24 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

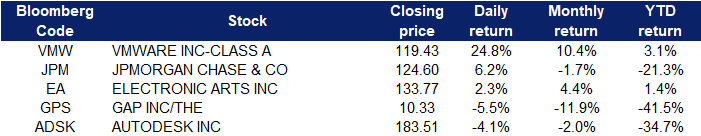

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +4% | Oil Prices Rise amid Expectations of Increased Demand, Tight Supply Conoco Phillips (COP US) |

| Integrated Oil | +2.8% | Oil Prices Rise amid Expectations of Increased Demand, Tight Supply Chevron Corp (CVX US) |

| Major Banks | +3.9% | JPMorgan rallies 6% on interest outlook, despite cost questions JP Morgan (JMP US) |

Top Sector Losers

| Sector | Loss | Related News |

| Casinos/Gaming | -1.4% | N/A Las Vegas Sands Corp (LVS US) |

| Homebuilding | -1.3% | N/A D.R. Horton Inc (DHI US) |

- VMWare Inc (VMW US) shares rose 24.8% after multiple reports said VMWare is in advanced talks to be acquired by chipmaker Broadcom. Broadcom shares dipped 3.1%.

- JPMorgan Chase & Co (JPM US) shares rose 6.2% after the bank said it expects to reach key return targets sooner than planned thanks to rising interest rates giving its lending business a boost. Other banks were also among the top gainers Monday. Citi and Bank of America got a 6% boost each, and Wells Fargo added 5%. Banks tend to benefit from rising rates, which allow for higher margins and profits.

- Electronic Arts Inc (EA US) shares added 2.3% on news that it’s seeking a sale or merger. Walt Disney, Apple and Amazon have reportedly held talks with the video game maker.

- Gap Inc (GPS US) shares fell 5.5% after Gap was downgraded by Citi along with a string of other apparel companies, such as Abercrombie and Fitch and Children’s Place, saying last week’s earnings reports should serve as a “wake-up call” for retailers.

- Autodesk Inc (ADSK US) shares fell 4.1% after Deutsche Bank downgraded the software company to hold from buy and cut its price target. Deutsche also said it anticipates mixed first-quarter results from Autodesk.

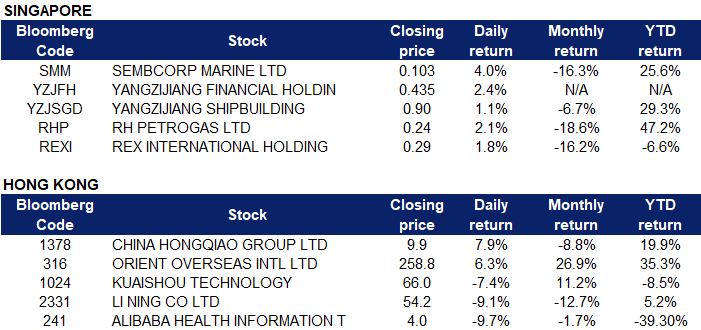

Singapore

- Sembcorp Marine Ltd (SMM SP) shares rose 4% yesterday. In a business update, Sembcorp Marine (SCM) announced that its cash flow and liquidity management have improved following the completion and successful deliveries of several projects in 1Q2022. As a result, the Group’s net debt/equity ratio has improved to 0.38 times at end 1Q2022 from 0.49 times at end 4Q2021. In March 2022, Sembcorp Marine secured a landmark contract from Maersk for the construction of a WTIV. The WTIV brings breakthrough design to the wind market with the vessel designed to operate at a high level of efficiency and to handle the next generation of larger wind turbines.

- Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP) and Yangzijiang Financial Holdings Ltd (YZJFH SP) shares rose 1.1% and 2.4% respectively yesterday. CGS-CIMB Research analysts Lim Siew Khee and Izabella Tan have kept an “add” rating on Yangzijiang Shipbuilding with a lowered target price of $1.63 from $2.41. To the analysts, Yangzijiang’s strength now lies on its strong shipbuilding execution, attractive valuations of 6x CY2023 P/E, and potential higher dividend payout. Tan and Lim see comfortable room for higher dividend, and estimate the dividend payout of Yangzijiang’s historical shipbuilding to be in the range of 23%-35% or 1.65 cents-2.63 cents.

- RH Petrogas Ltd (RHP SP) and Rex International Holdings Ltd (REXI SP) shares rose 2.1% and 1.8% respectively yesterday. WTI crude futures rose above $110.5 per barrel on Monday, building on gains from the past two sessions, as expectations of increased US fuel demand and hopes for demand return in China threatened to pressure an already tight global oil market. US gasoline and diesel prices remained at record levels as the US peak driving season, which traditionally begins on Memorial Day weekend at the end of May and ends on Labor Day in September, looms. Mobility data showed more people were on the roads in places like the US despite high fuel costs.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Agricultural, Poultry & Fishing Production | +1.95% | South Koreans pay 20% more for pork amid rising grain costs WH Group Ltd (288 HK) |

Precious Metal | +1.55% | Gold hits over 1-week high as dollar dips Zhaojin Mining Industry Company Limited (1818 HK) |

Nonferrous Metal | +0.59% | SHFE Aluminium to Move up amid Continued Decline in Social Inventory China Hongqiao Group Ltd (1378 HK) |

Top Sector Losers

Sector | Loss | Related News |

Electronic Component | -1.81% | Chinese lockdowns hitting Thai producers Aac Technologies Holdings Inc (2018 HK) |

Telecomm. Services | -1.58% | China’s state-backed blockchain company is set to launch its first major international project China Telecom Corp Ltd (728 HK) |

Semiconductors | -1.51% | Chip supplier says China will struggle to develop advanced technology Shanghai Fudan Microelectronics Company (1385) |

- China Hongqiao Group Ltd (1378 HK) Shares rose 7.87% yesterday. There was no company-specific news. LME aluminium gained 1.5% to $2,989.50/tonne. The stock will be included in the benchmark Hang Seng Index from 13th June.

- Orient Overseas (International) Limited (316 HK) Shares rose 6.33% yesterday and closed at a record high. The stock will be included in the benchmark Hang Seng Index from 13th June.

- Kuaishou Technology (1024 HK) Shares fell 7.44% yesterday. There was no company-specific news. The overall technology was sold down, following the US market sell-off last Friday. Alibaba Health Information Technology Limited (241 HK) fell 9.71% yesterday. Innovare Tech Limited, a shareholder of the Company holding a total of 932,337,347 shares of the company, representing approximately 6.90% of the issued share capital, distributed 641,090,678 shares to the limited partners of Yunfeng Fund L.P., the beneficial owner of all the voting equity capital in Innovare.

- Li Ning Co. Ltd (2331 HK) Shares fell 9.14% yesterday. There was no company-specific news. Morgan Stanley previously stated that the sales started to recover against the backdrop of increasing inventories and discounts.

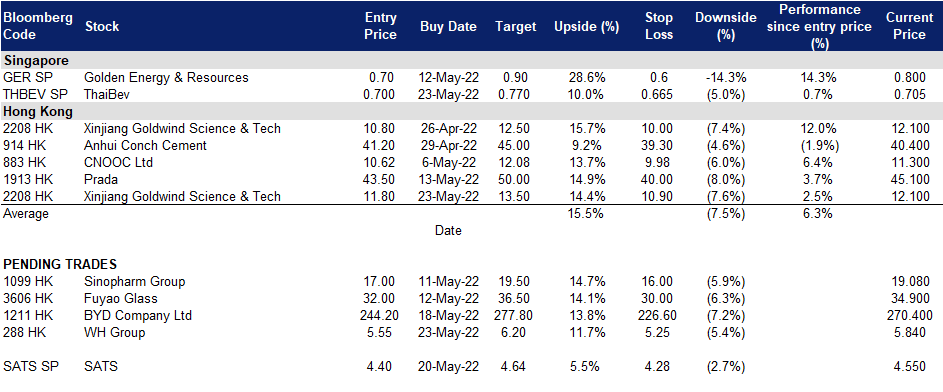

Trading Dashboard Update: Add Xinjiang Goldwind Science & Tech (2208 HK) at HK$11.80. Add Thaibev (THBEV SP) at S$0.700.