14 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

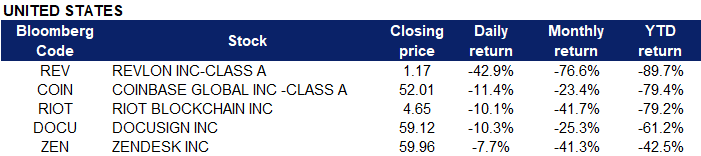

United States

Top Sector Losers

| Sector | Loss | Related News |

| Internet Retail | -6.5% | S&P 500, Nasdaq 100 Drive in to ‘Bear Market’ Territory Ahead of the Fed Amazon.com Inc (AMZN US) |

| Motor Vehicles | -6.3% | S&P 500, Nasdaq 100 Drive in to ‘Bear Market’ Territory Ahead of the Fed Tesla Inc (TSLA US) |

| Oil & Gas Production | -5.7% | Oil rises on tight supplies; trade choppy on demand worries ConocoPhillips (COP US) |

- Revlon Inc (REV US) shares cratered 42.9% following reports Friday that said the cosmetics company is preparing to file for bankruptcy as early as this week. A Wall Street Journal report citing unnamed sources said Revlon has been struggling with a high debt load, rising competition and greater supply chain pressures.

- Coinbase Global Inc (COIN US) and Riot Blockchain Inc (RIOT US) shares fell 11.4% and 10.1% respectively. Shares of cryptocurrency-related companies sold off as the price of bitcoin and other digital tokens pulled back sharply. Crypto exchange Bitcoin tumbled below $23,000 on Monday, hitting its lowest level since December 2020, as investors dumped crypto amid a broader sell-off in risk assets.

- DocuSign Inc (DOCU US) shares fell again on Monday, shedding 10.3%. This follows Friday’s 24% decline on the heels of the company missing first-quarter earnings and cutting billings growth guidance. The stock also got another downgrade from Wall Street, with Wolfe Research moving the stock to underperform from peer perform.

- Zendesk Inc (ZEN US) shares fell 7.7% after Morgan Stanley downgraded the name to equal weight from overweight. Morgan Stanley sees few near-term catalysts after Zendesk management’s decision to remain independent. The Wall Street firm also noted that Zendesk’s customer base is more cyclically sensitive.

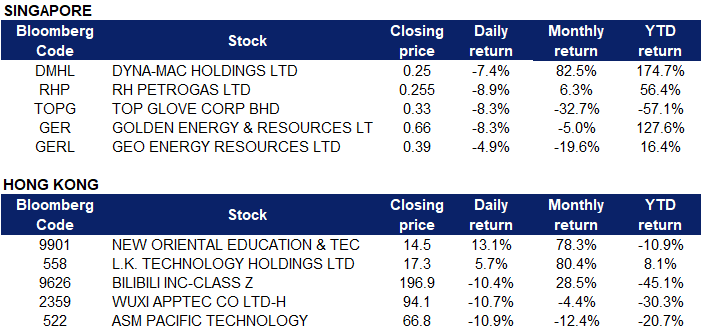

Singapore

- Dyna-Mac Holdings Ltd (DMHL SP) and RH Petrogas Ltd (RHP SP) shares fell 7.4% and 8.9% respectively yesterday. WTI crude futures fell nearly 2% toward $118 per barrel on Monday, sliding for the third straight session, as investors weighed the prospect of further US interest rate hikes to combat surging inflation and the potential for more Covid curbs in China. US inflation unexpectedly accelerated to a fresh 40-year high of 8.6% last month, raising the likelihood of more aggressive rate hikes from the Federal Reserve. US gasoline prices also averaged more than $5 a gallon for the first time on Saturday, extending a surge in fuel costs that is driving rising inflation. Goldman Sachs reiterated on Friday that energy prices need to rally further before achieving the demand destruction required for market rebalancing. Meanwhile, major Chinese cities are still battling against rising virus cases as the world’s biggest crude importer navigates a bumpy return from lockdowns.

- Top Glove Corp (TOPG SP) shares extended their losses and declined 8.3% yesterday. Top Glove, the world’s largest medical glove maker, posted a 98.6% drop in quarterly profit due to weaker demand for its products and higher production costs. The Malaysian firm, which saw profits and demand surge during the COVID-19 pandemic, has also deferred and reduced its capital expenditure for the near term due to moderating demand.

