5 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

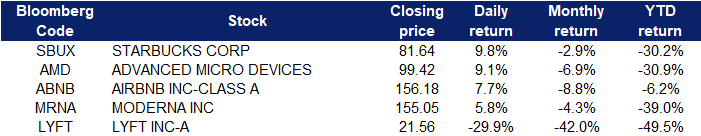

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Homebuilding | +5.1% | Homebuilders Jump Most in a Year as Powell Quells Bigger Rate Hikes D.R. Horton Inc (DHI US) |

| Oil Refining/Marketing | +5% | Oil Prices Hit $110 As Europe Prepares To Ban Russian Crude Marathon Petroleum Corp (MPC US) |

| Oilfield Services/Equipment | +4.6% | Oil Prices Hit $110 As Europe Prepares To Ban Russian Crude Schlumberger N.V. (SLB US) |

- Starbucks (SBUX US) shares rose 9.8%. Starbucks matched estimates with an adjusted quarterly profit of 59 cents per share, and revenue slightly above estimates. CEO Howard Schultz detailed improved wages and benefits for the coffee chain’s employees, although he added that unionised locations would need to negotiate their own deals.

- Advanced Micro Devices (AMD US) shares surged 9.1% after the chipmaker reported a top and bottom-line beat for its latest quarter. AMD earned an adjusted $1.13 per share, compared with a consensus estimate of 91 cents. It also issued a stronger-than-expected outlook amid increased demand from data centres for its chips.

- Airbnb (ABNB US) shares rose 7.7% after posting a quarterly loss of 3 cents per share, narrower than the 29-cent loss analysts were anticipating. Revenue also beat forecasts, as travellers continued to book rentals even in the face of rising prices by hosts.

- Moderna (MRNA US) shares rose 5.8%, as the vaccine maker’s quarterly results came in well above estimates. Moderna earned $8.58 per share for the quarter, compared with a consensus estimate of $5.21.

- Lyft (LYFT US) shares lost 29.9% after the ride-hailing company said it would increase spending to attract more drivers, leading to an earnings forecast that fell short of Wall Street predictions.

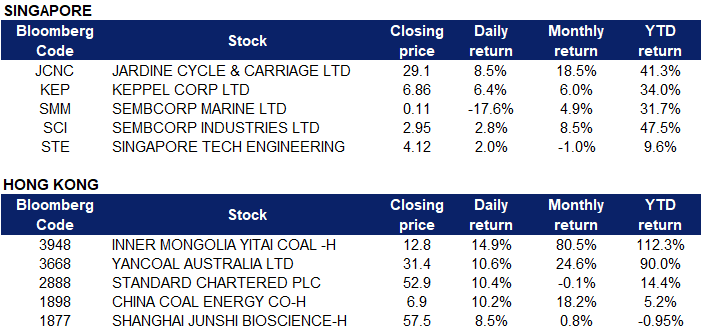

Singapore

- Dyna-Mac Holdings Ltd (NO4 SP) shares rose 20.3% yesterday after the group announced it secured S$180mn worth of new contracts. The net order book to-date reaches a record high of S$641.1mn, and the deliveries will stretch into 2024.

- Venture Corporation Ltd (V03 SP) shares rose 6.0% yesterday after the company announced its 1Q22 results last Friday. 1Q22 revenue jumped by 29.5% YoY to S$889.3mn. Net profit jumped by 28.6% YoY to S$84mn. The company anticipated a steady demand outlook, and the recent new product launches have been well received by end-customers and have contributed to additional growth.

- First Resources Ltd (EB5 SP) shares rose 7.0% yesterday. There was no company-specific news. Crude palm oil futures closed at an all-time high of MYR7,104/tonne on Wednesday.

- Riverstone Holdings Limited (AP4 SP) shares fell 14.5% yesterday. There was no company-specifc news. Yesterday was the EX-Dividend date. The dividend was MYR0.28, equivalent to S$0.089. However, the share price dropped by S$0.14.

- Yangzijiang Financial Holding (YF8 SP) shares fell 14.7% yesterday. The stock had plunged for three consecutive trading days since its listing on 28th April. There was no company-specific news. Investors remained berish on the economic growth in China.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Petroleum & Gases Equipment & Services | +2.3% | Oil jumps 3% as EU plans ban on Russian oil China Oilfield Services Ltd (2883 HK) |

Industrial Goods | +1.3% | China’s industrial profits up 8.5% in Q1, though risks linger for Q2 Xinyi Glass Holdings Ltd (868 HK) |

Nonferrous Metal | +1.1% | FPIs raise wager on metals and mining as commodities rally China Hongqiao Group Ltd (1378 HK) |

Top Sector Losers

Sector | Loss | Related News |

Biotechnology | -3.2% | FDA rejects Chinese cancer drugs WuXi Biologics (Cayman) Inc (2269 HK) |

Medical Equipment & Services | -1.7% | FDA rejects Chinese cancer drugs Shandong Weigao Group Medical Polymer Co Ltd (1066 HK) |

Gamble | -1.7% | MGM China falls to US$26 million EBITDAR loss in 1Q22 on falling Macau revenues MGM China Holdings Ltd (2282 HK) |

- JD Health International Inc (6618 HK) shares fell 13% yesterday. Liu Qiangdong, the founder and chairman of JD.com Group, has recently reduced his holdings of more than 8.84 million shares to cash out nearly 440 million yuan. After the reduction, his shareholding in JD Health dropped to 68.66%.

- Innovent Biologics Inc (1801 HK) shares fell 10.1% yesterday. Lyon reiterated its “Buy” rating on Innovent Biologics, however, cutting the target price from HK$45.1 to HK$37.2. Innovent Bio announced that its product sales in the first quarter of this year exceeded 1 billion yuan, with a rapid double-digit YoY growth, which was roughly in line with the bank’s forecast. However, Lyon pointed out that the company’s immunosuppressant PD -1 sales fell 22.1% YoY, below its forecast, while non-PD-1 drugs saw strong growth. The bank said it lowered its forecast for the company’s income statement to reflect its performance.

- Bilibili Inc (9626 HK) shares lost 8.2% yesterday, after trimming its forecast for its first-quarter revenue. However, the company also disclosed a bump in the number of users as Covid-related lockdowns force millions of citizens to stay indoors. Average monthly active users were 293.6 million in the first quarter of 2022, an increase of 31.5% YoY. Nevertheless it lowered its forecast of revenue for the first quarter to a range of 5.0 billion yuan to 5.1 billion yuan, compared to the range of 5.3 billion yuan to 5.5 billion yuan as of March 3, 2022. As such, fellow peers, Weibo Corp (9898 HK) and Kuaishou Technology (1024 HK) shares fell 8.9% and 5.8% yesterday.

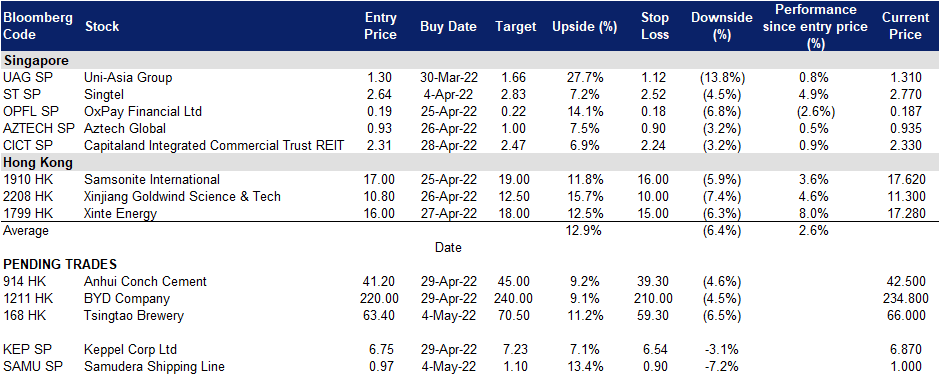

Trading Dashboard Update: No deletions or additions of stocks.