6 October 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Energy Minerals | +1.54% | OPEC+ to cut oil production by 2 million barrels per day to shore up prices, defying U.S. pressure Exxon Mobil Corp (XOM US) |

| Electronic Technology | +0.32% | Taiwan Pledges to Keep Advanced Chips From Chinese Military Taiwan Semiconductor Mfg. Co. Ltd (TSM US) |

| Commercial Services | +0.32% | Argentine fintech Uala to invest US$150 million on Mexico, Colombia expansion, CEO says PayPal Holdings, Inc (PYPL US) |

Top Sector Losers

| Sector | Loss | Related News |

| Consumer Durables | -2.37% | Musk’s move to close Twitter deal leaves Tesla investors worried Tesla, Inc (TSLA US) |

| Utilities | -1.75% | Utilities Down Sharply as Treasury Yields Rise — Utilities Roundup Duke Energy Corp (DUK US) |

| Communications | -1.68% | Cisco to set up hardware manufacturing unit in India BCE Inc (BCE US) |

- Chewy Inc (CHWY US) Shares jumped 10.72% yesterday after data from market research firm YipitData suggested the company is due to exceed 3Q22 sales estimates.

- Schlumberger NV (SLB US) Shares rose 6.26% yesterday. Exxon Mobil Corporation (XOM US) Shares rose 4.04% yesterday. Halliburton Company (HAL US) Shares rose 3.98% yesterday. Oil rose for a fourth session on Thursday after the OPEC+ agreed to the biggest production cut since 2020 and Russia reiterated a warning that it won’t sell crude to any countries that adopt a price cap. OPEC+ plans to slash daily output by 2 million barrels, its deepest cuts to production since the Covid-19 pandemic, despite a tight market and opposition to cuts from the US and others.

- Enphase Energy Inc (ENPH US) Shares plunged 9.25% yesterday. The solar sector plunged after Muddy Waters chief Carson Block ripped the two renewables companies in the Financial Times. Muddy Waters sees Sunrun (RUN US) as “an uneconomic business built on three shaky pillars: the equity story of exaggerated ‘Subscriber Values’ and ‘Gross/Net Earning Assets,’ funding growth through abusing tax incentives, and issuing ABS that could be exposed to a RUN bankruptcy.” The short seller has said Hannon Armstrong’s (HASI US) accounting is “so complex and misleading that its financial statements are effectively meaningless,” and the company is “a prime example of how public market incentives can warp a company into relentlessly destroying value to feed a Wall Street growth narrative.”

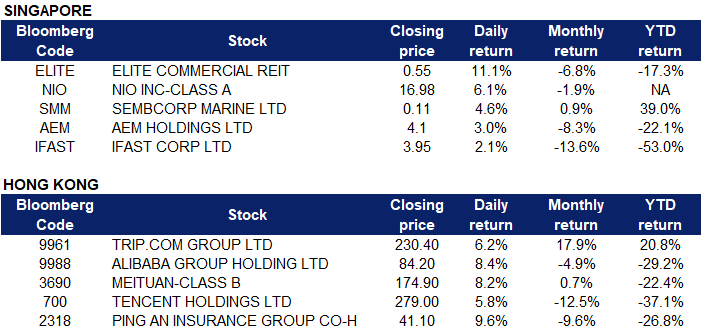

Singapore

- Elite Commercial REIT (ELITE SP) Shares jumped 11.11% yesterday. There was no company-specific news. The rally was due to the recovery of GBP against USD. Sterling pound had gained for 6 consecutive trading days and risen to a two-week high on hopes Kwasi Kwarteng will bring forward details of how he will cut debt

- NIO Inc (NIO SP) Shares rose 6.06% yesterday, following the rally in the overnight US market. NIO had started shipping the first batch of ET5 electric sedans to customers in China on September 30. As scheduled, the EV startup delivered ET5 vehicles to customers in Chinese cities including Shanghai, Suzhou, Hefei, Jiaxing and Guangzhou, with more ET5s expected to arrive in other cities in the following weeks. The ET5 compact electric sedan is an important vehicle for NIO as it gives the Chinese startup a direct competitor to the Tesla Model 3 in the domestic market and in overseas markets.

- Sembcorp Marine Ltd (SMM SP) Shares rose 4.59% yesterday. The company through its wholly-owned subsidiary, Sembcorp Marine Rigs & Floaters Pte Ltd, has been awarded an EPC (Engineering, Procurement and Construction) contract for the P-82 FPSO (Floating, Production, Storage and Offloading) vessel through an international tender from Brazilian state-owned oil and gas producer, Petroleo Brasileiro S.A. for US$3.05 billion (S$4.25 billion).

- AEM Holdings Ltd (AEM SP) Shares rose 3.02% yesterday, following the rally in the US semiconductor sector overnight. There was no company-specific news.

- iFAST Corporation Ltd (IFAST SP) Shares rose 2.07% yesterday, following the rally in the US finance sector overnight. There was no company-specific news.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Biotechnology |

+4.67% |

Hong Kong’s Hang Seng pops 6% on return to trade; Asia markets rise after U.S. stocks rallied WuXi Biologics (Cayman) Inc (2269 HK) |

|

Household Appliances |

+4.48% |

Holiday spending reflects upturn in China’s consumer market Haier Smart Home Co Ltd (6690 HK) |

|

Insurance |

+4.46% |

HSBC weighs multibillion pound Canada sale amid Ping An siege Ping An Insurance (Group) Company of China, Ltd (2318 HK) |

- JD.com Inc (9961 HK) Shares jumped 10.13% yesterday. There was no company-specific news. Alibaba Group Holding Ltd (9988 HK) Shares jumped 8.44% yesterday. There was no company-specific news. Meituan (3690 HK) Shares jumped 8.16% yesterday. There was no company-specific news. Tencent Holdings Limited (700 HK) Share rose 5.76% yesterday. On Monday, the company repurchased 1.34mn shares at the price range between HK$259.6 and HK$266.4 with HK$352mn. The Hang Seng Tech index soared 7.54% higher, following the overnight US market rally.

- Ping An Insurance (Group) Company of China, Ltd (2318 HK) Shared jumped 9.6% yesterday. There was no company-specific news. Hang Seng index surged to close 5.9% higher at 18,087.97 on its return after a holiday Tuesday.

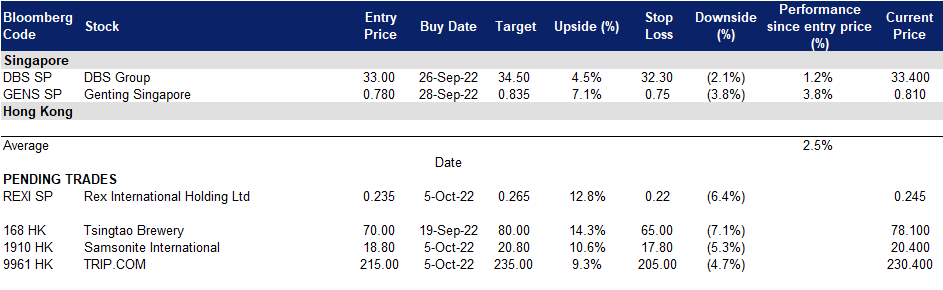

Trading Dashboard Update: Cut loss on Singtel (ST SP) at S$2.58.