KGI DAILY TRADING IDEAS – 2 July 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Golden Energy & Resources (GER SP): A hidden GEM

- BUY Entry – 0.30 Target – 0.43 Stop Loss – 0.26

- GER owns and operates thermal coal mines in Indonesia (through 63% owned PT Golden Energy Mines), and metallurgical coal (75% owned Stanmore Resources) and gold mining (50% owned Ravenswood Gold) in Australia. Stanmore has coal resources estimates of 1.7 billion tonnes, marketable coal reserves estimates of 130.0 million tonnes and a coal handling preparation plant capacity of up to 3.5 million tonnes per annum. PT Golden Energy Mines (GEMS) has more than 2.9 billion tonnes of energy coal resources and more than 1 billion tonnes of coal reserves. Meanwhile, Ravenswood Gold has 3.9 million ounces of gold resources and 2.6 million ounces of gold reserves, and a gold processing facility of up to 5.0 million tonnes per annum.

- Record production; long-life assets. The company has ramped up production significantly over the past 10 years. For its Indonesian operations, production increased from 1.8mt in 2010 to 33.5mn in 2020. Meanwhile, its assets in Australia are made up of high quality met coal mines and sizable gold reserves and resources. Post expansion, GER’s Ravenswood Gold is expected to be one of the largest gold producers in Queensland, Australia.

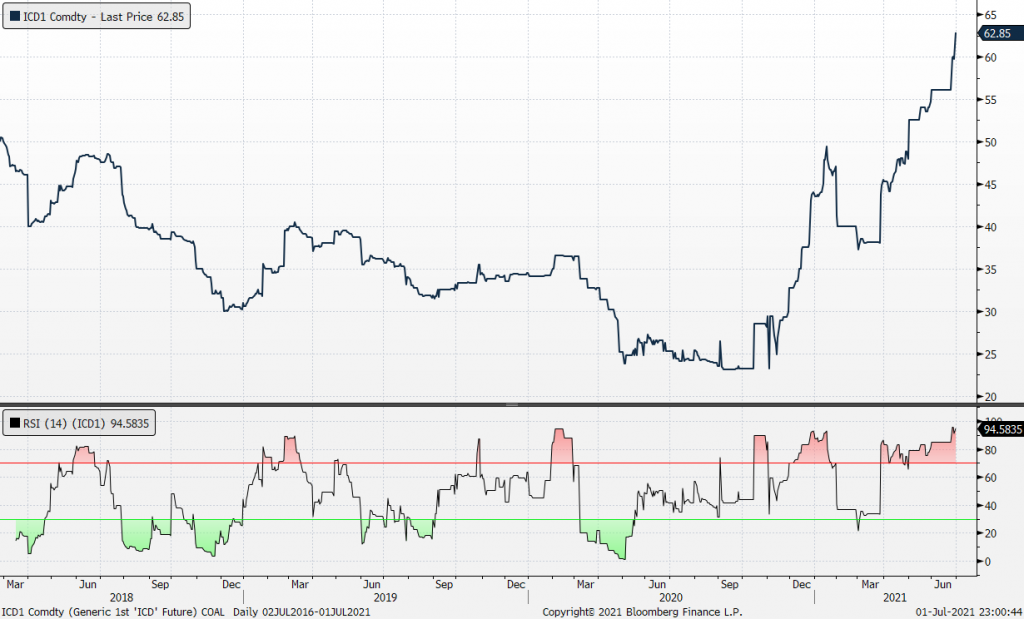

- Coal prices are near their highest in a decade, as a combination of natural gas shortfall, rebounding electricity usage and limited rainfall in China have lifted demand for thermal coal. Thermal coal prices have almost doubled from last year, and we expect prices to remain firm going into the second half of 2021. While global demand for coal peaked in 2014, the dearth of new supplies combined with the surge in electricity demand could lead to even higher prices.

- GER’s share price should be around 34-48 cents based on the previous time that coal prices were trading at these levels in 2017-2018. In fact, current coal prices are more than 30% higher than the previous cycle peak in 2018.

ICI 4 Indonesian Coal Index (Argus/Coalindo) Futures

Hyphens Pharma (HYP SP): A fresh start; raise entry price

- RE-ITERATE BUY Entry – 0.325 Target – 0.43 Stop Loss – 0.28

- Hyphens focuses on the sales and marketing of specialty pharmaceutical products in several ASEAN countries through exclusive distributorship or licensing and supply agreements with brand principals from Europe and the US. In addition, the company markets its own proprietary range of dermatological products under Ceradan, TDF brands and health supplements under Ocean Health.

- 1Q2021 turnaround. Hyphens 1Q21 revenue increased 7.5% YoY while gross profit rose 11.2% YoY thanks to a resurgence in its Vietnam sales. While the latest quarterly net income was relatively flat YoY, we note that it managed to achieve a record quarterly sales in 1Q.

- Growth spurt. We expect the company to speed up growth going forward as countries in the region reopen. In the online space, one of its subsidiaries was awarded with an e-pharmacy license for wellAway Pharmacy to provide a platform for clinics to order and deliver medicine to patients’ homes. The group also launched several new products last year, including Ceradan Hand Lotion Sanitiser and High Strength Omega-3 Vitamin D3-Enriched and Fast Absorb Iron Energy Formula.

- Fundamental Outperform and TP of S$0.43, based on 17x FY2022F P/E. Read our full report here.

HONG KONG

Geely Automobile Holdings Limited (175 HK): Another chance to get on board

- Buy Entry – 22.5 Target – 26.5 Stop Loss – 20.5

- Geely Automobile Holdings Ltd is an investment holding company principally engaged in the production and sales of automobiles. The company mainly develops, manufactures and sells automobiles, including cars, sport utility vehicles (SUVs), new energy and electrified vehicles. The company’s car types include home, travel and sports. The company’s new energy and electrified vehicles include electric vehicles, battery electric vehicles, hybrid electric vehicles, mild hybrid electric vehicles and plug-in hybrid electric vehicles. In addition, the Company produces and sells automobile parts and related automobile components.

- The recent correction was due mainly to the withdrawal of an application for listing on Shanghai Star Board. This had limited impact on the fundamental business. Therefore, it could be a buy-the-dip opportunity for investors who missed out on the previous rally which was driven by the positive sentiment of the EV sector.

- Previously, the company announced some good news. Jidu Auto, the electric vehicle (EV) venture between Chinese search and AI giant Baidu and automaker Geely, will unveil its first model at the 2022 Beijing Auto Show. The 1.56mn units vehicle sales target for this year is intact despite the ongoing chip shortage. The company also formed a JV with Guangdong Xinyueneng Semiconductor to cover the design, manufacturing and sale of integrated circuits, and the manufacturing of discrete semiconductors.

- Updated market consensus of the estimated growths of EPS in FY21 and FY22 are 62% and 27.2% respectively, which translates to 23.7x and 18.6x forward PE. The current PE is 36.2x. Bloomberg consensus average 12-month target price is HK$27.27.

Xinyi Solar Holdings Limited (968 HK): Get sunshine for the summer

- Reiterate Buy Entry – 16.5 Target – 20.3 Stop Loss – 14.9

- Xinyi Solar Holdings Limited is an investment holding company principally engaged in the manufacturing and sale of solar glass. Along with subsidiaries, the company operates its business through three segments. The Sales of Solar Glass segment is involved in the production and sale of solar glass products. The solar glass products include ultra-clear processed glass (PV) raw glass, as well as other PV processed glass such as ultra-clear PV tempered glass, ultra-clear PV anti-reflective coating glass and back glass. The Solar Farm and Solar Power Generation segment is involved in the operation of utility-scale ground mounted solar farms. The Engineering Procurement and Construction (EPC) Services segment is engaged in the provision of EPC services for solar farms.

