31 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

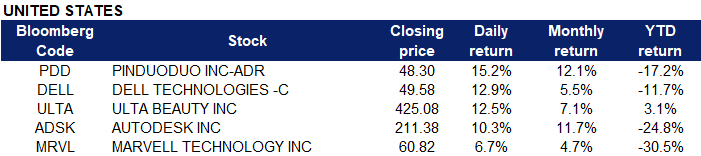

United States

Top Sector Gainers

Sector | Gain | Related News |

Motor Vehicles | +4.9% | Another Analyst Stays Bullish on Tesla Stock. That’s Helping to Fuel a 3-Day Rally. Tesla Inc (TSLA US) |

Telecommunications Equipment | +4.0% | Recent ‘realityOS’ trademarks hint at Apple moving closer to AR/VR headset announcement Apple Inc (AAPL US) |

Semiconductors | +3.9% | NVIDIA Announces Financial Results for First Quarter Fiscal 2023 Nvidia Inc (NVDA US) |

Top Sector Losers

Sector | Loss | Related News |

Tobacco | -0.50% | N/A Philip Morris International Inc (PM US) |

- Pinduoduo Inc (PDD US) shares soared 15.2% after the Chinese e-commerce company reported quarterly results that surpassed expectations. Pinduoduo also reported a 7% in active buyers from the year-earlier period.

- Dell Technologies Inc (DELL US) shares surged 12.9% following better-than-expected profit and revenue for the previous quarter. The computer hardware maker said it benefited from a jump in demand for desktop and laptop computers by business customers.

- Ulta Beauty Inc (ULTA US) shares surged 12.5% following better-than-expected quarterly earnings and revenue. Ulta Beauty also shared a better-than-expected outlook for the full year.

- Autodesk Inc (ADSK US) shares surged 10.3% after the software company reported earnings and revenue that beat analyst expectations. Autodesk reported total net revenue of $1.170 billion that was better than Refinitiv consensus estimate of $1.145 billion. The company’s earnings came in at $1.43 per share, beating expectations by 9 cents a share.

- Marvell Technology Inc (MRVL US) shares jumped 6.7% after the company reported earnings that beat expectations. Marvell Technology reported earnings of 52 cents per share on revenues of $1.447 billion. Analysts polled by Refinitiv were expecting earnings of 51 cents per share on revenues of $1.427 billion.

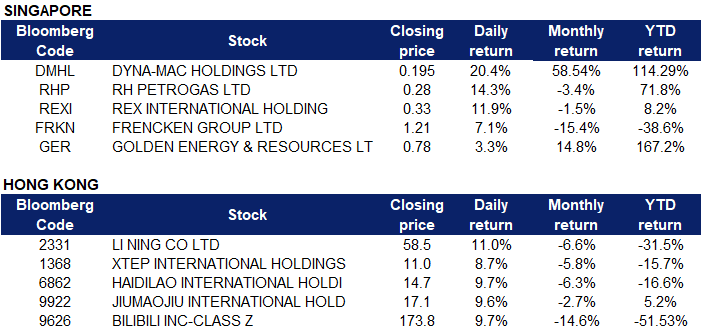

Singapore

- Dyna-Mac Holdings Ltd (DMHL SP), RH Petrogas Ltd (RHP SP) and Rex International Holdings Ltd (REXI SP) shares rose 20.4%, 14.3% and 11.9% respectively yesterday. WTI crude futures gained 1% to around $116 per barrel on Monday, hitting their highest in nearly three months, as traders speculated on whether the EU would reach an agreement on banning Russian oil, while major Chinese cities eased coronavirus curbs. Despite failing to agree on an embargo on Russian oil on Sunday, EU governments are expected to continue working on a deal to ban seaborne deliveries of Russian oil while allowing deliveries by pipeline, ahead of an EU summit on Monday. Any further ban on Russian oil threatens to exacerbate an already tight crude market amid rising demand for gasoline, diesel and jet fuel ahead of the peak summer demand season in the US and Europe. Meanwhile, Shanghai said Sunday it will lift “unreasonable” curbs on businesses from June 1, while Beijing reopened parts of its public transport as well as some malls and other venues as infections stabilised. An easing in China’s virus curbs would help to support global consumption.

