30 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Managed Health Care | +1.47% | N/A Unitedhealth Group Inc (UNH US) |

| Beverages: Non-Alcoholic | +1.15% | Consumer defensive stocks continue to trek higher Coca-Cola Company(KO US) |

| Home Improvement Chains | +1.13% | Home Depot (HD) Gains As Market Dips: What You Should Know Home Depot Inc(HD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oil & Gas Production | -4.07% | Oil slides 2% on rising U.S. fuel stocks and output Occidental Petroleum Corp (OXY US) |

| Investment Managers | -2.46% | Blackstone dealt legal setback after $5bn low-income housing deal Blackstone Inc(BX US) |

| Integrated Oil | -2.19% | Strike begins at Exxon’s Fos refinery in France Turbulent oil, gas markets to persist ‘for some time to come,’ Shell CEO says Exxon Mobil Corporation(XOM US) |

- Bed Bath & Beyond Inc (BBBY US) shares plummeted 23.6% after the company missed revenue estimates and posted a wider-than-expected loss in the recent quarter. Bed Bath & Beyond also announced it is replacing CEO Mark Tritton.

- Carnival Corp (CCL US) shares fell 14.1% after Morgan Stanley cut its price target on the stock roughly in half and said it could potentially go to zero in the face of another demand shock, given Carnival’s debt levels. The call dragged other cruise stocks lower. Royal Caribbean (RCL US) and Norwegian Cruise Line Holdings (NCLH US) dropped 10.3% and 9.3%, respectively.

- McDonald’s Corp (MCD US) shares climbed 2.0% following an upgrade to overweight by Atlantic Equities. The firm said hamburger chain will hold out as consumer spending slows.

Singapore

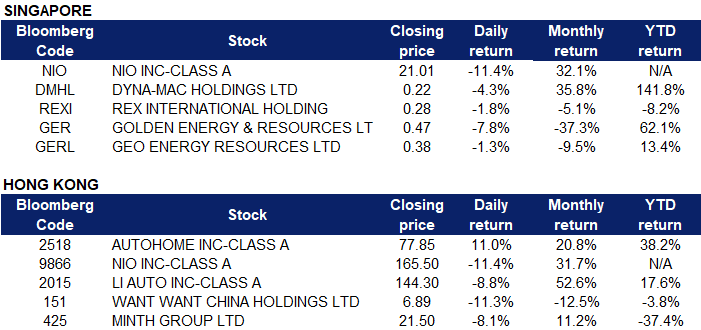

- Nio Inc shares fell 11.4% yesterday, after the short-seller Grizzly Research published a report claiming that it had inflated its revenue figures. Nio used its Wuhan Weineng battery venture to “juice its numbers by pulling forward seven years of revenue,” playing “Valeant-esque accounting games to inflate revenue and boost net income margins,” akin to the accounting scandal that led to the 2016 collapse of the Canadian pharmaceutical firm Valeant, said Grizzly Research, divulging that it has a short position that profits from any tumble in Nio’s stock price.

- Dyna-Mac Holding Ltd (DMHL SP) and Rex International Holding Ltd (REXI SP) shares fell 4.3% and 1.8% respectively yesterday. According to AAA, the drop in oil and gasoline futures prices stemmed from traders’ concerns about an overall drop in U.S. economic activity following the Federal Reserve Board’s three-quarters-of-a-percentage point increase in benchmark interest rates on June 15 — the most aggressive hike since 1994. Economic slowdowns typically lead to downward pressure on oil and gasoline if fewer goods are being made, fewer trips are needed to move them, and fewer consumers are driving to stores to buy them.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares fell 7.8% and 1.3% respectively yesterday. North China’s Shanxi Province, a major coal-producing region, recently announced a move to increase its annual coal production output by 107 million tons to 1.3 billion in 2022 to ensure domestic energy supply. Shanxi is also seeking to raise coal production by another 50 million tons next year, bringing its annual coal output to 1.35 billion tons, according to a circular issued by the provincial government. Impacted by the prolonged pandemic and the Russia-Ukraine conflict, the prices of fossil fuels including coal, oil and natural gas surged to record highs, which, along with soaring shipping freight and a strong US dollar, have constrained China’s coal imports this year.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Consumer Electronics | +2.81% | N/A Smoore International Holdings Ltd (6969 HK) |

Food Additives & Flavouring | +2.67% | N/A Fufeng Group Ltd (546 HK) |

Coal | +1.72% | Shanxi Province raises annual coal output to 1.3 billion tons to ensure China’s energy supply China Shenhua Energy Co Ltd (1088 HK) |

Top Sector Losers

Sector | Loss | Related News |

Diversified Food & Beverage | -6.40% | Want Want China Shares Fall as Analysts See Dimmer Outlook Want Want China Holdings Ltd (151 HK) |

Automobiles & Components | -3.68% | Nio shares plunge on short-seller allegations; company says report ‘without merit’ Nio Inc (9866 HK) |

Biotechnology | -2.61% | N/A WuXi Biologics (Cayman) Inc (2269 HK) |

- Autohome Inc (2518 HK) shares rose 11.0% yesterday, a new high in nearly eight months, with a total market value of nearly HK$40 billion. The company has successfully established many new departments and incorporated speech recognition and intelligent interaction. They will continue to recruit talents for their live broadcasting, new retail and Metaverse industrial chain in the next half of the year. Additionally, there will be many highly anticipated car launches happening in the second half of the year, which will help drive the recovery of the automotive marketing industry.

- Nio Inc (9866 HK) shares fell 11.4% yesterday, after the short-seller Grizzly Research published a report claiming that it had inflated its revenue figures. Nio used its Wuhan Weineng battery venture to “juice its numbers by pulling forward seven years of revenue,” playing “Valeant-esque accounting games to inflate revenue and boost net income margins,” akin to the accounting scandal that led to the 2016 collapse of the Canadian pharmaceutical firm Valeant, said Grizzly Research, divulging that it has a short position that profits from any tumble in Nio’s stock price.

- Li Auto Inc (2015 HK) shares fell 8.8% yesterday. On June 28, Li Auto announced that it would sell ADSs with a total amount of not more than 2 billion US dollars through the on-site stock issuance plan, each ADS representing 2 shares of Class A ordinary shares. Net proceeds from the offering will be used to research next-generation electric vehicle technologies, including BEVs, smart cockpits and autonomous driving technologies; develop future platforms and manufacture vehicle models, as well as meet working capital needs and general corporate purposes.

- Want Want China Holdings Ltd (0151 HK) shares fell 11.3% yesterday, as industry analysts flagged headwinds for earnings due to costlier raw materials and Covid-19-related lockdowns in China. In a research note Daiwa Capital analysts said near-term growth could continue to be challenged by lockdown measures and described the “commodity cost surge” this year as having exceeded the company’s expectations. They expect gross margin pressure to persist in the near term despite the company’s move to raise many of its average selling prices earlier this year.

- Minth Group Ltd (0425 HK) shares fell 8.1% yesterday. It was reported that the review status of the company’s science and technology innovation board has been changed to “suspended”, due to its financial report update. Daiwa reported that the company cut production by 20% year-on-year in April, however production returned to normal in May. Due to the production impact, the bank expects revenue to drop by 4% year-on-year in the first half of this year, and net profit to drop by 28%, but it is expected that revenue for the whole year may increase by 18% year-on-year and net profit increase by 4%.

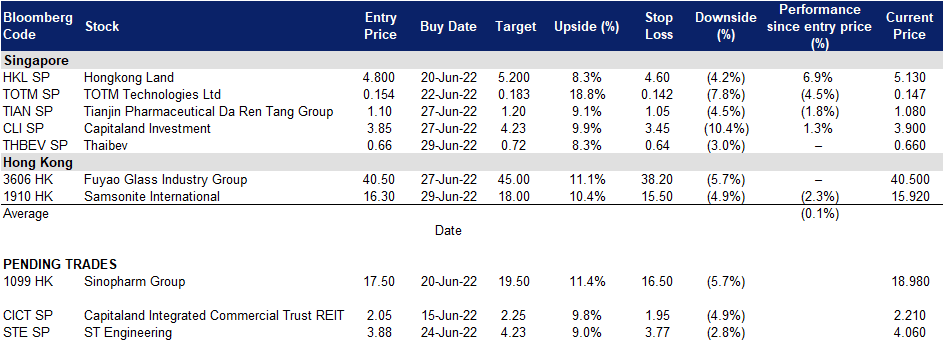

Trading Dashboard Update: Take profit on Prada (1913 HK) at HK$45.5. Add Thaibev (THBEV SP) at S$0.660 and Samsonite International (1910 HK) at HK$16.3.