23 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Biotechnology | +1.67% | 22nd Century Soars on Biden Admin Decision, Here’s All You Need to Know 22nd Century Group (XXII US) |

| Managed Healthcare | +1.54% | UnitedHealth launches lab management solution to cut unnecessary testing UnitedHealth Group Inc (UNH US) |

| Household/Personal Care | +1.33% | Latest meme stock Revlon surges more than 50% in heavy trading Revlon Inc (REV US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oil & Gas Production | -5.11% | Oil falls around 3% as investors eye U.S. Fed rate hikes Marathon Oil Corporation (MRO US) |

| Other Metals/Minerals | -4.91% | Copper sinks to lowest since March 2021 on fears of global economic downturn Freeport-Mcmoran Inc (FCX US) |

| Steel | -3.67% | Steel Price fades rebound from yearly low on China oversupply fears, risk-off mood United States Steel Corp (X US) |

- Coinbase Global Inc (COIN US) shares fell 9.7% on Wednesday after rival crypto exchange Binance.US said it’s dropping spot bitcoin trading fees for customers. Coinbase historically has relied heavily on trading volumes for revenue but in recent months has been looking to diversify its revenue streams.

- Altria Group (MO) shares dropped 9.2% after The Wall Street Journal reported that the Food and Drug Administration is preparing to order Juul Labs to take its e-cigarettes off the U.S. market. The Biden administration also plans to propose a rule to establish a maximum nicotine level in cigarettes.

- Revlon Inc (REV US) shares surged 34.3%, extending a rally that came after the company filed for Chapter 11 bankruptcy protection last week. Revlon soared 62% in the previous session.

- Marathon Oil Corporation (MRO US) and ConocoPhillips (COP US) shares fell 7.2% and 6.3% respectively yesterday. Oil prices tumbled around 3% on Wednesday as investors worried that rate hikes by the Federal Reserve could push the U.S. economy into recession, dampening demand for fuel.

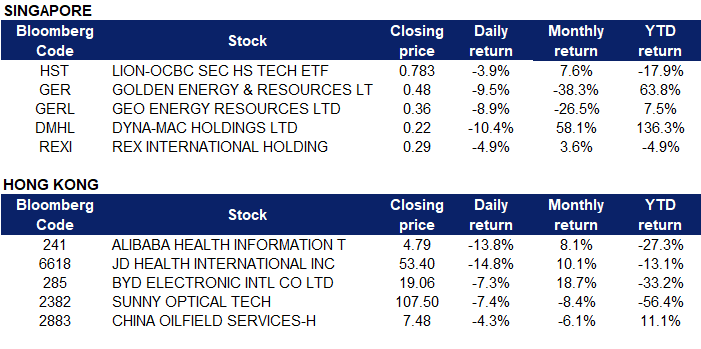

Singapore

- Lion-OCBC Securities Hang Seng Tech ETF (HST SP) units dropped 3.9% yesterday. Chinese shares fell sharply, with healthcare stocks succumbing to selling pressure after reports emerged that Beijing is mulling a ban on sales of medicines on third-party e-commerce platforms.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares declined 9.5% and 8.9% respectively yesterday. China’s state planner is stepping up efforts to keep a lid on domestic coal prices to avoid more power shortages this summer, as traders blame a clampdown on Australian imports for a shortage of high-grade coal to meet surging demand. The National Reform and Development Commission this week ordered agents who sell coal to power plants above price caps imposed last month to return the excess funds. Officials said they were determined to keep prices stable to ensure power plants had access to affordable coal during the northern hemisphere summer.

- Dyna-Mac Holdings Ltd (DMHL SP) and Rex International Holding (REXI SP) shares dropped by 10.4% and 4.9% respectively yesterday. Oil prices tumbled by more than $6 a barrel on Wednesday amid a push by U.S. President Joe Biden to cut fuel costs for drivers in the latest episode to aggravate relations between the White House and the U.S. oil industry. Biden is expected to make the announcement at 1800 GMT. On Thursday, seven oil companies are set to meet the president under pressure from the White House to drive down fuel prices as they make record profits.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Coal | +8.41% | Coal prices likely to remain firm amid high global demand China Shenhua Energy Co Ltd (1088 HK) |

Consumer Electronics | +8.42% | N/A Smoore International Holdings Ltd (6969 HK) |

Petroleum & Gases | +1.05% | Oil slumps $6 a barrel as Biden pushes for US fuel cost cuts CNOOC Ltd (883 HK) |

Top Sector Losers

Sector | Loss | Related News |

Software | -1.76% | Chinese stocks tumble as tech shares in Hong Kong fall; oil drops more than 4% Sensetime Group Inc (20 HK) |

Biotechnology | -1.77% | WuXi Biologics (Cayman) Inc (2269 HK) |

Construction Materials | -1.42% | N/A Anhui Conch Cement Co Ltd (914 HK) |

- Alibaba Health Information Technology Ltd (0241 HK) and JD Health International Inc (6618 HK) shares dropped by 13.8% and 14.8% respectively yesterday. Shares of China’s online drug sellers slumped in Hong Kong on Wednesday after a media report renewed concerns that Beijing may ban third-party platforms from offering medicines over the internet.

- BYD Electronic International Co Ltd (0285 HK) and Sunny Optical Technology Group Co Ltd (2382 HK) shares fell 7.3% and 7.4% respectively yesterday. According to media reports, Tianfeng International analyst Ming-Chi Kuo said that “Meta has postponed all new headset/AR/MR hardware projects after 2024 and lowered its 2022 shipment forecast by 40%.” In addition, Samsung recently announced that they will immediately suspend the purchase of mobile phone parts until the end of July, impacting the consumer electronics supply chain. In addition, data from the China Academy of Information and Communications Technology shows that in May 2022, the domestic market volume of mobile phone shipments was 20.805 million units, a year-on-year decrease of 9.4%.

- China Oilfield Services Ltd (2883 HK) shares declined 4.3% yesterday. Oil prices tumbled by more than $6 a barrel on Wednesday amid a push by U.S. President Joe Biden to cut fuel costs for drivers in the latest episode to aggravate relations between the White House and the U.S. oil industry. Biden is expected to make the announcement at 1800 GMT. On Thursday, seven oil companies are set to meet the president under pressure from the White House to drive down fuel prices as they make record profits.

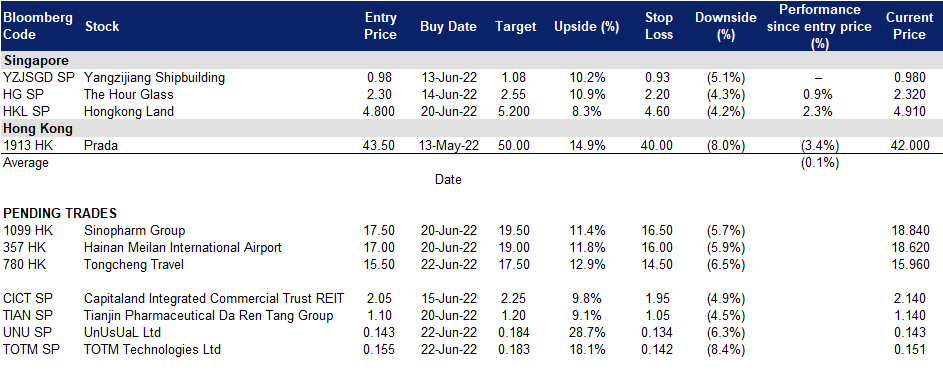

Trading Dashboard Update: No additions/deletions of stocks.