19 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Losers

| Sector | Loss | Related News |

| Specialty Stores | -13% | Target plunges 26% as soaring costs lead the retail giant to widely miss quarterly earnings expectations and cut its profit guidance Target Corp (TGT US) |

| Department Stores | -12.4% | Why Costco, Kohl’s, and Five Below Were All Sliding Today Costco Wholesale Corp (COST US) |

| Internet Retail | -6.7% | Wall Street ends sharply lower as Target and growth stocks sink Amazon (AMZN US) |

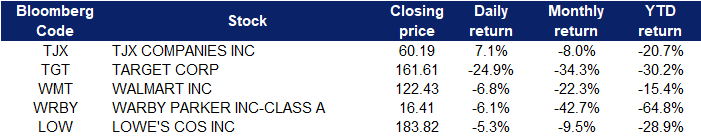

- TJX Companies Inc (TJX US) shares jumped 7.1% after the company reported quarterly earnings that beat analysts’ estimates by about 8 cents per share, according to Refinitiv, as other retailers reported seeing inflation cut into their profits.

- Target Corp (TGT US) shares plunged 24.9% after the retailer reported disappointing quarterly results, citing high fuel costs and inventory troubles. Target posted an adjusted quarterly profit of $2.19 per share, below the $3.07 Refinitiv consensus estimate. The big-box retailer reported lower-than-expected sales of discretionary products.

- Walmart Inc (WMT US) shares fell 6.8%, falling for a second session after suffering its worst one-day loss since 1987 on Tuesday. Target’s quarterly report echoed similar inflationary challenges Walmart reported in its disappointing first-quarter report Tuesday.

- Warby Parker Inc (WRBY US) shares dipped 6.1% after Goldman downgraded Warby Parker to neutral from buy. Goldman said it sees a longer path to growth for the eyewear retailer, which reported lower-than-expected quarterly earnings earlier this week.

- Lowe’s Company Inc (LOW US) shares fell 5.3% on the back of weaker-than-expected revenue for the first quarter. Lowe’s posted revenue of $23.66 billion versus $23.76 expected, according to Refinitiv. Lowe’s said cooler spring weather hurt demand for outdoor project supplies.

Singapore

- Golden Energy and Resources Limited (GER SP) Shares rose 12.8% yesterday and closed at a 52-week high. There was no company-specific news. Its 64% owned subsidiary Stanmore Resource (SMR AU) gapped up and rose 10.4% yesterday after Morgans Financial reinstated coverage with a TP of A$3.80. As of 17 May, SGX TSI FOB Australia premium coking coal futures closed at US$501.5/tonne (YTD high/low: US$585/tonne/US$388.33/tonne).

- Yangzijiang Shipbuilding (Holdings) Ltd (YZJSGD SP) Shares rose 6.7% yesterday after the company released the minutes of annual general meeting. There was no company-specific news.

- Hong Fok Corporation Limited (HFC SP) Shares rose 4.0% yesterday. There was no company-specific news. The company has been buying back shares since the end of April.

- Yanlord Land Group Limited (YLLG SP) Shares fell 5.1% yesterday which was the ex-dividend date. The proposed dividend was S$0.068. Previously, the company announced that for the four months ended 30 April 2022, the group together with its joint ventures and associates’ total contracted pre-sales from residential and commercial units, and car parks was approximately RMB17.681bn on contracted GFA of 362,499 sqm, a decrease of 14.7% YoY and 41.7% YoY respectively.

- Frencken Group Limited (FRKN SP) Shares fell 5.3% yesterday after the company released its business updates for 1Q22. The profit attributable to equity shareholders dropped by 12.6% YoY to S$12.8mn due to higher selling and distribution, administrative and general expenses in the wake of supply chain challenges.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Semiconductors | +2.5% | SMIC, Hua Hong show mixed business outlook for 2Q22 Hua Hong Semiconductor (1347 HK) |

Utilities – Electricity Supply | +1.7% | China is ready to make electricity out of air Huaneng Power International Inc (902 HK) |

Environmental Energy Material | +1.4% | Solar rooftops, manufacturing to get boost under draft EU plan Xinyi Solar (968 HK) |

Top Sector Losers

Sector | Loss | Related News |

Property Management & Agency | -1.2% | China stocks fall on concerns government stimulus inadequate Ke Holdings Inc (2423 HK) |

Dairy Products | -0.74% | N/A Mengniu Dairy (2319 HK) |

Warehousing & Logistic Services | -0.55% | JD records slowest quarterly growth since 2014 amid Covid resurgence in China JD Logistics (2618 HK) |

- NWS Holdings Ltd (659 HK) shares rose 8.3% yesterday, following news that the company will implement a share repurchase plan from May 18, 2022 to May 17, 2023 (both days inclusive) for a period of twelve months. The duration of the share repurchase program is designed to provide companies with greater flexibility to repurchase shares valued at up to $300 million over the duration of the program. The Company believes that its current share price is below its intrinsic value and may not fully reflect the Group’s business prospects. The Board believes that the proposed share repurchase reflects the company’s confidence in the long-term prospects and potential growth of its business.

- China Resources Power Holdings Co Ltd (836 HK) and Huaneng Power International Inc (902 HK) shares rose 8.3% and 7.8% respectively yesterday. The National Standing Committee recently stated that it will allocate 50 billion yuan in renewable energy subsidies to central power generation enterprises, and inject 10 billion yuan through the state-owned capital operating budget to support coal power companies’ bailouts and more power generation. Orient Securities said that following the renewable energy subsidies, it is expected that the cash flow of relevant green power central enterprises is expected to improve significantly, thereby helping them to accelerate the development and commissioning of new projects.

- Zai Lab Ltd (9688 HK) shares rose 7.8% yesterday, extending its rally from the previous day. JP Morgan released a research report saying that it gave Zai Lab-SB an “overweight” rating. However, the target price was lowered from HK$105.9 to HK$90. Based on the company’s first-quarter performance, the adjusted loss per share forecast for this year and next year was adjusted from $6.87/3.88 to a loss of $3.55/1.1. The company’s quarterly revenue more than doubled from last year, helped by Y/Y growth in sales for the following products: Zejula, Optune, Qinlock and Nuzyra. In addition, Repotrectinib, introduced by Zai Lab, was granted breakthrough therapy designation by the FDA and the company expects to have discussions with regulators on its listing application in Q4 this year.

- Man Wah Holdings Ltd (1999 HK) shares rose 7.3% yesterday. Changjiang Securities released a research report saying that it maintains its “buy” rating on Man Wah Holdings, and the net profit attributable to the parent in fiscal year 2023-25 is expected to be HK$2.674/3.189/3.705 billion, corresponding to a PE of 10/9/7 times. The company has a high competitive edge in brand/product/supply chain, which is strengthened by its design/marketing & channel reforms. In addition, the company will improve the level of internal management and channel informatization to lay a solid foundation for long-term development.

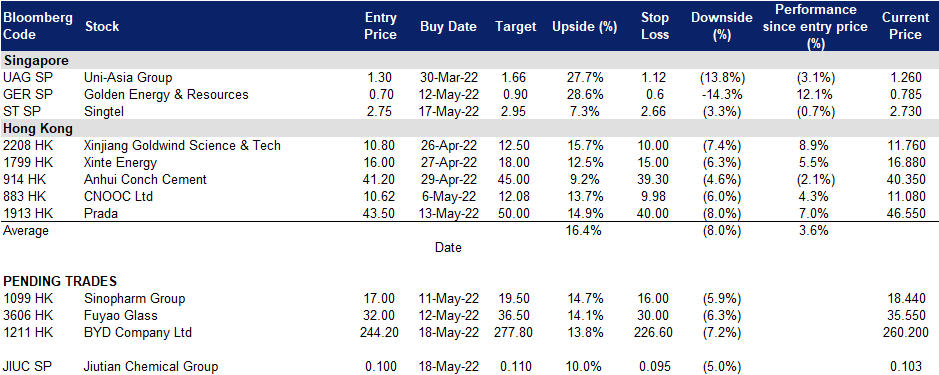

Trading Dashboard Update: Take profit on Jiutian Chemical Group (JIUC SP) at HK$0.11.