KGI DAILY MARKET MOVERS – 14 September 2021

Market Movers | Trading Dashboard

Market Movers

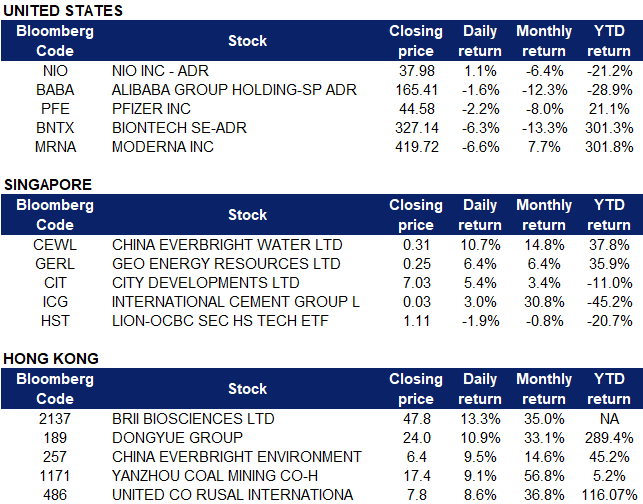

United States

- Shares of COVID-19 vaccine stocks, with Moderna (MRNA US), BioNTech (BNTX US) and Pfizer (PFE US) were down 6.6%, 6.3% and 2.2% respectively. In a medical journal by The Lancet, scientists said that existing COVID-19 vaccines remain “protective against severe diseases from all the main viral variants.” They also added that clinical studies do not support the benefit of boosting COVID-19 vaccinations; instead, the scientists proposed getting shots out to unvaccinated people. In the U.S., roughly 47% of eligible people are unvaccinated, according to the Centers for Disease Control and Prevention.

- NIO (NIO US) shares traded 2.5% lower on Monday before closing 1.08% higher at $38.39 after China’s minister of industry and information technology, Xiao Yaqing said that China has “too many” EV makers and the government will encourage the more successful companies to merge with or acquire smaller rivals.

- Alibaba (BABA US) shares fell 1.6% on Monday after Reuters reported that China’s Ministry of Industry and Information Technology has issued an ultimatum to internet companies that they should cease blocking each other’s links on their sites or risk facing regulatory action. “Restricting normal access to internet links without proper reason affects the user experience, damages the rights of users and disrupts market order,” Zhao Zhiguo, ministry spokesperson, reportedly said. It was also reported that regulators want to break up Ant Group’s Alipay, the payments app with more than 1 billion users. Alibaba’s stocks have lost about half their value, from a high of $319.32 in October 2020.

Singapore

- China Everbright Water Ltd (CEWL SP) shares rose by 10.7% yesterday and closed at a 52-week high even though there was no company specific news. The rise in share price is likely in line with its parent company, China Everbright Environment Group Ltd (257 HK) whose shares closed at a two-year high yesterday. The utilities sector has been turning around as funds pulled out from growth stocks, especially technology companies, and put into more defensive sectors. Last Friday, The Edge published an article featuring the company as the second winner in terms of 3-year shareholder returns, profit growth and ROE. According to Bloomberg consensus, China Everbright Water currently has 3 BUYS, 2 HOLDS and 0 SELL recommendations, with a 12M TP of S$0.32, representing an upside of 3.2% as of yesterday’s closing price of S$0.31.

- Geo Energy Resources Ltd (GER SP) shares rose by 6.4% yesterday after the company announced that it will fully redeem its outstanding USD bonds. The group will have little debt while having a cash balance over US$60bn following the redemption of the bonds. GEO is also set to benefit from the 4,200 GAR Coal (ICI4) coal index reaching a record high of US$77/tonne as at 10 September 2021. We currently have an OUTPERFORM recommendation and a TP of S$0.42, implying an upside of 68% as of yesterday’s closing price of S$0.25. Our DCF calculation (13.5% WACC and no terminal value) estimates a fair value of S$0.42 based on a conservative 6-year mine life and 66mn tonnes production. While we expect coal prices to soften in 2H2021, dynamics favour coal miners given the buoyant demand from India and China. Read our full report here.

- City Developments Ltd (CIT SP) shares rose by 5.4% yesterday, after the company announced last Friday that it had exited its investment in China-based Sincere Property Group for a consideration of US$1, while raising its stake in a technology park in Shenzhen. Read the full article by The Edge here. According to Bloomberg consensus, City Developments currently has 15 BUYS, 1 HOLDS and 0 SELL, with a 12M TP of S$9.21, representing an upside of 31% from yesterday’s closing price of S$7.03.

- International Cement Holdings Ltd (ICG SP) shares rose by 3% yesterday, closing at a 2-month high even though there was no company specific news. Investors are likely investing in traditional sector stocks, as a safer option amidst economic uncertainty. Positive sentiment on the stock could also be due to a spillover effect from HK-listed cement related stocks, such as China Resources Cement Holdings (1313 HK), which gained a total of 21.8% since end August. We currently have a TP of S$0.044 for ICG, implying an upside of 29% as of yesterday’s closing price of S$0.034.

- Lion-OCBC Securities Hang Seng Tech ETF S$ (HST SP). The ETF declined by 1.9% yesterday, bringing total losses to 3.9% over the last 4 trading days. Chinese technology shares fell once again yesterday on the latest moves from Beijing to reshape online businesses. The Chinese government intends to break up Ant Group’s Alipay business, calling for better protection of gig economy workers’ rights and the latest warning against blocking links to rival services. The Hang Seng Tech Index finished 2.3% lower, with Meituan, Alibaba Group Holding and Tencent Holdings Ltd. the biggest drags on the gauge.

Hong Kong

- Brii Biosciences Ltd (2137 HK) Shares closed at a new high since its IPO on 13th July. There was no company specific news. Previously, the company announced it is committing an additional investment in an amount of US$100 million, to advance global regulatory filings and commercial efforts for its investigational SARS-CoV-2 (virus that causes COVID-19) combination therapy, BRII-196/BRII198. BRII-196/BRII-198 is a SARS-CoV-2 neutralizing monoclonal antibody combination therapy. Interim results from Phase 3 of the NIH-sponsored ACTIV-2 trial recently demonstrated that the combination therapy achieved a statistically significant reduction of 78%, relative risk in the combined endpoint of hospitalization and death compared with placebo in non-hospitalized COVID-19 patients at high risk of clinical progression.

- Dongyue Group Ltd (189 HK) Shares rebounded from three consecutive days of sell-off. Credit Suisse raised its TP to HK$31 from HK$30 and maintained an OVERWEIGHT rating. The bank expects its 20% ramp-up in PVDF (current capacity: 10,000 tonnes) will help the company to gain another 10% market share from the current 25%.

- China Everbright Environment Group Ltd (257 HK) Shares closed at a two-year high. There was no company-specific news. The utilities sector has been turning around as funds were pulled out from growth stocks, especially technology companies, and put into more defensive sectors. The company is a typical value stock with low PERs (mid-single digit) and decent dividend yields (5% to 6%).

- Yanzhou Coal Mining Company Limited (1171 HK) Shares closed at another 52-week high as coal prices continued to break new highs on Monday. Shares have almost doubled in 4 weeks.

- RUSAL (486 HK) Shares closed at a 52-week high as aluminum prices continued to break new highs on Monday. LME aluminium futures reached US$3,000/tonne on Monday.

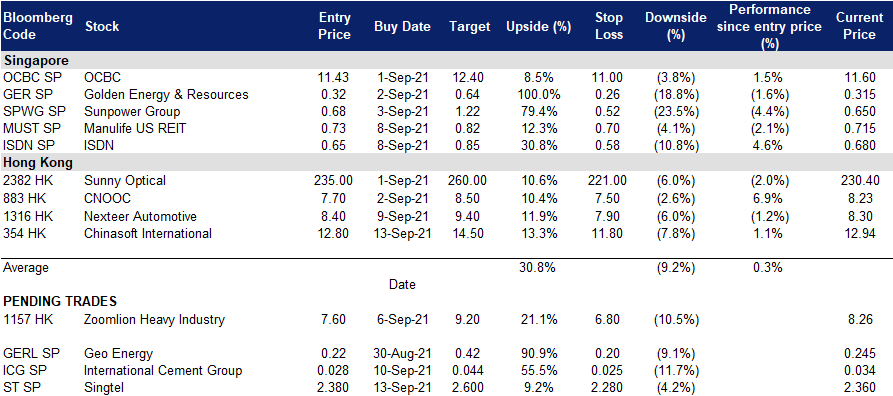

- Trading dashboard: KWG Living (3913 HK) cut loss at HK$5.8. TRIP.com (9961 HK) cut loss at HK$235. Add Chinasoft International (354 HK) at HK$12.8.

Trading Dashboard

Related Posts: