24 November 2022: Wealth Product Ideas

|

Fund Name (Ticker) |

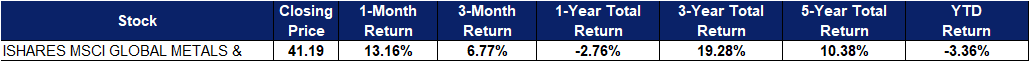

iShares MSCI Global Metals & Mining Producers ETF (PICK) |

|

Description |

The iShares MSCI Global Metals & Mining Producers ETF seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 21 Nov) |

232,630.00 |

|

Net Assets of Fund (as of 22 Nov) |

$1,380,075,394 |

|

12-Month Trailing Yield (as of 31 Oct) |

10.15% |

|

P/E Ratio (as of 21 Nov) |

6.16 |

|

P/B Ratio (as of 21 Nov) |

1.68 |

|

Management Fees |

0.39% |

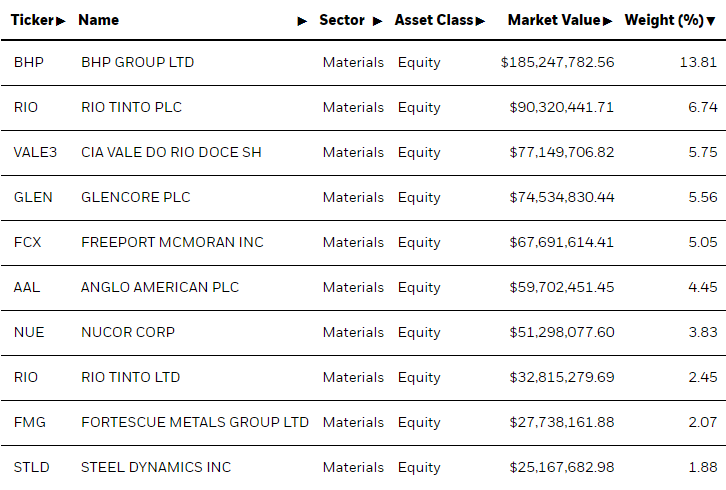

Top 10 Holdings

(as of November 21, 2022)

- BUY Entry – 40 Target – 48 Stop Loss – 36

- US dollar index peaked

- US inflation growth decreased and the market expectations of peak inflation were reinforced.

- US labour market is starting to cool down

- Rate hikes are expected to slow down.

- The authorities are focused on economic recovery after the 20th National Congress of the Chinese Communist Party

- Easing of Zero Covid policy

- Several measures were released to bail out the property market

- Ongoing infrastructure expansion to drive demand for basic metals

Source: Bloomberg

|

Fund Name (Ticker) |

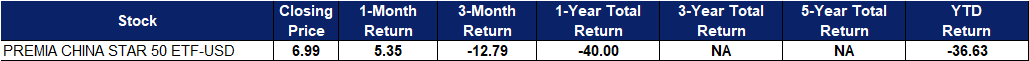

Premia China STAR50 ETF (3151HK) |

|

Description |

The investment objective of the ETF is to provide investment results that, before fees and expenses, closely correspond to the performance of the SSE Science and Technology Innovation Board 50 Index. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 22 Nov) |

160,930 |

|

Net Assets of Fund (as of 22 Nov) |

RMB 268,000,000 |

|

12-Month Trailing Yield |

NA |

|

P/E Ratio (as of 22 Nov) |

48.93 |

|

P/B Ratio (as of 22 Nov) |

5.10 |

|

Management Fees |

0.58% |

Top 10 Holdings

(as of November 22, 2022)

- BUY Entry – 7.0 Target – 8.0 Stop Loss – 6.5

- Focus on emerging strategic sectors

- Captures China’s emerging leaders across strategic industries with hardcore technology, high R&D and scientific innovations

- Supported by China’s 14th Five-Year Plan

- Covers policy-supported sectors including semiconductor, AI, cloud computing, new materials, green economy, biotech

Source: Bloomberg