7 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Managed Health Care | +1.82% | S&P 500 rises for third straight session as Fed restates commitment to bringing down inflation UnitedHealth Group Inc (UNH US) |

| Aerospace & Defence | +1.51% | Defense Stocks Lockheed, Northrop And Raytheon Receive Ukraine-Aid Boost Northrop Grumman Corporation (NOC US) |

| Property/Casualty Insurance | +0.98% | N/A Chubb Ltd(CB US) |

Top Sector Losers

| Sector | Loss | Related News |

| Hotels/Resorts/Cruise lines | -3.25% | U.S.-Listed Shipping Stocks Fall Ahead Of Federal Reserve Meeting Norwegian Cruise Line Holdings Ltd (NCLH US) |

| Oil & Gas Production | -2.48% | Crude oil price forecasts under pressure as recession fears mount ConocoPhillips (COP US) |

| Life/Health Insurance | -2.47% | N/A China Life Insurance Company Limited (LFC US) |

- Shares of Uber Technologies Inc (UBER US) slumped 4.5% and DoorDash Inc (DASH US) fell 7.4% on news that Amazon agreed to take a stake in Grubhub in a deal that will give Prime subscribers a one-year membership to the food delivery service.

- Norwegian Cruise Line Holdings Ltd (NCLH US) slumped 9.6% and Royal Caribbean Cruises Ltd (RCL US) fell 7.2%, on concern about second-half cruise ship demand. Norwegian said it would no longer require guests to test for Covid-19 before joining a cruise, unless required by local regulations.

- Coinbase Global Inc (COIN US) slipped 6.7% after Atlantic Equities downgraded the crypto exchange to neutral and slashed its price target, citing increased volatility in the industry.

Singapore

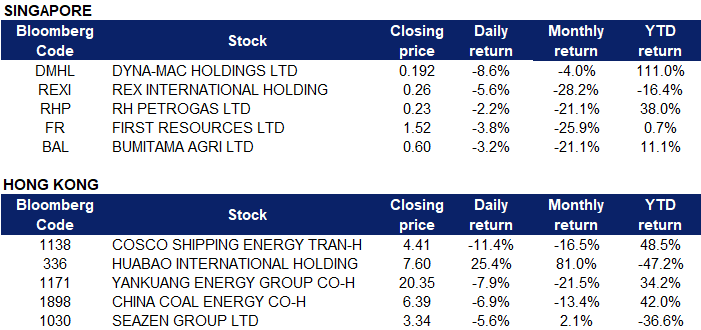

- Dyna-Mac Holdings Ltd (DMHL SP), Rex International Holding Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares fell 8.6%, 5.6% and 2.2% respectively yesterday. Oil prices rose as much as nearly 3 per cent on Wednesday before paring some gains as investors piled back into the market after a heavy rout in the previous session, with supply concerns returning to the fore even as worries about a global recession linger. “Although crude oil still faces the problem of a supply shortage, key factors that led to the sharp selloff in oil yesterday remain,” said Leon Li, a Shanghai-based analyst at CMC Markets. He cited policy tightening by global central banks and a likely interest rate hike by the U.S. Federal Reserve is pressuring commodities prices. Renewed concerns of COVID-19 lockdowns across China could also cap oil price gains.

- First Resources (FR SP) and Bumitama Agri Ltd (BAL SP) shares fell 3.8% and 3.2% respectively yesterday. Indonesia is considering setting its crude palm oil (CPO) export reference price every two weeks instead of monthly, a senior trade ministry official said on Wednesday, aiming to adjust quicker to fast-changing international market prices. The Malaysian benchmark palm oil futures fell 22 per cent in June and have slumped more than 20 per cent so far in July, a result of Indonesia boosting exports and expectation of Malaysian production increasing, while global demand is sluggish amid recession concerns.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Chemical Products | +1.34% | Oil prices bounce back from Tuesday tumble as supply concerns return China Risun Group Ltd (1907 HK) |

Electricity Supply | +0.80% | Russia sanctions provide price support for Indonesia coal plays: Maybank Huaneng Power International Inc (902 HK) |