- The confrontation between China and the US has been expanding to various sectors. Apart from semiconductor and electric vehicles, photovoltaic industry is the field where both superpowers are devoting energy and resources to popularise the application across the country. Recently, Biden’s administration banned import of solar panel material from China-based Hoshine Silicon Industry over forced labour allegations. The movement probably will trigger a surge in prices of solar-grade polysilicon.

- The China National Energy Administration proposed to push trials of distributed photovoltaic development on rooftops across counties and cities domestically. Meanwhile, Biden’s administration is pro-solar power. Investors in the US have been accumulating shares of related solar companies in the hope that the upcoming infrastructure plan will have some supporting budget for the sector.

- Market consensus of net profit growth in FY21 and FY22 are 20.5% YoY and 4.0% YoY, which implies forward PERs of 25.8x and 24.8x. Current PER is 31.4x. Bloomberg consensus average 12-month target price is HK$15.57.

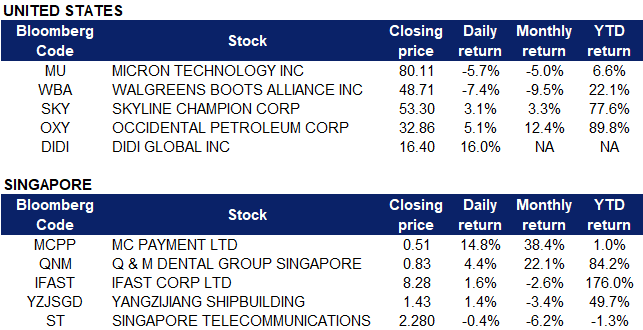

Market Movers

United States

- Micron (MU US) fell back near the US$80 price point despite posting strong fiscal 3Q results. Both sales and non-GAAP EPS have exceeded Wall Street forecasts, while guidance for fiscal 4Q was raised to US$8.2bn sales and non-GAAP EPS of US$2.30. However, analysts are increasingly apprehensive over the stock due to rising input costs and the trajectory of memory prices, leading to the sell-off.

- Walgreens Boots Alliance (WBA US) also tanked after reporting strong fiscal 3Q results, as analysts highlight weak 4Q FY21 estimates. While Walgreens boosted its full year earnings growth estimate to around 10%, the implied 4Q FY21 results is thus weaker than the results posted in 3Q FY21, as vaccine demand wanes in the US and prescription counts are expected to fall.

- Skyline Champion (SKY US) climbed to a new high with positive momentum for the week after Zacks upgraded the stock to Rank #1 earlier in the week, citing strong earnings estimates for the mid-cap home builder.

- Occidental Petroleum Corporation (OXY US) closed just shy of its 2021 high, forming a long-legged doji after OPEC+ delayed a highly anticipated decision on oil output levels. WTI crude oil futures traded above US$75, climbing another 2% on Thursday’s trading due to the delay.

- DiDi Global (DIDI US) climbed 16% on its 2nd trading day after a lukewarm market debut on Wednesday, bringing its market cap to around US$80bn. Didi is expected to be added to various equity indices in the coming weeks, with the FTSE Russell index changes coming on 8 July, while S&P Dow Jones will make the amendments on 12 July.

Singapore

- Yangzijiang (YZJSGD SP) The shipbuilder added another US$871mn of new orders for 11 vessels, bringing its order wins to 100 vessels worth a total of US$5.6bn year-to-date. The new order makes this year a record in the company’s history. Total outstanding order book stood at US$7.7bn as of 30 June 2021. Consensus has 7 BUYS / 1 HOLD / 1 SELL and 12m TP of S$1.64 (+15% upside potential).

- Q&M Dental (QNM SP) UOB Kay Hian initiated coverage on the company with a BUY rating and a target price of S$0.94. The research firm expects the group to likely post record core earnings in 2021 boosted by its dental and Covid-19 testing businesses. Consensus has a bullish view on Q&M with 6 BUYS and no hold/sell ratings.

- MC Payment (MCPP SP) surged 15% yesterday after shareholders voted to appoint five new directors to the company’s board. Meanwhile, most of the current directors, including CEO Anthony Koh and COO and executive director Kim Moon Soo, tendered their resignations from the board.

- iFAST Corp (IFAST SP) shares continued to gain after the announcement that it has led a consortium in the submission of an application for a digital bank license to Bank Negara Malaysia. iFAST will own a 40% stake in the digital bank if the application is successful.

- Singtel (ST SP) The digital bank JV between Grab and Singtel, together with other investors, has applied for a digital bank license in Malaysia. Based on the guidance provided by Bank Negara Malaysia, it is expected to issue up to five digital bank licences by the first quarter of 2022. Singtel offers a 4.5% and 5.3% dividend yield for FY2022 and FY2023 (YE March). Consensus is overall bullish on the stock with 15 BUYS / 4 HOLDS / 0 SELLS and a 12m TP of S$2.84 (+25% upside potential).

- Company buyback on 30 June: AEM (150k shares @ S$3.84), Tuan Sing (25k @ S$0.505-0.510), JEP (508k @ S$0.214), Telechoice Int’l (320k @ S$0.18)

Hong Kong

The HK market was closed yesterday for a public holiday (Hong Kong Special Administrative Region Establishment Day). Trading resumes today Friday, 2 July 2021.

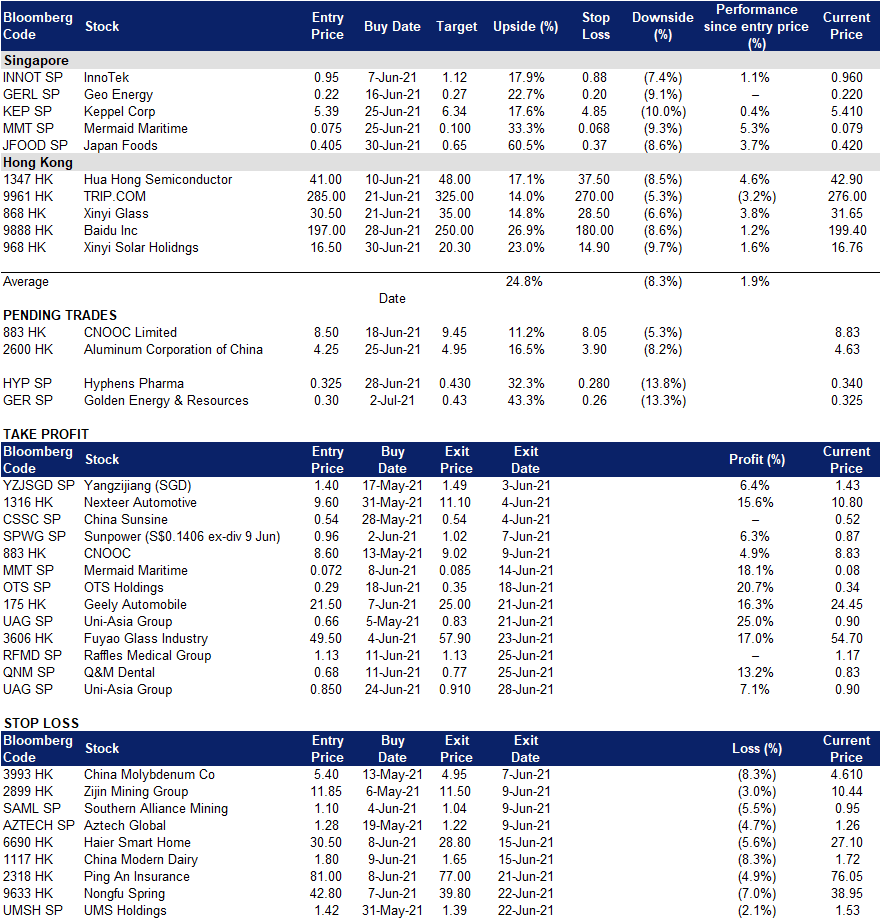

Trading Dashboard

Related Posts: