5 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Internet Retail | +3.17% | Why Coupang Stock Was Rallying 12% Higher Today Coupang Inc (CPNG US) |

| Precious Metals | +2.71% | Gold Import Duty Hiked by 5%: Will Gold Prices Increase? Know How it Will Impact Investors Newmont Corporation(NEM US) |

| Restaurants | +2.67% | McDonald’s (NYSE:MCD) Given New $280.00 Price Target at Guggenheim McDonald’s Corp(MCD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -3.95% | TSMC sees clients scale back orders Taiwan shares extend losses as TSMC continues to trend lower Taiwan Semiconductor Mfg Co Ltd (TSM US) |

| Steel | -1.92% | Steel Price extends losses as China, Europe signal demand-supply mismatch amid recession fears BHP Group Limited(BHP US) |

| Apparel/Footwear | -0.80% | Down 35%, This Stock’s Price Plunge Is a Gift to Savvy Investors Nike Inc(NKE US) |

- Micron Technology Inc (MU US) shares fell 2.9% after the company issued disappointing fiscal fourth-quarter guidance and said weakening consumer demand will hurt smartphone sales. The warning pulled down other chip stocks, which were among the top decliners in the S&P 500. Western Digital Corp (WDC US) and On Semiconductor Corp (ON US) lost 3.1% and 6.9%. Nvidia, Qualcomm and Advanced Micro Devices all pulled back by more than 3%.

- Kohl’s Corporation (KSS US) stock cratered 19.6% after Kohl’s confirmed a CNBC report that it had ceased talks with Franchise Group, saying that the retail environment has worsened since bidding began. Kohl’s also cut its outlook for the current quarter.

- Coupang Inc (CPNG US) soared 18.0% after Credit Suisse upgraded shares of the South Korean e-commerce company to “outperform” from “neutral.”

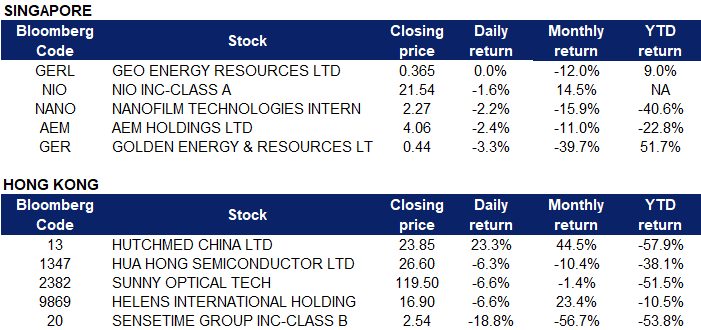

Singapore

- Golden Energy and Resources Ltd (GER SP) shares fell 3.3% yesterday. A ban on all Russian coal imports into the European Union set to come into effect in August, which the EU estimated would deprive Moscow of at least €8 billion ($12 billion) a year. Japan and the United States have also announced import restrictions on Russian coal. The bans prompted Russia to offer deeply discounted coal which, according to S&P, is being shipped to China, the Mediterranean, India and western European nations looking to stockpile the commodity ahead of the ban. Russia is now one of China’s largest suppliers of metallurgical coal. Whereas, Geo Energy Resources Ltd (GERL SP) shares remained flat.

- Nanofilm Technologies International Ltd (NANO SP) shares fell 2.2% yesterday. Analysts have lowered their target prices on Nanofilm Technologies in view of the expected slowdown in demand, which will weaken its earnings prospects in the near term. CGS-CIMB analyst William Tng said that suppliers such as Nanofilm are grappling with higher input costs. With rising inflation concerns, there is also a risk of a decline in consumer spending, especially on discretionary consumer tech-related products, which accounted for 63 percent of Nanofilms revenue in the first quarter of this year, he added.

- AEM Holdings Ltd (AEM SP) shares fell 2.4% yesterday. AEM, a global leader in test innovation, expands its operation by having a new site in Malaysia and the US. AEM will also expand its R&D centres in the aforementioned countries and Singapore. The new facilities are scheduled to start operating by the end of 3Q22. A significantly weaker-than-expected business outlook by memory-chip firm Micron Technology Inc on Thursday raised concern that following nearly two years of strong demand the semiconductor industry was turning towards a down cycle.

