x, similar to that of CME (CME US).

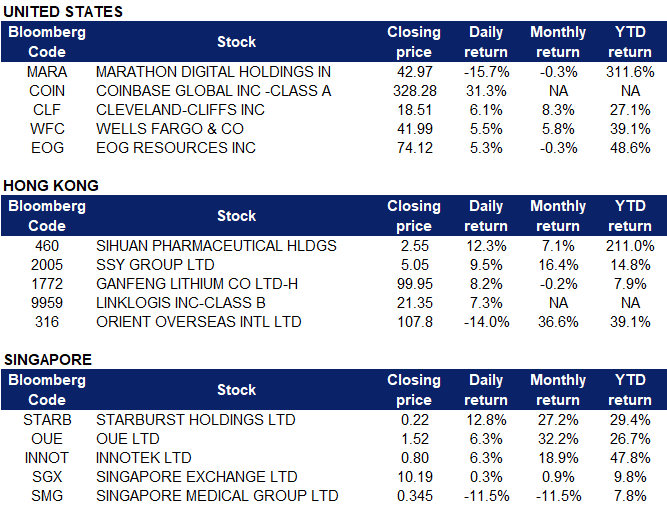

MARKET MOVERS

United States

- Marathon Digital (MARA US), Riot Blockchain (RIOT US) and various other crypto-related stocks gave up gains after Bitcoin retreated from the US$65,000 mark.

- Coinbase (COIN US) opened at US$381, traded to a peak of US$429.54 and closed at US$328.28, up 31% from the company’s reference price of US$250. However, the market largely took Coinbase’s first trading day as a sell-off

- Cleveland Cliffs Inc (CLF US), United States Steel (X US) and other steelmakers and infrastructure-linked commodity players rallied as the US$2.3 trillion infrastructure bill makes progress amongst the Senate.

- Wells Fargo (WFC US) saw the highest daily gain amongst banks and reached a new high despite being linked earlier to the block trade saga on the back of good 1Q21 earnings.

- EOG Resources (EOG US) and other Oil & Gas stocks rallied on announcement of falling US inventories and stronger oil demand outlook from OPEC and the US Energy Information Administration.

- Trading Dashboard: Include Micron (MU US) at US$91, take profit from Waste Management (WM US) at US$133.88.

- Earnings Watch: CitiGroup, Bank of America, TSMC, Pepsi Co (Thursday); Ehang, Morgan Stanley (Friday)

Hong Kong

- Sihuan Pharmaceutical Holding Group Ltd. (460 HK). Aesthetics medical sector jumped. Tianfeng Securities initiated a coverage with a TP of HK$4.68 and a BUY rating. The outlook of its exclusive distribution of Letybo 50U, a botulinum toxin product from a Korean biopharmaceutical company, Hugel Inc, is upbeat. The botox market in China was RMB4bn as of 2019, and is expected to grow to RMB12.5bn by 2025. So far there have been only 4 botox products approved by the National Medical Products Administration of the People’s Republic of China.

- SSY Group Ltd (2005 HK). The company announced it has obtained approval for drug production and registration for Terbutaline Sulfate Nebuliser Solution (2ml:5mg) from the National Medical Products Administration of China, being the second one of such approval in the PRC and regarded as passing the consistency evaluation. Terbutaline Sulfate Nebuliser Solution is under type 4 chemical new drug, and is mainly used for the treatment of bronchial spasm combined with bronchial asthma, chronic bronchitis, emphysema and other lung diseases.

- Ganfeng Lithium Co., Ltd. (1772 HK). Electric vehicle and lithium battery related stocks jumped. Macquarie Group upgraded TP to HK$138 from HK$144 and maintained a BUY rating. The catalysts include Chile closing border, potential inclusion in MSCI in May, and new ramp-up of capacity.

- Linklogis Inc (9959 HK). Shares closed at a new high since IPO. The SaaS sector gradually recovered from the recent lows.

- Orient Overseas (International) Limited (316 HK). Market news reported that the company placed 7.75mn shares at HK$110 to Crest Apex, a subsidiary of CK Hutchison Holdings Limited (1 HK).