- Frencken Holdings Ltd (FRKN SP) shares rose 7.1% yesterday. There was no company specific news. On May 19, Frencken Group’s non-executive non-independent chairman Gooi Soon Chai acquired 200,000 shares of the company at S$1.15 per share. With a consideration of S$230,000, this took his total interest in the integrated technology solutions company from 23.48% to 23.53%. Also, on May 19, Frencken Group president and executive director Dennis Au acquired 200,000 shares of the company at S$1.16 per share. This took his interest from 0.89% to 0.94%. His preceding acquisitions were between Mar 7 and 8, with 150,000 shares acquired at S$1.52 per share.

- Golden Energy & Resources Ltd (GER SP) shares rose 3.3% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, consolidated above the $400-per-tonne mark and just 20 dollars shy of its record peak, supported by continued robust demand against a tightening market backdrop. Along with increasing demand for power generation with a resumption in economic activity after the coronavirus-induced slump, soaring natural gas prices in Europe and Asia in late 2021 boosted coal consumption. On top of that, Russia’s invasion of Ukraine and the unprecedented economic sanctions, including the EU’s ban on coal imports from Russia, have thrown the global energy market into chaos

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Marine & Harbour Services | +5.90% | China’s logistics chain resumes normal operations Sinotrans Limited (598 HK) |

Electronic Component | +3.86% | China’s factory activity likely contracted more slowly in May – Reuters poll Sunny Optical Technology (Group) Co. Ltd (2382 HK) |

Alcoholic Drinks & Tobacco | +3.33% | Asia: Markets extend Wall Street rally as China eases curbs China Resources Beer Holdings Co Ltd (291 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -0.75% | Yankuang Energy Group Co Ltd (1171 HK) |

Property Development | -0.66% | China leverages targeted policies to bolster property market China Resources Land Limited (1109 HK) |

Agricultural, Poultry & Fishing Production | -0.49% | China can ensure domestic grain supply without hoarding from intl. market: Chinese FM WH Group Ltd (288 HK) |

- Li Ning Co. Ltd (2331 HK) Shares jumped 11.0% yesterday. Xtep International Holdings Limited (1368 HK) Shares rose 8.7% yesterday. There was no company-specific news for both companies. The sportswear sector jumped today after several research houses called a bottom for the sector as the resumption of manufacturing is on track. Logistics gradually normalise. Meanwhile, municipalities launch several supporting policies to uphold domestic consumption. In a nutshell, retail sales are expected to bottom out in June.

- Haidilao International Holding Ltd (6862 HK) Shares rose 9.7% yesterday. Jiumaojiu International Holdings Ltd (9922 HK) Shares rose 9.6% yesterday. There was no company-specific news for both companies. The food and beverage sector jumped today as Shanghai said on Sunday “unreasonable” curbs on businesses will be removed from June 1 as it looks to lift its COVID-19 lockdown, while Beijing reopened parts of its public transport as well as some malls and other venues as infections stabilised.

- Bilibili Inc (9626 HK) Shares rose 9.7% yesterday. Bilibili will release its first-quarter results on June 9. Tianfeng Securities released a research report saying that the company’s revenue in the first quarter is expected to be 5.04 billion yuan, a YoY increase of 29%. The bank said that in terms of users, MAU maintained a YoY growth rate of more than 30%, DAU/MAU increased MoM, and the average daily duration of a single user hit a record high.

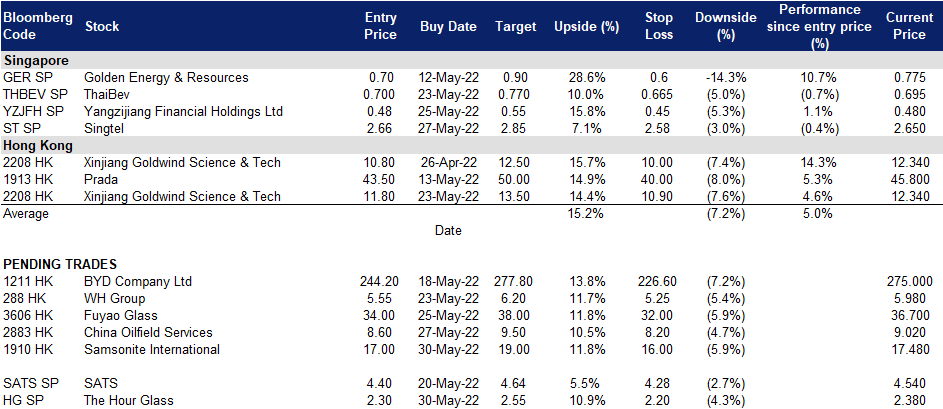

Trading Dashboard Update: No additions or deletions to trading dashboard.