- NIO Inc (NIO SP) shares fell 1.6% yesterday. Nio Inc announced that it delivered 12,961 vehicles in June, which represents an increase of 60.3% year-on-year. During the 2QFY2022, Nio saw a 14.4% y-o-y increase in the number of vehicles delivered to 25,059. Cumulatively, Nio delivered 217,897 vehicles as at June 30. Nio certainly has some bullish catalysts for the second half of 2022, but investors are wary of false accounting accusations, particularly against Chinese-domiciled ADR stocks.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Biotechnology | +3.56% | Inspired by Xi’s visit, HK sci-tech firms eye closer GBA cooperation Hutchison China Meditech Ltd (13 HK) |

Textile & Apparels | +1.65% | China’s textile-garment exports expand in 1st 5 months of 2022 Billion Industrial Holdings Ltd (2299 HK) |

Environmental Energy Material | +0.92% | GCL Technology Holdings Ltd (3800 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -2.86% | Australia punished as Russian coal helps China Yancoal Australia Ltd (3668 HK) |

Gamble | -2.49% | Macau Casinos Win Just $310M in June, Worst Month So Far in 2022 SJM Holdings Limited (880 HK) |

Airline Services | -1.77% | Chinese airlines, including Air China, buy almost 300 planes from Airbus Air China Limited (753 HK) |

- SenseTime Group Inc (0020 HK) shares fell 18.8% yesterday. The share price tumbled 47% on 30 June when the lockup of pre-listing investors and cornerstone investors was freed up, HSBC Global Research said in its report. In HSBC’s view, the falling share price of SenseTime was due to the fact that U.S. investors might have already exited, since the company was placed on the U.S. Non-SDN Chinese Military-Industrial Complex Companies List, and that pre-listing investors might have pocketed gains.

- Helens International Holdings Co Ltd (9869 HK) shares fell 6.6% yesterday. According to the research report issued by Huatai Securities, Helens opened 130 new taverns in 1H22. As of the end of June, Helens had 848 self-operated taverns. Store sales from January to May were under pressure from the recent epidemic outbreak.

- Sunny Optical Technology (Group) Co. Ltd (2382 HK) shares fell 6.6% yesterday. Huatai Securities said that weak smartphone demand dragged down Sunny Optical’s 2022 earnings, and lowered its 2022/2023/2024 revenue forecast by 16/13/12% and net profit forecast by 28/26/28% to reflect the weak smartphone market shipment forecast.

- Hua Hong Semiconductor Ltd (1347 HK) shares fell 6.3% yesterday. Zhitong Finance APP learned that chip stocks generally fell in early trading. According to media reports, TSMC has rarely seen three major customers adjust orders. The mass production of Apple’s iPhone 14 series has started, but the target of the first batch of 90 million units has been cut by 10%. In addition, AMD reduced orders for about 20,000 7/6 nanometers from the fourth quarter of this year to the first quarter of 2023, and Nvidia asked to delay and reduce orders in the first quarter. In addition, on July 1, market news said that the storm of semiconductor chip orders and price cuts expanded again.

- HUTCHMED (China) Ltd (0013 HK) shares rose 23.3%, alongside most biopharmaceutical stocks yesterday. Guosen Securities said that some innovative drug and innovative device companies have performed strongly, and the market sentiment in the pharmaceutical sector of Hong Kong stocks has improved significantly.

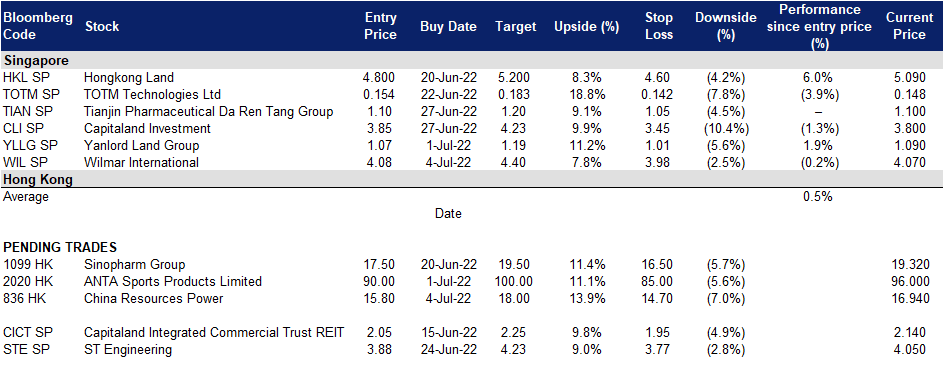

Trading Dashboard Update: Cut loss on Fuyao Glass Industry Group (3606 HK) at HK$38.2. Add Wilmar International (WIL SP) at S$4.08.