26 April 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Computer Communications | +4.1% | Businesses are rightly worried about Russian cyber attacks, Darktrace CEO says Fortinet Inc (FTNT US) |

| Homebuilding | +3.7% | D. R. Horton Q2 2022 Earnings Preview DR Horton Inc (DHI US) |

| Internet Software/Services | +2.6% | Elon Musk taking Twitter private in $60.5 billion deal Twitter Inc (TWTR US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oilfield Services/Equipment | -5.8% | Oil slumps 4% as Shanghai lockdowns stoke demand fears Schlumberger NV (SLB US) |

| Precious Metals | -3.4% | Gold Price Forecast: Gold Bears Threaten Bigger Break After 2k Reversal Barrick Gold Corp (GOLD US) |

| Oil & Gas Production | -3.2% | Oil slumps 4% as Shanghai lockdowns stoke demand fears Occidental Petroleum (OXY US) |

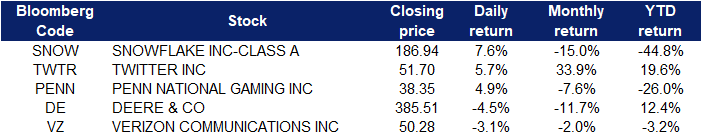

- Snowflake Inc (SNOW US) shares surged 7.6% after Wolfe Research initiated coverage of the cloud data company with an outperform rating. The stock, which is trading at “Black Friday prices,” could get a boost at its upcoming analyst day, the analyst said. Wolfe expects new product reveals, as well as updated guidance on how Snow will reach $10 billion in annual product revenues by the 2029 fiscal year.

- Twitter Inc (TWTR US) shares rose 5.7% on news that Twitter would accept a buyout from Elon Musk to take the company private for $54.20 per share.

- Penn National Gaming (PENN US) shares rose 4.9% after an upgrade from Morgan Stanley. The investment firm hiked its rating to overweight, saying that the recent slump for Penn National’s stock made it an attractive valuation and that the company has a better strategy for gaining sports-betting customers than its competitors.

- Deere & Co (DE US) shares tumbled 4.5% after Bank of America downgraded the stock to neutral from buy. Analysts said they see limited upside for the agricultural machinery stock, which could get hit by rising fertilizer prices amid the ongoing conflict in Ukraine.

- Verizon Communications Inc (VZ US) shares fell 3.1% after Goldman Sachs downgraded Verizon to neutral from buy on valuation, following a big subscriber loss for the telecom giant. Goldman said Verizon is positioned to remain a wireless leader in the 5G cycle but also anticipates a slowdown in revenue growth.

Singapore

- SATS Ltd (SATS SP) shares rose 2.7% yesterday. Food solutions and gateway services provider SATS has commenced a lease agreement with JTC to build an innovative food hub in Singapore’s Jurong Innovation District. The move is in line with SATS’ strategy to strengthen its Singapore core, while growing its international and non-travel businesses. The $150 million project will bring together all of SATS’ expertise in food production, ranging from culinary, food technology, supply chain, innovation, sustainability, digitalization, food safety and nutrition.

- RH Petrogas Ltd (RHP SP) and Rex International Holdings Ltd (REXI SP) shares fell 5.1% and 4.4% respectively yesterday. WTI crude futures fell 3% to around $99 per barrel on Monday, hitting their lowest in nearly 2 weeks, amid mounting concerns that prolonged Covid lockdowns in China and rapid rate hikes in the US would weigh on global economic growth and fuel demand. Monday’s slump extended a nearly 5% drop in the US oil benchmark last week as demand concerns outweighed worries over tight global supply. China’s demand for gasoline, diesel and aviation fuel in April is expected to decline 20% YoY, Bloomberg reported, which is equivalent to a drop in crude oil consumption of about 1.2 million barrels a day.

- Bumitama Agri Ltd (BAL SP) and First Resources Ltd (FR SP) shares fell 12.9% and 5.3% respectively yesterday. Indonesia president Joko Widodo announced yesterday that the country will ban palm oil exports, as he wanted to ensure the availability of food products at home. By banning exports of crude palm oil (CPO) for an unknown period of time, the Indonesian government believes that exporters and distributors will have no choice but to flood the domestic market with oil. Indonesia produces 46 million tonnes of palm oil annually, of which 27 million tonnes are exported.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Petroleum & Gases Equipment & Services | +1.30% | Oil Sinks Below $98 as China’s Lockdowns Imperil Demand Outlook CNOOC Limited (883 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -4.93% | Onsemi halts operations at Shanghai distribution center Hua Hong Semiconductor Limited (1347 HK) |

| Medicine | -4.80% | Stocks sink in Hong Kong, mainland China as Covid spreads to Beijing with district lockdown adding to cracks in economy Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (2196 HK) |

| Footwears | -4.63% | China Lockdown Angst Rips Through Markets as Stocks, Yuan Plunge Xtep International Holdings Limited (1368 HK) |

- Cathay Pacific Airways Ltd (293 HK) shares rose 3.7% yesterday after Lyon released a research report and upgraded the company from “outperform” to “buy”. The target price-to-book ratio was raised from 0.7 times to 1.3 times, and the target price was raised from HK$7.3 to HK$9.4. Lyon believes that the company is in the early stage of the recovery cycle.

- Aluminum Corporation of China Ltd (2600 HK) and China Hongqiao Group Ltd (1378 HK) shares lost 13.8% and 6.7% respectively yesterday. Aluminum futures hovered around $3,250 per tonne, close to their lowest in two months, as weak demand in China and Japan overshadowed worries of supply disruptions from Russia. The latest data showed China’s primary aluminum imports fell by 55.1% from a year earlier in March and by 71% in Q1.

- Angang Steel Company Ltd (347 HK) and Chongqing Iron & Steel Company Ltd (1053 HK) shares lost 12.1% and 7.6% respectively yesterday. Steel rebar futures pulled back toward CNY 5,000 per tonne from a nearly 6-month high hit above 5,100 in the previous week on renewed concerns about demand due to Covid-19 while production resumed its pace after the Beijing Olympics. Several districts in steel city Tangshan have been placed again under lockdown this week while mills in northern China ramped up production in the second half of March after the end of constraints due to Beijing Olympics.

Trading Dashboard

Trading Dashboard Update: Cut loss on China Oilfield Services (2883 HK) at HK$7.50, BYD Company (1211 HK) at HK$220, AviChina Company at HK$3.90, Ganfeng Lithium (1772 HK) at HK$80. Enter OxPay Financial Ltd (OPFL SP) at S$0.19, Golden Energy & Resources Ltd (GER SP) at S$0.68, Samsonite International (1910 HK) at HK$17.

(Click to enlarge image)

Related Posts: