CME Group Micro E-mini S&P 500 Index Futures

Offering traders around the world a liquid, fully electronic way to access the S&P 500 Index.

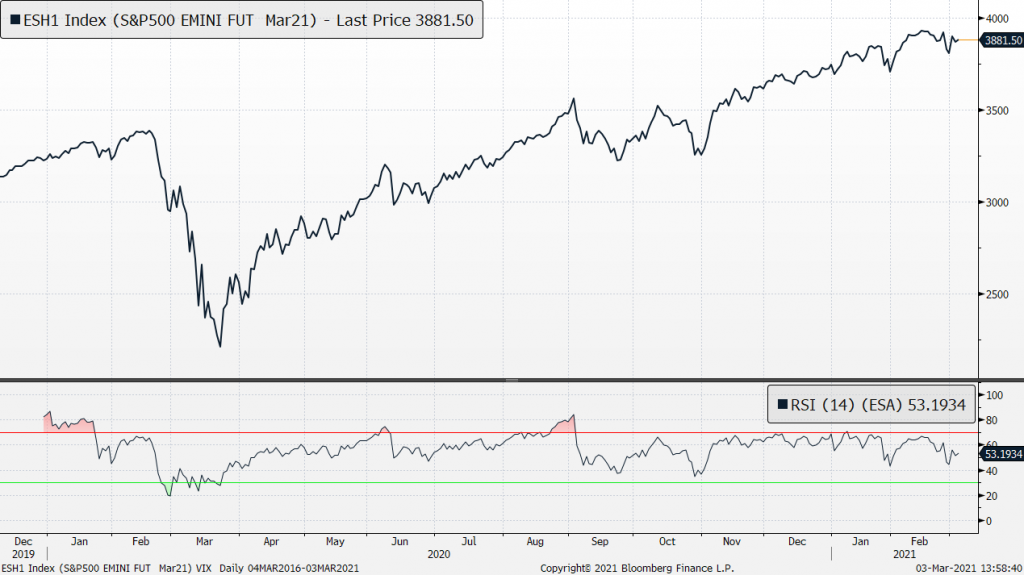

While we are optimistic on the fundamentals of the S&P 500 Index in 2021, interest rates and the steepening of the yield curve are likely to dominate trading action of global equity benchmarks over the coming few months. Active traders can now use the micro E-mini S&P and Micro E-mini Nasdaq-100 to execute strategies around the clock in a smaller-sized contract than the standard E-mini contracts.

About Micro E-mini S&P500 futures

- Micro E-mini S&P 500 futures (MES) offer smaller-sized versions of our liquid benchmark E-mini contracts

- They are designed to manage exposure to the 500 U.S. large-cap stocks tracked by the S&P 500 Index, widely regarded as the best single gauge of the U.S. stock market

- The Micro E-mini S&P 500 futures contract is $5 x the S&P 500 Index and has a minimum tick of 0.25 index points

- View delayed data for Micro E-mini S&P 500 futures below for the open, high and low prices and volume for the active contracts

Source: CME Group

3 thoughts on “CME Group Micro E-mini S&P 500 Index Futures”

Comments are closed.