21 April 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Hospital/Nursing Management | +3.8% | Tenet Healthcare Corp. Q1 Profit Increases, beats estimates Tenet Healthcare Corp (THC US) |

| Construction Materials | +3.7% | CRH Plc Sees Improved Performance In First Half CRH Plc (CRH US) |

| Home Improvement Chains | +2.5% | N/A Home Depot Inc (HD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Software/Services | -3.7% | Netflix Stock Price Drops 35%, Posting Biggest Fall Since 2004 Netflix Inc (NFLX US) |

| Cable/Satellite TV | -3.7% | Netflix Stock Price Drops 35%, Posting Biggest Fall Since 2004 Walt Disney Co (DIS US) |

| Motor Vehicles | -3.3% | China automakers face production suspensions in May, warns XPeng CEO XPeng Inc (XPEV US) |

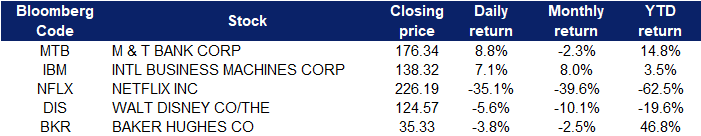

- M&T Bank Corp (MTB US) shares surged 8.8% after M&T Bank exceeded earnings expectations. M&T Bank reported earnings of $2.73 per share, which was above $2.19 per share expected by analysts surveyed by Refinitiv.

- IBM (IBM US) shares surged 7.1% after beating on revenue and earnings in the recent quarter. The company reported an adjusted quarterly profit of $1.40 per share, 2 cents above a Refinitiv estimate. Revenue rose 7.7% over the year-ago quarter, with sales to Kyndryl lifting revenue growth by 5 percentage points.

- Netflix Inc (NFLX US) shares sank 35.1% after Netflix reported a loss of 200,000 subscribers in the most recent quarter. Netflix cited increasing competition, password sharing and the situation in Ukraine among the reasons for the dip. The news led to a wave of downgrades from major Wall Street firms. As a result, fellow streaming peer, Walt Disney Co (DIS US) shares fell 5.6%.

- Baker Hughes Co (BKR US) shares slid 3.8% after Baker Hughes missed estimates for the first quarter. The company reported 15 cents in adjusted earnings per share on $4.84 billion of revenue. Analysts surveyed by Refinitiv were expecting 20 cents per share and $5.02 billion in revenue. CEO Lorenzo Simonelli said in a release that the results “reflect operating in a very volatile market environment.”

Singapore

- Hong Fok Corp Ltd (HFC SP) shares rose 9.3% yesterday. A sprawling mansion at 5 Oxley Rise, where Jewish businessman Manasseh Meyer and real estate tycoon Cheong Eak Chong once resided, has been put up for sale. The hilltop two-storey bungalow, which sits on a 151,205 sq ft freehold site in prime District 9, is expected to attract offers in excess of $300 million, marketing agent CBRE said on Monday (April 18). The property is owned by seven members of the same family, all sons of the late Mr Cheong, founder of listed developer Hong Fok Corporation and Tian Teck group, according to The Business Times.

- Golden Agri-Resources Ltd (GGR SP) and Bumitama Agri Ltd (BAL SP) shares rose 4.5% and 3.1% respectively yesterday. Malaysian palm oil futures were above MYR 6400 per tonne, not far from the one-month high of MYR 6520 touched on April 15th amid lingering concerns of lower supply while the war in Ukraine continued to support higher vegetable oil prices. Exports of Malaysian palm oil products fell by 14%-23% during the first half of April, compared to the same period of March, according to data by cargo surveyors. Shortage of sunflower and rapeseed oil, which Russia and Ukraine account for nearly 75% of exports, continues to force the food industry to scrap for alternatives.

- Place Holdings Ltd (THEPLACE SP) shares rose 5.4% yesterday. The Place Holdings has entered into a non-binding memorandum of understanding (MOU) with Stellar Lifestyle, a business arm of SMRT Corporation, to jointly collaborate to shape the future of digital media and tap new opportunities in the digital economy. As part of the collaboration, both parties aim to build Singapore’s first Sky Screen, a suspended video screen. The Sky Screen is envisaged to be a new attraction in Singapore that will be integrated with smart digital technology system and immersive media, boosting new business vibrancy and creating new possibilities in digital media solutions.

- LHN Holdings Ltd (LHN SP) shares rose 4.5% yesterday. LHN Logistics lodged its final offer document on Tuesday (April 19) as its parent company, property player LHN Group, looks to spin off and list its logistics arm. Through the initial public offering, LHN Logistics will raise approximately $5 million through the listing of 25,238,000 placement shares at 20 cents each. Based on the placement price and post-placement share capital of 167,678,800 shares, the newly listed company will have a market capitalization of $33.5 million.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Medicine | +6.87% | Singapore trial under way on use of Lianhua Qingwen in treating mild COVID-19 New Ray Medicine International Holding (6108 HK) |

| Leisure & Recreation | +5.01% | Talks of HK-mainland border reopening regain momentum amid fall in cases in HK Haichang Ocean Park Holdings Ltd (2255 HK) |

| Telecomm. & Networking Equipment | +2.01% | NA Time Interconnect Technology Ltd (1729 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Coal | -2.86% | China buys cheap Russian coal as world shuns Moscow Yanzhou Coal Mining Co. Ltd. (1171 HK) |

| Precious Metal | -2.52% | Gold price drops as stronger dollar, yields weigh on safe havens Zijin Mining Group Co Ltd. (2899 HK) |

| Property Management & Agency | -2.23% | China’s property sector could be turning around, but red-hot growth may be a thing of the past Country Garden Services Holdings Co Ltd (6098 HK) |

- Tongcheng Travel Holdings Ltd (780 HK) shares rose 5.3% yesterday after Lyon maintained its Outperform rating on Tongcheng Travel and raised the target price from HK$16 to HK$16.8. The bank expects Tongcheng’s first-quarter results to be in line with its forecast of 1.66 billion yuan in revenue and 242 million yuan in adjusted net profit. The bank slashed its 2022 revenue forecast by 9%, reflecting the weakest second quarter, but still expects 2023 revenue and forward P/E levels to normalise.

- Li Ning Co Ltd (2331 HK) shares rose 4.4% yesterday after Citic Securities maintained its Buy rating on Li Ning with a target price of HK$90. Considering the impact of Covid-19 in Q1/Q2, the bank downgraded its annual revenue/net profit forecast by approximately 4%/6%, and the EPS forecast for 2022-24 was lowered to 1.8/2.36/2.96 yuan. The bank believes that the epidemic is a one-off, and the company’s core competitiveness and long-term growth remains strong. The current valuation of Li Ning is attractive, as compared to Nike which is trading around 36x P/E. Fellow apparel peer Bosideng International Holdings Ltd (3998 HK) shares rose 6.1% yesterday.

- Country Garden Services Holdings Co Ltd(6098 HK) and China Vanke Co Ltd (2202 HK) shares fell 10.7% and 10.5% respectively yesterday. Morgan Stanley released a research report saying that the performance of property management stocks last year was roughly in line with expectations, with average revenue up 54% YoY, profit up 60%, and gross profit margin down 0.4 percentage points YoY to 28.2%. Due to the uncertainty of the property market and the continued liquidity concerns on developers and the impact of the pandemic, most property management companies have a more moderate medium-term outlook.

Trading Dashboard

Trading Dashboard Update: Add Yangzijiang Shipbuilding (YZJSGD SP) at S$1.58, Cut Ping An Insurance (2318 HK) at HK$54, Metallurgical Corporation of China at HK$2, China National Building Material at HK$9.80.

(Click to enlarge image)

Related Posts: