19 April 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Computer Processing Hardware | +1.9% | N/A HP Inc (HP US) |

| Oil & Gas Production | +1.8% | Oil prices steady amid fears over slowing China demand Occidental Petroleum Corp (OXY US) |

| Semiconductors | +1.6% | Here’s What Made Needham Bullish On Nvidia, AMD Versus Others In Semiconductor Space Nvidia Corp (NVDA US) |

Top Sector Losers

| Sector | Loss | Related News |

| Biotechnology | -3.0% | Why BioNTech, Moderna, and Novavax Stocks Are Sinking Today Moderna Inc (MRNA US) |

| Cable/Satellite TV | -2.2% | N/A Walt Disney Corp (DIS US) |

| Pharmaceuticals: Major | -1.6% | Eli Lilly Faces $165M in Charges over R&D Acquisitions in Latest SEC Exchange Eli Lilly & Co (LLY US) |

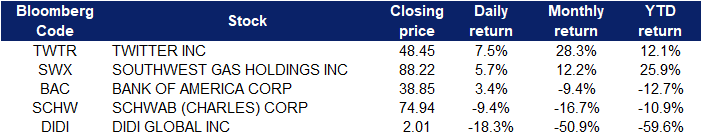

- Twitter Inc (TWTR US) shares rose 7.5% after the company announced on Friday that the board adopted a limited duration shareholder rights plan, often referred to as a “poison pill.” The move comes after billionaire Elon Musk offered to buy the company for $43 billion.

- Southwest Gas Holdings Inc (SWX US) shares rose 5.7% after the company said its board had authorised the review of a full range of strategic alternatives, after receiving what it called an “indication of interest” well in excess of investor Carl Icahn’s $82.50 per share offer.

- Bank of America Corp (BAC US) shares jumped 3.4% after reporting an earnings beat on Monday. Bank of America topped expectations in the first quarter with earnings of 80 cents per share and $23.33 billion in revenue, helped by strength in consumer lending. Analysts surveyed by Refinitiv expected earnings of 75 cents per share and $23.2 billion in revenue.

- Charles Schwab Corp (SCHW US) shares fell 9.4% after the company missed analyst estimates on the top and bottom lines in the first quarter. The company reported earnings per share of 77 cents on $4.67 billion in revenue. Analysts expected 84 cents per share on revenue of $4.83 billion.

- DiDi Global Inc (DIDI US) shares dropped 18.3% after the China-based ride-hailing firm reported a 12.7% drop in fourth-quarter revenue compared with a year earlier. The company announced a shareholding meeting would be held on May 23 to vote on delisting from the New York Stock Exchange.

Singapore

- OxPay Financial Ltd (OPFL SP) shares gained 11.7% yesterday. OxPay Financial, on April 18, announced that it has been appointed as the official digital payment service provider for Q&M Dental’s clinics in Singapore. The rollout of the digital payment services programme will be done in two phases. The first phase will comprise all non-credit card payments processing, including GrabPay, PayNow, Dash, AliPay and WeChat Pay, while the second phase will consist of credit card payments processing, such as Visa, Mastercard and other cards, as well as instalment payment plans. Q&M Dental’s 21 clinics will participate in the pilot testing before the program is progressively rolled out to all 99 clinics in Singapore by 2QFY2022. We currently have an OUTPERFORM rating on OxPay with a 12M TP of S$0.30.

- Aztech Global Ltd (AZTECH SP) shares rose 5.3% yesterday. UOB Kay Hian’s John Cheong has maintained his “buy” call on Aztech Global with an unchanged target price of $1.55, as he expects the company to report “robust earnings” of about $15-$17 million for its 1QFY2022 ended March 31. The $15-$17 million figure would represent a 20% y-o-y growth. According to Cheong, this forecast is backed by Aztech’s robust orderbook of $762 million as of Feb 22, which is 22% higher than its 2021 revenue.

- Golden Energy & Resources Ltd (GER SP) shares rose 3.2% yesterday. Fitch Ratings on Sunday (Apr 10) revised its outlook on Golden Energy and Resources (Gear) to “positive” from “stable”. The credit rating agency has also affirmed the coal miner’s long-term foreign-currency issuer default rating (IDR) at B+. The revision in outlook comes as Fitch expects an improvement in the credit profile of Gear’s key subsidiary, Golden Energy Mines (GEMS), in the next 12 to 18 months. GEMS’ production scale may also match its BB- rated peers in Indonesia.

