27 October 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Other Metals/Minerals | +3.55% | Copper price jumps as dollar eases Freeport-McMoRan Inc (FCX US) |

| Precious Metals | +2.86% | Gold Price Forecast: XAU/USD bulls on the verge of a significant breakout Newmont Corporation (NEM US) |

| Miscellaneous Commercial Services | +2.43% | Visa fiscal Q4 earnings helped by consumer spending; boosts dividend, announces buyback Visa Inc (V US) |

Top Sector Losers

| Sector | Loss | Related News |

| Telecommunications Equipment | -1.66% | Dow Jones Futures: Meta Continues Tech Titan Meltdown; Apple On Deck Apple Inc (AAPL US) |

| Internet Retail | -1.33% | Is a dark cloud likely to hang over Amazon earnings? Amazon.com Inc (AMZN US) |

| Semiconductors | -1.01% | Nvidia Leads Chip Stocks Higher on Meta’s Planned Tech Binge NVIDIA Corp (NVDA US) |

- Harley-Davidson Inc (HOG US) climbed 12.6% after Harley reported quarterly earnings beat top- and bottom line estimates. The Wisconsin company said higher shipments and strong pricing helped its performance.

- Spotify Technology SA (SPOT US) fell 13.0% after Spotify reported a wider-than-expected Q3 loss. The per-share loss was 0.99 euros per share on 3.04 billion of euros in revenue. Analysts surveyed by Refinitiv were expecting a loss of 0.85 euros per share and 3.02 billion of euros in revenue. Spotify’s gross margin declined year over year even as subscribers grew.

- Alphabet Class A (GOOGL US) slipped 9.1% Wednesday after it reported quarterly results that missed Wall Street’s expectations on the top and bottom lines. A revenue miss for YouTube ads weighed on the quarter. Alphabet also said it would reduce headcount going forward.

- Rollins Inc (ROL US) jumped 10.0% following strong Q3 earnings. Rollins posted earnings of 22 cents per share, compared to FactSet estimates of 21 cents per share. Revenue came in at $729.7 million for the quarter against analysts’ $714.9 million estimate, according to FactSet.

- Microsoft Corp (MSFT US) fell 7.7%, one day after the maker of Windows software released its fiscal first-quarter earnings and offered weak guidance for the quarter ending in December. The drop came despite Barclays analysts’ comments Wednesday, which said management is still guiding for revenue and profit that “should ensure relative outperformance.”

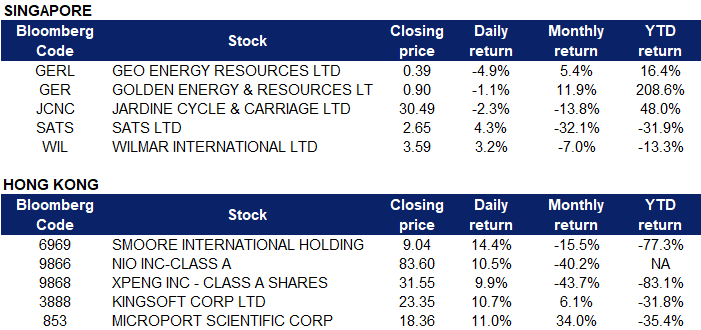

Singapore

- Geo Energy Resources Ltd (GERL SP) and Golden Energy & Resources Ltd (GER SP) dropped 4.9% and 1.1% respectively yesterday. Thailand expects to burn coal for power for longer after it extended the lifespans of some plants to cope with record-high natural gas prices, the assistant secretary general of its Energy Regulatory Commission said on Wednesday (Oct 26). The country has intensified its search for alternative energy sources, ranging from coal to renewables, to cut liquefied natural gas imports amid a surge in prices of the super-chilled fuel. The price volatility coincided with a rebound in Thailand’s electricity demand which hit a new peak in April as industries ramped up post-COVID, hitting consumers hard.

- Jardine Cycle & Carriage Ltd (JCNC SP) Shares fell 2.3% yesterday. China’s real estate investment in January-September fell 8.0 percent from the same period a year earlier, official data showed on Monday, worsening from the 7.4 percent decline seen in the first eight months of the year. China under President Xi Jinping has tightened financial controls on the real estate industry since 2021 to bring a bubble under control. This has caused developers to run out of funds and shut down construction on properties before they were finished.

- SATS Ltd (SATS SP) and Wilmar International Ltd (WIL SP) rose 4.3% and 3.2% respectively yesterday. There was no specific company news. Singapore stocks kicked off Wednesday positively due to the Wall Street stocks rallying for a third straight day on Tuesday even after US Treasury yields dropped on disappointing consumer confidence data – the latest to suggest a slowing US economy.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Biotechnology | +4.64% | Healthcare ‘little giants’ gain ground in Beijing on capital, tech support WuXi Biologics (Cayman) Inc (2269 HK) |

Software | +3.60% | Hang Seng rebounds slightly as Asia markets rise; Australia inflation hits highest in 32 years SenseTime Group Inc (20 HK) |

Medical Equipment & Services | +3.25% | Healthcare ‘little giants’ gain ground in Beijing on capital, tech support Shandong Weigao Group Medical Polymer Co Ltd (1066 HK) |

Top Sector Losers

Sector | Loss | Related News |

Electronic Component | -1.20% | There’s No Cheap Way to Sidestep China’s Energy Supply Chains Sunny Optical Technology Group Co Ltd (2382 HK) |

Alcoholic Drinks & Tobacco | –0.80% | China Resources Beer Tumbles as Brewer Buys Liquor Firm for USD1.7 Billion China Resources Beer Holdings Co Ltd (291 HK) |

Apparel | –0.56% | China to promote foreign investment in manufacturing Li Ning Company Limited (2331 HK) |

- Smoore International Holdings Ltd (6969 HK) Shares jumped 14.4% yesterday. CICC stated that on October 25, the Ministry of Finance, the General Administration of Customs, and the State Administration of Taxation jointly issued an announcement on the collection of consumption tax on electronic cigarettes, including electronic cigarettes in the scope of consumption tax collection, and implementing the method of ad valorem to calculate tax payment. The tax rate is 36%, the wholesale rate is 11%, and the overseas export of electronic cigarettes will continue to enjoy the tax rebate policy, which will be implemented from November 1, 2022.

- NIO Inc (9866 HK) Shares climbed 10.5% yesterday. According to the WeChat public account of “Shanghai Jiading”, on October 25, the signing ceremony of the NIO International Headquarters project was held in Jiangqiao Town. It is reported that NIO will build a landmark building with international influence in Jiading. The project signed this time plans to build the NIO International Business Headquarters in Jiangqiao Town, with a full-featured layout of R&D, office, and exhibition halls. After the project is completed, 10,000 high-end talents will be introduced, and about 2,000 new employees will be employed, of which about 90% are employees with college (or vocational) certificates or above.

- Xpeng Inc (9868 HK) Shares popped 9.9% yesterday. In the news, Wu Xinzhou, vice president of autonomous driving of Xpeng Inc, said recently that he hopes to start the Robotaxi test operation in Guangzhou in 2023 or 2024; in 2025, the development of Robotaxi and hardware capabilities can achieve joint training and enter the high-level autonomous driving stage. It is reported that Xpeng G9 has passed the closed-site test of autonomous driving and obtained the license for the “Road Test of Intelligent Connected Vehicles”.

- Kingsoft Corp Ltd (3888 HK) and Microport Scientific Corp (853 HK) Shares climbed 10.7% and 11.0% respectively yesterday. Shares in Hong Kong rose on Wednesday as sentiment overnight improved over the Fed potentially turning less aggressive. Hong Kong’s Hang Seng index was up 1% at 15,317.67 after three consecutive negative sessions. The Hang Seng Tech index gained 2.48%. In mainland China, the Shanghai Composite added 0.78% to 2,999.50 and the Shenzhen Component gained 1.678% to 10,818.33 – the China Securities Regulatory Commission on Tuesday said it intends to expedite the development of a “regulated, transparent open, lively and resilient” market. Onshore Chinese yuan strengthened to 7.1880 per dollar from hovering around 7.3 levels, while the offshore yuan last traded at 7.2150 against the greenback after trading above 7.25.

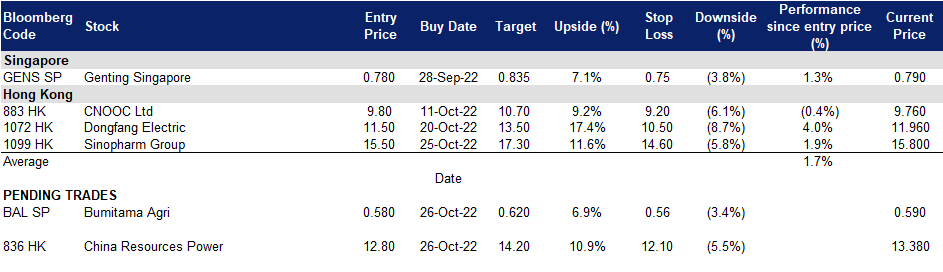

Trading Dashboard Update: Add Sinopharm Group (1099 HK) at HK$15.5.