7 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

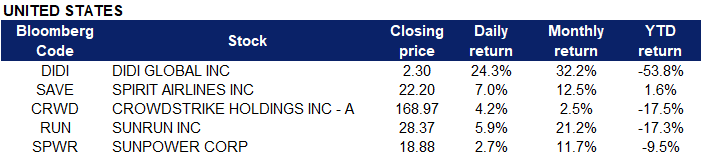

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Internet Retail | +2.8% | U.S. Stocks Lifted by Tech; Investors Cheer China Reopening JD.com Inc (JD US) |

| Internet Software/Services | +1.8% | U.S. Stocks Lifted by Tech; Investors Cheer China Reopening Alphabet Inc (GOOG US) |

| Motor Vehicles | +1.5% | Why Tesla, Nio, and Li Auto Stocks All Just Popped Tesla Inc (TSLA US) |

Top Sector Losers

| Sector | Loss | Related News |

| Biotechnology | -1.4% | Gilead drug cuts disease progression in commonest type of breast cancer Gilead Sciences Inc (GILD US) |

| Cable/Satellite TV | -1.1% | N/A Walt Disney Co (DIS US) |

| Precious Metals | -0.9% | Gold prices slip on expectations of higher interest rates Barrick Gold Corp (GOLD US) |

- DiDi Global (DIDI US) shares surged 24.3% after The Wall Street Journal reported regulators are concluding investigations into the company. The Journal reported that authorities would lift a ban on Didi adding new users as early as next week and reinstate the company’s app in domestic app stores. Didi has been one of the worst-hit companies by Beijing’s regulatory tightening and has been the subject of a cybersecurity probe since days after its U.S. IPO.

- Spirit Airlines Inc (SAVE US) shares jumped 7% after its bigger rival, JetBlue Airways, sweetened its offer to buy the company Monday. Spirit rejected JetBlue’s initial offer of $30 per share last month. Under the new terms, Spirit shareholders would get $31.50 per share. JetBlue shares added 2.1%.

- CrowdStrike (CRWD US) shares rose 4.2% after Morgan Stanley upgraded them to overweight from equal weight, calling them a buy as the macro environment becomes less certain.

- Solar stocks jumped after the Biden administration announced it would suspend tariffs on panel products from several Southeast Asian nations. The levies will be halted for 24 months. Sunrun Inc (RUN US) shares traded 5.9% higher, while SunPower Corp (SPWR US) popped 2.7%.

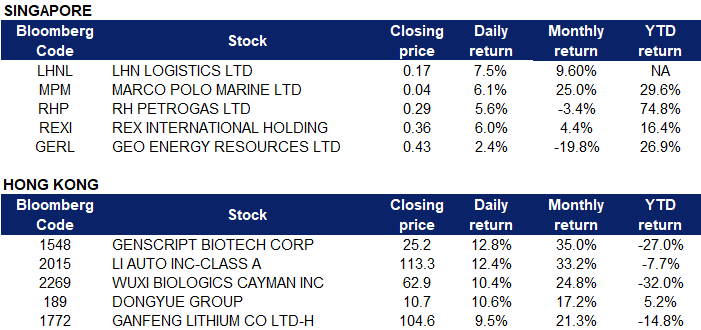

Singapore

- LHN Logistics Ltd (LHNL SP) shares rose 7.5% yesterday. CGS-CIMB is positive on LHN Logistics as it projects earnings growth for the logistics arm of LHN in the near term amid recovering trade activity. In a report on Thursday (Jun 2), analyst Kenneth Tan initiated coverage on the group with an “add” call and target price of S$0.22, which implies a 50% market size discount to peers based on its valuation of 9 times CGS-CIMB’s price-to-earnings estimates for 2023.

- Marco Polo Marine Ltd (MPM SP) shares extended their gains and rose 6.1% yesterday. RHB Group Research analyst Jarick Seet has maintained his “buy” call on Marco Polo Marine (MPM), with an unchanged target price of 4 cents as the company is on track for turnaround and better performance. In his June 3 note, Seet says MPM’s 1HFY2022 utilisation rate has recovered to pre-pandemic levels and rises YoY, driven by strong demand from both the oil and gas (O&G) and offshore wind farm sectors. RHB expects utilisation rates to pick up to 70%-80% from the current 60% by the end of the year.

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 5.6% and 6.0% respectively yesterday. WTI crude futures jumped toward $120 per barrel on Monday after Saudi Arabia sharply raised prices for its crude sales in July, highlighting tight global supplies even after OPEC+ agreed to accelerate its output increases over the next two months. Saudi Arabia raised the official selling price for its flagship Arab light crude bound for its main Asian market and to northwest Europe, while holding the premium steady for barrels going to the US. Monday’s gains followed sharp moves last week when OPEC+ decided to increase output in July and August by 648,000 barrels per day or 50% more than previously planned. However, markets continued to doubt the group’s ability to meet demand as several member countries struggled to boost output, at a time demand is soaring in the US amid peak driving season and as China eases Covid lockdowns. Meanwhile, Brent crude futures jumped toward $121 per barrel on Monday.

- Geo Energy Resources Ltd (GERL SP) shares rose 2.4% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, consolidated above the $400-per-tonne mark and just 20 dollars shy of its record peak, supported by continued robust demand against a tightening market backdrop. Along with increasing demand for power generation with a resumption in economic activity after the coronavirus-induced slump, soaring natural gas prices in Europe and Asia in late 2021 boosted coal consumption.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Alcoholic Drinks & Tobacco | +3.95% | China’s Holiday Spending Shows Slow Consumer Rebound Underway China Resources Beer Holdings Co Ltd (291 HK) |

Environmental Energy Material | +3.36% | China to Add 108 GW of Solar by the End of 2022: NEA Flat Glass Group Co Ltd (6865 HK) |

Software | +2.40% | China to Wrap Probe Into Didi as Soon as This Week, WSJ Says SenseTime Group Inc (20 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -0.95% | Glencore to reject offer for Yancoal Australia stake as too low – sources Yancoal Australia Ltd (3668 HK) |

Automobile Retailing, Maintenance & Repair | -0.83% | China Electric Car Sales Rose in May as Lockdowns Start to Ebb China Yongda Automobiles Services Holdings Limited (3669 HK) |

Infrastructure | -0.73% | Iron Ore Extends Gains Above $140 on Optimism For China Demand China Railway Group Ltd (390 HK) |

- Genscript Biotech Corp (1548 HK) Shares jumped 12.8% yesterday after the company announced that Legend Biotech Corporation, a non-wholly owned subsidiary of the Company, whose shares are listed by way of American Depositary Shares on the Nasdaq Global Select Market in the United States, presented on 4 June 2022 new and updated results from the CARTITUDE clinical development program studying ciltacabtagene autoleucel (ciltacel) in the treatment of multiple myeloma at the 2022 American Society of Clinical Oncology Annual Meeting. Earlier data from the CARTITUDE-1 study supported recent regulatory approvals for CARVYKTI™ by the U.S. Food and Drug Administration and the European Commission, and ongoing results from the multi-cohort CARTITUDE-2 study are being used to inform future trials of CARVYKTI™ treatment in multiple patient populations and treatment settings.

- Li Auto Inc (2015 HK) Shares jumped 12.4% yesterday after the company announced that it delivered 11,496 Li ONEs in May 2022, up 165.9% YoY. The cumulative deliveries of Li ONE have reached 171,467 since the vehicle’s market debut in 2019. As of May 31, 2022, the Company had 233 retail stores in 108 cities, as well as 253 servicing centers and Li Auto-authorized body and paint shops operating in 214 cities.

- Dongyue Group Ltd (189 HK) Shares rose 10.6% last yesterday and closed at a two-month high. Last week, the prices of PVDF remained high. Lithium-battery- grade PVDF was quoted at RMB470,000/tonne. In the near term, the manufacturers are impacted by the raw materials supply shortage and the cap on electricity supply.

- WuXi Biologics (Cayman) Inc (2269 HK) Shares rose 10.4% yesterday. The CRO-themed stocks jumped. Market analysts believe that the company’s 2Q22 revenue to achieve its guidance growth of 63%-65% YoY as overseas clients are their main sources of revenue.

- Ganfeng Lithium Co Ltd (1172 HK) Shares rose 9.5% yesterday. The company and its subsidiary Litio Minera Argentina kicked off this week the construction phase of their Mariana lithium project, located in Argentina’s northwestern Salta province. Based on a feasibility study completed in 2019, the Mariana project has a measured and indicated resource of 4,410,000 tonnes of lithium carbonate equivalent and an inferred resource of 786,000 tonnes of LCE. This makes it one of the biggest lithium deposits in the world, competing with Lithium America and Ganfeng’s Cauchari-Olaroz, Orocobre’s Olaroz, Advantage Lithium’s Cauchari and Lithium South’s Hombre Muerto projects. Once fully operational, total production should reach 20,000 tons of lithium chloride per year.

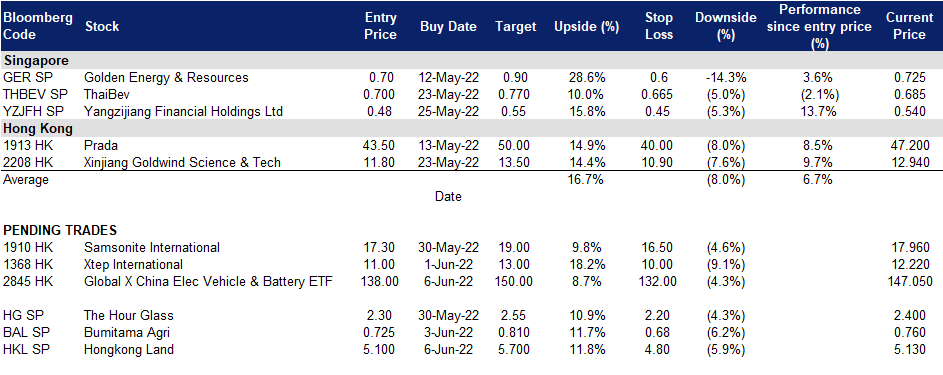

Trading Dashboard Update: No additions/deletions of stocks.