- RH Petrogas Ltd (RHP SP) and Rex International Holdings Ltd (REXI SP) shares gained 1.6% and 1.4% respectively yesterday. WTI crude futures rose above $107 per barrel on Monday, scaling its highest in over 2 weeks, as a deepening crisis in Ukraine raised the prospect of heavier western sanctions on Russian oil in an already tight global energy market. Tensions grew over the weekend as Ukrainian soldiers resisted a Russian ultimatum to lay down arms in the pulverized port of Mariupol, providing no signs of ceasefire. WTI also jumped 8.8% last week on news that the EU might phase in a ban on Russian oil imports.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Airline Services | +2.58% | More Chinese cities tighten controls as Shanghai COVID-19 cases rise Beijing Capital Internatinl Arprt Co Ltd (694 HK) |

| Biotechnology | +2.24% | Omicron-specific Sinopharm Covid-19 vaccine cleared for clinical trial in China Akeso Inc (9926 H) |

| Property Management & Agency | +2.17% | China cuts reserve requirement ratio to boost economy, releasing US$83.2 billion into banking system Jinke Smart Services Group Co Ltd (9926 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Alcoholic Drinks & Tobacco | -0.84% | China data to show sharp March deterioration as COVID-19 bites, but solid Q1 growth: Poll Tsingtao Brewery Co Ltd. (168 HK) |

| Furniture & Household Goods | -0.29% | China’s Key Economic Data to Show Price Paid for Covid Zero Blue Moon Group Holdings Ltd (6993 HK) |

| System Applications & IT Consulting | -0.08% | Chinese telecoms giant Huawei speeds up bond sales to help fund expansion into software, services Chinasoft International Ltd (354 HK) |

- Hygeia Healthcare Holdings Co Ltd (6078 HK) shares rose 11.8% on Thursday. CITIC Securities pointed out that the company is a leader in private oncology medical services, and mergers and acquisitions promote high growth in the number of beds and performance. With the completion of the second phase of the company’s projects and self-built hospitals, it is expected that by the end of 2023, the number of open beds for the company is expected to increase to more than 10,000. In addition, the size of China’s oncology medical service market is about 400 billion yuan in 2020, and the bank expects a compound growth rate of about 11.5% from 2020 to 2025.

- Pacific Basin Shipping Ltd (2343 HK) shares rose 10.9% on Thursday. Pacific Shipping announced that the average daily income of Handysize and Supramax dry bulk carriers recorded in the first quarter on a time charter basis was US$23,810 and RMB32,510, which translates to a YoY growth of 117% and 122% respectively. During the period, the average daily performance of the Handysize and Supramax dry bulk carriers were higher by $3,260 and $8,610 respectively.

- Smoore International Holdings Ltd (6969 HK) shares rose 10.9% on Thursday after Guosen Securities released a research report saying that it maintained its “buy” rating on Smoore International. The bank said the company’s results were in line with expectations and profit margins improved slightly. In 2021, annual revenue was 13.755 billion yuan (+36.5%), net profit was 5.287 billion yuan (+53.6%), and adjusted net profit was 5.443 billion yuan (+39.8%).

- Jinke Smart Services Group Co Ltd (9666 HK) shares rose 9.9% on Thursday after Everbright Securities released a research report saying that it maintained its “buy” rating on Jinke Smart Services. The company aims to make strategic investments to optimise its shareholding structure, enhance operations and management capabilities, optimise business structure and enhance non-residential business development capabilities.

- Samsonite International S.A. (1910 HK) shares rose 7.3% on Thursday. According to thee latest information from the Hong Kong Stock Exchange, on April 6, Schroders Plc increased its holdings of Samsonite by 3,235,500 shares at a price of HK$17.3224 per share, with a total amount of about HK$56,046,600. After the increase in holdings, the latest number of shares held is about 117 million shares, and the latest shareholding ratio is 8.16%.

Trading Dashboard

Trading Dashboard Update: No additions or deletions to trading dashboard.

(Click to enlarge image)

Related Posts: