8 November 2022: Wealth Product Ideas

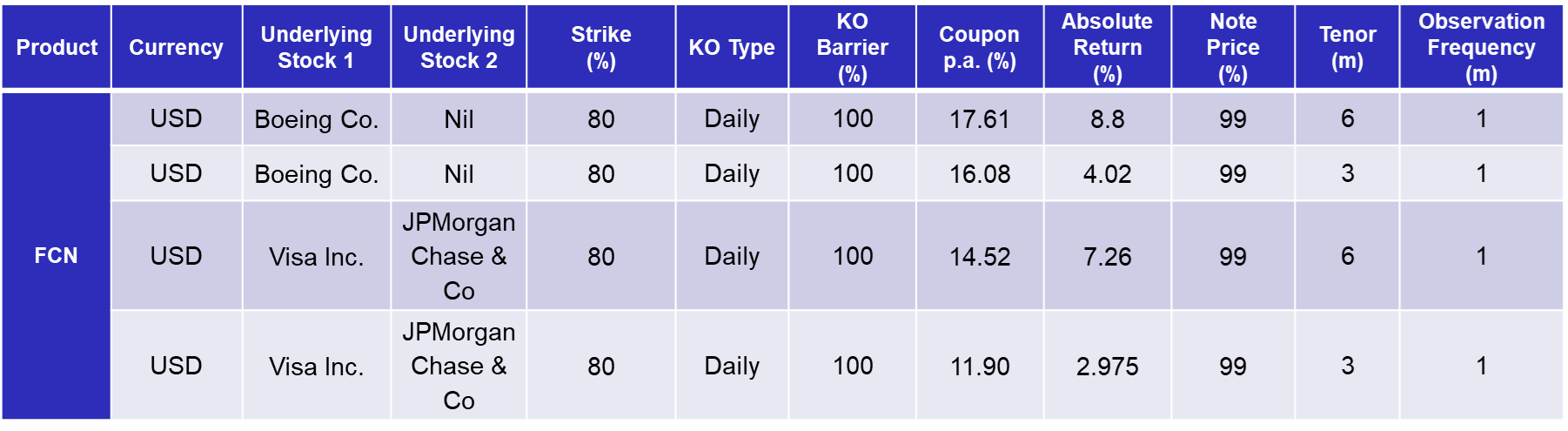

3 Scenarios

- Early knock-out after 1st month = receive 100% notional + eligible coupons

- No knockout; underlying is at or above strike on final observation date = receive 100% notional + final coupon

- No knockout; underlying is below strike on final observation date = receive 100% notional converted to shares at strike + final coupon

Boeing Price Performance

Visa and JP Morgan Price Performance

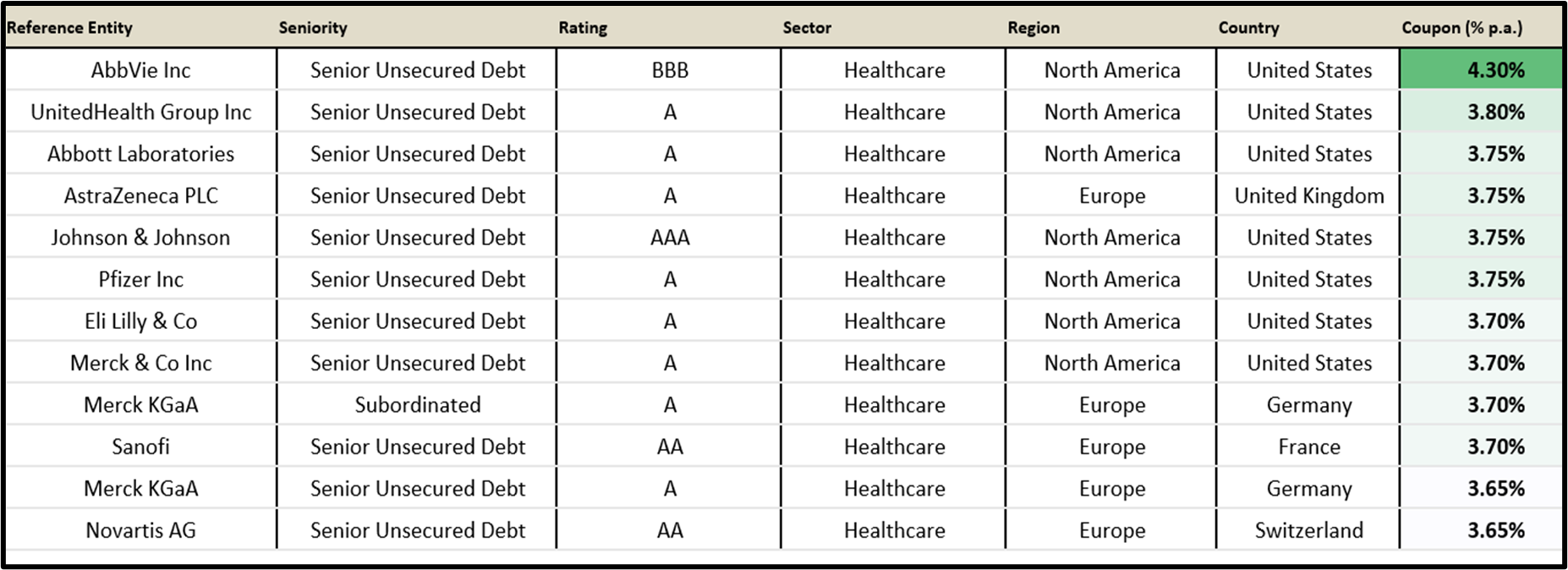

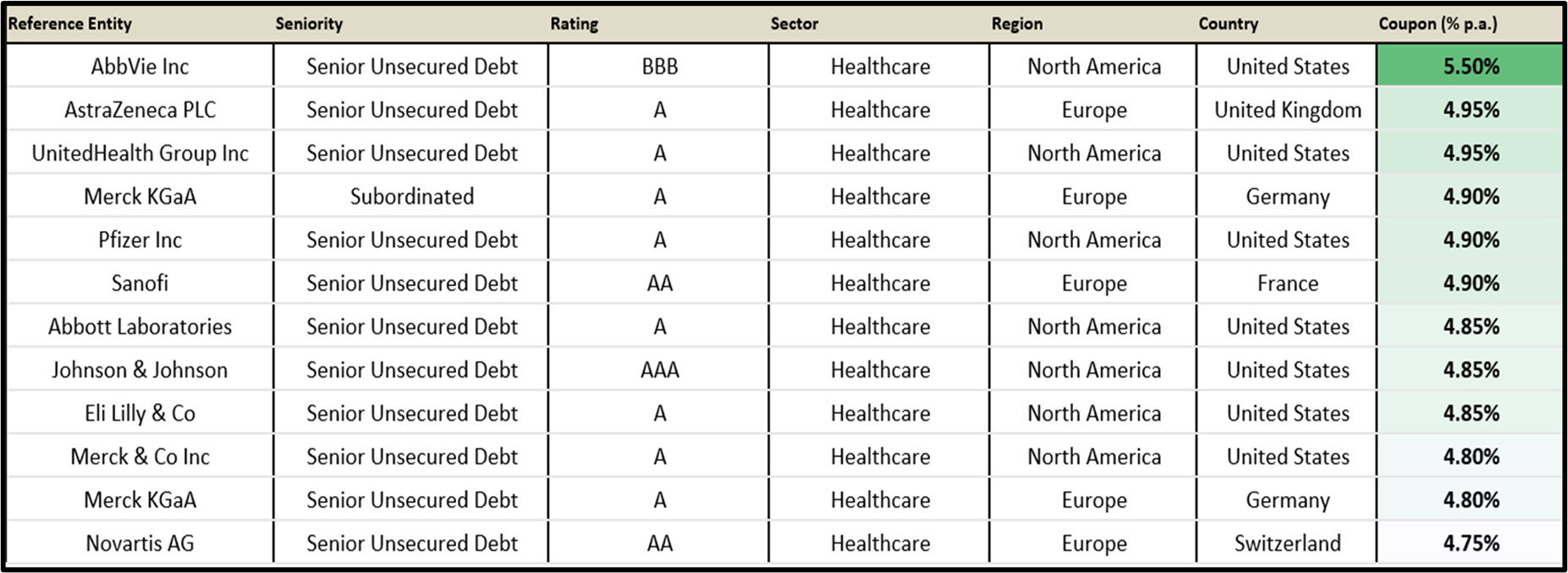

- The healthcare sector has long been recognized as one of the most reliable defensive industries

- Regardless of how the economy performs, hospitals, drugmakers, medical device companies, and other companies in the healthcare industry benefit from steady consumer demand

- Short and medium-term CLN ideas with investment-grade companies to offer clients stable and enhanced yields

- Min. investment: US$300K; AI only (exemption applies for min. investment of S$200K)

1-Year Healthcare CLNs

3-Year Healthcare CLNs

Outcome 1 (Positive) – No Credit Event

- Investor receives quarterly coupons till maturity

- Upon maturity, investor receives 100% of principal + final coupon

Outcome 2 (Negative) – Credit Event Occurs

- Coupon payments will cease, including the coupon accrued

- Investor will receive a Recovery Value, which is determined by Calculation Agent, the issuer, subject to a minimum of zero – calculated by (i) the nominal value, multiplied by redemption factor (ii) minus unwind costs