Other Support Services | +0.63% | NA New Oriental Education & Technology Group Inc (9901 HK) |

Top Sector Losers

Sector | Loss | Related News |

Alcoholic Drinks & Tobacco | -4.99% | Fresh Covid-19 outbreaks put millions under lockdown in China China Resources Beer Holdings Co Ltd (291HK) |

Airline Services | -3.47% | Shanghai spike, subvariant’s spread tests China Covid-19 policy Beijing Capital International Airport Company Limited (694 HK) |

Travel & Tourism | -2.03% | China battles karaoke COVID cluster in Shanghai among other outbreaks Trip.com Group Ltd (9961 HK) |

- COSCO SHIPPING Energy Transportation Co Ltd. (1138 HK) shares fell 11.4% yesterday. Crude oil prices tumbled overnight, and the outlook for energy demand is also dimming. Oil prices and tanker rates soared earlier this year, but have since fallen as the war in Ukraine disrupted supply routes and the global post-coronavirus reopening boosted demand. But factors such as fast-rising inflation, slowing consumption and sharp interest rate hikes around the world have dragged down traders’ forecasts for oil demand and dragged down tanker rates as a result.

- Huabao International Holdings Ltd (0336 HK) shares rose 25.4% yesterday. As of June 30, a total of 35 e-cigarette-related companies have obtained tobacco production enterprise licences. Tianfeng Securities believes that the domestic market will see the issuance of more production licences in the future. At present, there are several listed companies in the upstream production link of nicotine processing, e-cigarette processing and branding. Tianfeng pointed out that Huabao’s new tobacco-supply chain cooperation has been established and a new product launch may boost its performance. Additionally, southbound funds have increased their positions by about 1.5 percentage points.

- Yankuang Energy Group Co Ltd (1171 HK) and China Coal Energy Co Ltd (1898 HK) shares fell 7.9% and 6.9% respectively yesterday. Zhang Hong, a spokesman for the China Coal Industry Association, said that in the first five months of this year, the national coal output reached 1.81 billion tons, a year-on-year increase of 10.4%. The national average daily output of raw coal exceeded 12 million tons, a record high and the coal supply security capacity has increased significantly. He said that with the arrival of the peak period of coal consumption in the summer, the demand for coal has gradually recovered, but at the same time, the country’s hydropower and new energy power generation are substituting a portion of coal. At present, the valuation of the coal sector is still at the historical bottom in the past 10 years.

- Seazen Group Ltd (1030 HK) shares fell 5.6% yesterday. It announced that the Company, together with its wholly-owned subsidiary, Changzhou Hengxuan Consulting Management Co, entered into a memorandum of understanding with the potential buyer, Hengdian Entertainment Co, in relation to the potential disposal of equity interests of Shanghai Xingyi Cinema Management Co. Pursuant to the MOU, the Potential Buyer intends to acquire 100% equity interests of the Target Company.

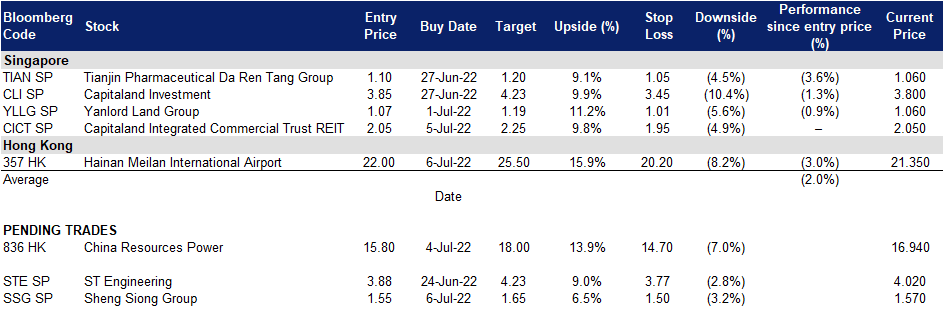

Trading Dashboard Update: Cut loss on TOTM Techonologies (TOTM SP) at S$0.142. Cut loss on Wilmar Internation (WIL SP) at S$3.98. Add Hainan Meilan International Airlport (357 HK) at HK$22.0.