Singapore

- OUE (OUE SP) shares surged 6% after The Straits Times published an article highlighting OUE’s deep value compared to its NAV of S$4.21. OUE currently trades at S$1.52, implying a 64% discount to NAV. Furthermore, the company had conducted 13 share buybacks year-to-date and accumulated a total of around 4mn shares worth S$5mn. This is in addition to the S$22mn worth of share buybacks it did in 2020.

- SPH resumed its uptrend on continued interest over its strategic review. SPH currently still trades at a 20% discount to its book value.

- SGX (SGX SP). Shares of SGX rose on trading volume that was 50% higher than the one year average. Jefferies upgraded its recommendation on SGX to a BUY from HOLD, and raised its target price to S$11.30 from S$10.50, citing stronger securities volumes and higher derivative fees.

- Singapore Medical Group (SMG SP) requested for a trading halt yesterday afternoon after its shares fell 11.5%. We think the drop in SMG’s share price is related to the ongoing discussions with a third party regarding a possible transaction involving the company’s shares. In December 2020, the company said that talks are preliminary and there is no certainty that any deal will materialize.

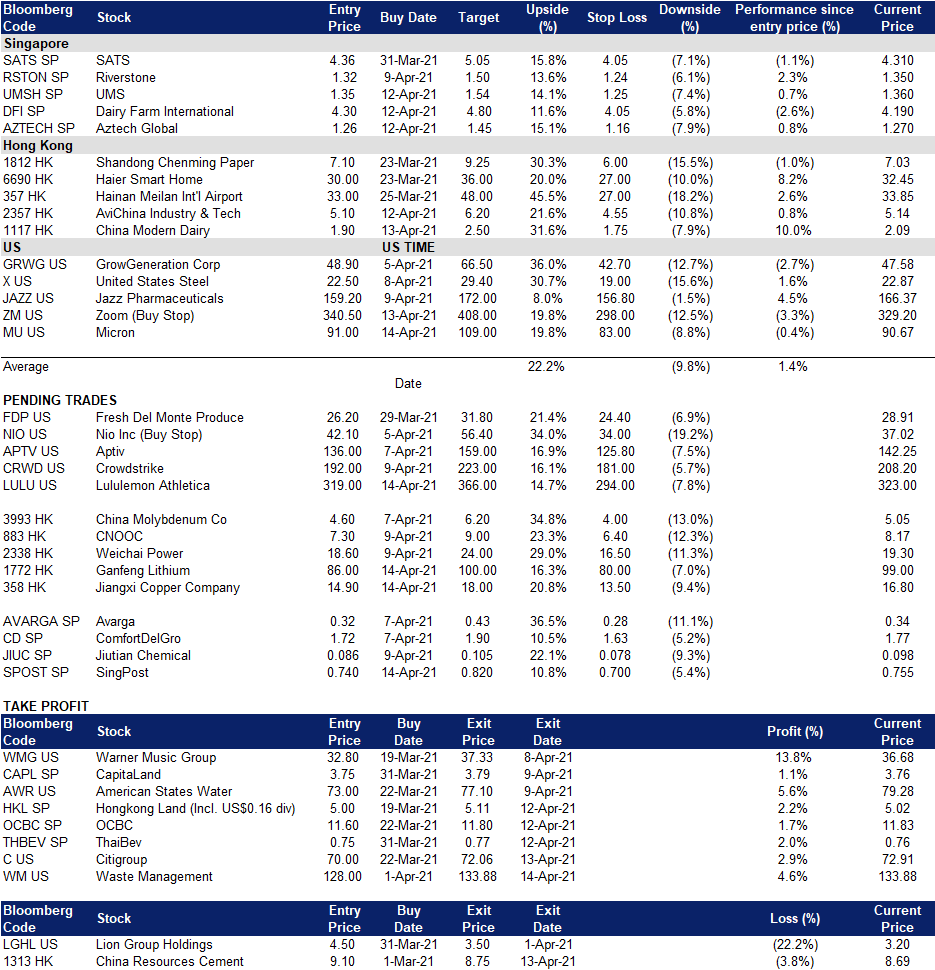

TRADING DASHBOARD