- Geo Energy Resources Ltd (GERL SP) and Golden Energy & Resources Ltd (GER SP) shares lost 4.9% and 8.3% respectively yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, consolidated around the $400-per-tonne mark and just 35 dollars shy of its record peak, supported by continued robust demand against a tightening market backdrop. Along with increasing demand for power generation with a resumption in economic activity after the coronavirus-induced slump, soaring natural gas prices in Europe and Asia in late 2021 boosted coal consumption. On top of that, Russia’s invasion of Ukraine and the unprecedented economic sanctions, including the EU’s ban on oil and coal imports from Russia, have thrown the global energy market into chaos.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Precious Metal | +1.78% | Gold Hits 4-Week Highs as U.S. Inflation Report Shocks Markets China Gold International Resrcs Corp Ltd (2099 HK) |

Other Support Services | +1.55% | New Oriental Education Operates Bilingual Livestream E-Commerce New Oriental Education & Techlgy Grp Inc (9901 HK) |

Consumer Electronics | +0.37% | China Aims to Restore Car Demand with Strong Fiscal Stimulus Smoore International Holdings Ltd (6969 HK) |

Top Sector Losers

Sector | Loss | Related News |

Biotechnology | -3.41% | Zai Lab Ltd (9688 HK) |

E-Commerce & Internet Services | -2.66% | NA Baidu Inc (9888 HK) |

Semiconductors | -2.49% | NA ASM Pacific Technology Limited (522 HK) |

- New Oriental Education & Techlgy Grp Inc (9901 HK) Shares jumped 13.1% and closed near the YTD high. On Friday and over the weekend, New Oriental’s live streaming clips made social media headlines in China, after former tutor-hosts began selling products in both Chinese and English. On Sunday, the company said its daily sales volume over the past few days jumped around tenfold thanks to the popularity of the bilingual delivery model.

- LK Technology Holdings Limited (558 HK) Shares rose 5.7% and closed at a high since last December. Tesla’s sole provider for its gigantic Giga Casting machines IDRA Group from Italy has finally fully unveiled the production version of the 9000-ton machine. This 9,000-ton machine is going to be used for making Tesla Cybertruck body parts. IDRA is a subsidiary of the company.

- Bilibili Inc (9626 HK) Shares fell 10.4% yesterday. WuXi AppTec Co., Ltd (2359 HK) Shares fell 10.7% yesterday. ASM Pacific Technology Limited(522 HK) Shares fell 10.9% yesterday. The stock was removed from the Heng Seng Tech Index yesterday. Hong Kong stocks slumped by the most in five weeks after a rebound in Covid-19 cases in the city and across mainland China revived lockdown fears while concerns about further US monetary tightening also crimped risk appetite.

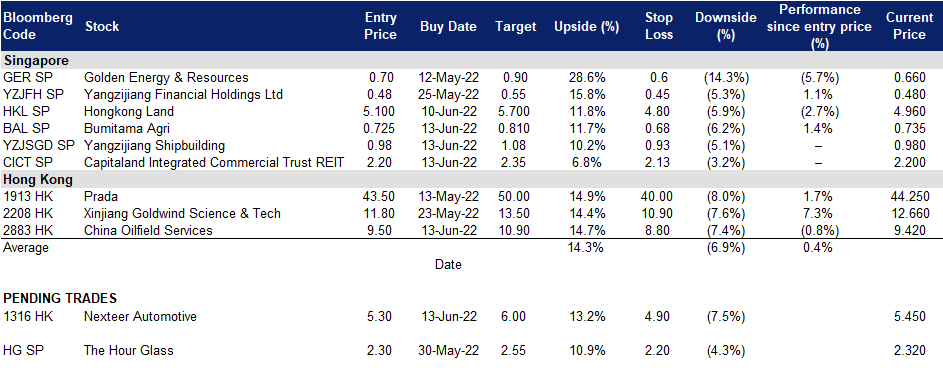

Trading Dashboard Update: Cut loss on Rex International (REXI SP) at S$0.34 and Samsonite International (1910 HK) at HK$16.5. Add Bumitama Agri (BAL SP) at S$0.725, Yangzijiang Shipbuilding (YZJSGD SP) at S$0.98, Capitaland Integrated Commercial Trust REIT (CICT HK) at S$2.2, and China Oilfield Services (2883 HK) at HK$9.50.