20 October 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +2.71% | U.S. Offical: OPEC+ Cut Came At “The Worst Possible Moment” Conocophillips (COP US) |

| Integrated Oil | +2.38% | Oil up in tight market as U.S. sets release of more reserves Exxon Mobil Corp (XOM US) |

| Oil Refining/Marketing | +2.34% | Oil up in tight market as U.S. sets release of more reserves Marathon Petroleum Corp (MPC US) |

Top Sector Losers

| Sector | Loss | Related News |

| Home Improvement Chains | -3.88% | Equities close lower as rise in yields overshadows earnings Home Depot Inc (HD US) |

| Biotechnology | -3.53% | Why Moderna Stock Dropped Today Moderna Inc (MRNA US) |

| Internet Retail | -2.62% | Jeff Bezos is the latest to warn on the economy, saying it’s time to ‘batten down the hatches’ Amazon.com Inc (AMZN US) |

- Generac Holdings Inc (GNRC US) shares were trading down 25.3% after the company cut its expected full-year revenue growth to a range of 22% to 24%, down from 36% to 40%, which is also below Wall Street expectations. The power company also reported preliminary third-quarter results, with earnings per share expected to come in at $1.75 compared to the $3.21 estimate.

- Netflix Inc (NFLX US) soared 13.1% after the firm on Tuesday posted better-than-expected results on the top and bottom lines. Netflix also reported the addition of 2.41 million net global subscribers, more than doubling the adds the company had projected a quarter ago.

- Intuitive Surgical Inc (ISRG US) rose 9.0% after the company on Tuesday posted quarterly earnings and revenue that came in slightly higher than expected, according to FactSet. Intuitive also reported growth in its da Vinci procedures of about 20% compared with the third quarter of 2021.

- ASML Holding NV (ASML US) jumped 6.3% after the semiconductor equipment maker beat sales and profit expectations in its most recent quarter.

- United Airlines Holdings Inc (UAL US) jumped 5.0% after United Airlines surpassed earnings expectations and issued an upbeat outlook for the current quarter as consumers continue to travel.

Singapore

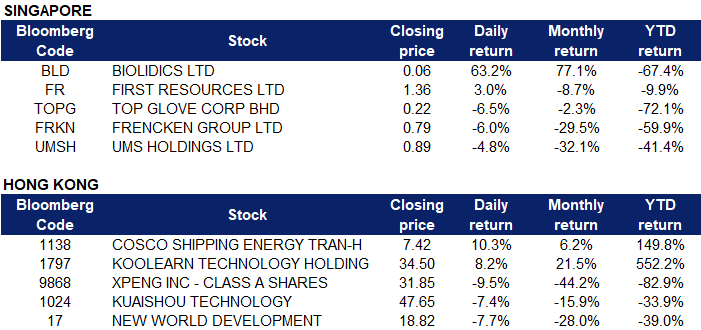

- Biolidics Ltd (BLD SP) surged 63.2% yesterday. The company recently announced the resignation of the lead independent director of the company as well as changes to the composition of the remuneration committee, board of directors and board committees of the company.

- First Resources Ltd (FR SP) climbed 3.0% yesterday. Malaysian palm oil futures jumped on Tuesday to their highest close in almost seven weeks, helped by a weakening ringgit and concerns over global edible oil supply. The weaker ringgit along with fears of floods hitting production in Malaysia is keeping prices elevated. There are also worries that escalating Russia-Ukraine tensions may limit sunflower oil shipments from Ukrainian ports, which may channel demand to alternatives including palm oil.

- Top Glove Corp Bhd (TOPG SP) tumbled 6.5% yesterday after, CGS-CIMB said investors should take profit on glove stocks after the recent rally in their share prices. Even though glove makers worldwide have slowed down their capacity expansion plans substantially, industry dynamics remain supply-led, with slow demand and an abundance of supply commissioned during the peak of the Covid-19 pandemic, the oversupply situation would not be resolved so quickly.

- Frencken Group Ltd (FRKN SP) and UMS Holdings Ltd (UMSH SP) fell 6.0% and 4.8% respectively yesterday. It was reported on Tuesday that Apple Inc is cutting production of iPhone 14 Plus within weeks of starting shipments as it re-evaluates demand for the mid-range model. The company told at least one manufacturer in China to immediately halt production of iPhone 14 Plus components, according to the report. The move comes at a time when the global smartphone market has been softening, shrinking 9% in the third quarter compared with the same period a year earlier, according to estimates from data research firm Canalys, which expects weak demand over the next six to nine months.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Marine & Habour Services | +0.64% | Gains for larger vessels perk up Baltic dry bulk index Orient Overseas (International) Ltd (316 HK) |

Conglomerates | +0.54% | China’s Shock GDP Delay Shows Communist Party Trumps Economy CITIC Ltd (267 HK) |

Textile & Apparels | +0.48% | Fabric makes up 78.75% of China’s total textile shipment in H1 2022 ANTA Sports Products Ltd (2020 HK) |

Top Sector Losers

Sector | Loss | Related News |

Dairy Products | -2.26% | NA China Mengniu Dairy Company Limited (2319 HK) |

Biotechnology | -2.18% | Hong Kong exchange poised for record streak in profit declines WuXi Biologics (Cayman) Inc (2269 HK) |

Gamble | -1.85% | Hong Kong stocks fall 2%, leading losses in mixed Asia trade after John Lee’s speech Galaxy Entertainment Group Ltd (27 HK) |

- COSCO Shipping Energy Transportation Co Ltd (1138 HK) Shares spiked 10.3% yesterday, mainly due to the overnight rise in the Baltic dry bulk freight index and the increasing demand for oil transportation. The Baltic Dry Index closed up 5 points, or about 0.3%, at 1,843 overnight, as rates for capesize and panamax vessels were higher. COSCO Shipping Energy said in a recent institutional survey that more oil purchases can be expected in the short term, low inventories and the diesel deficit in Europe will support cross-regional arbitrage, bringing trade activity and demand for ships. At the same time, Middle East refineries may release more capacity in the fourth quarter, and more refined oil products are expected to be sold from the Middle East to Europe, thereby providing increased transportation demand.

- Koolearn Technology Holding Ltd (1797 HK) Shares soared 8.2% yesterday. In terms of supply chain, the number of SKUs of the company’s self-operated products increased to 59 at the end of September; in terms of logistics, in early September, it reached close cooperation with SF Express and JD.com and plans to establish 20 self-operated product warehouses in five major cities. Huatai Securities Research Report stated that the company’s business model has the characteristics of live broadcast influence, e-commerce platform, and high-quality consumer goods brand enterprises. The bank maintained a “hold” rating and raised the target price to HK$31.31.

- Xpeng Inc (9868 HK) and Kuaishou Technology (1024 HK) Shares tumbled 9.5% and 7.4% respectively yesterday. Shares of Hong Kong-listed tech companies and EV makers continued to trade lower during Hong Kong leader John Lee’s policy address, dragging down the overall index. The Hang Seng index in Hong Kong fell around 2.38% to 16,511.28, with the Hang Seng Tech index slipping 4.19% following leader John Lee’s policy address.

- New World Development Co Ltd (17 HK) Shares fell 7.7% yesterday, after JPMorgan issued a research report giving New World Development an “underweight” rating. Due to the declining profit trend and the current distribution ratio exceeding 100%, the 2023/24 dividend per share forecast was lowered by 7%/9% to 2/1.95 The target price was lowered from HK$29.4 to HK$16. In addition, the company’s core profit forecast for fiscal years 2023/24 was lowered by 38% and 45% respectively, mainly due to the decrease in the assumption of the gross profit margin of the third phase of “Bao Zhuang”, and taking into account the increase in its financing costs, reflecting the deterioration of the balance sheet.

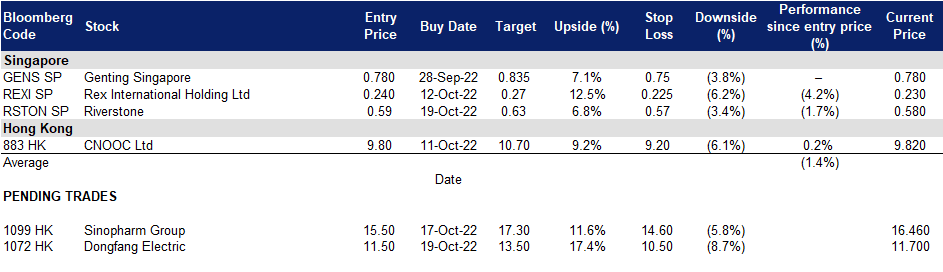

Trading Dashboard Update: Take profit on China Resources Power (1072 HK) at HK$14.2. Add Riverstone (RSTON SP) at S$0.59.