12 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Tobacco | +2.4% | Philip Morris could buy Zyn-maker Swedish Match Philip Morris International Inc (PM US) |

| Integrated Oil | +1.7% | Oil prices rebound higher on looming EU ban on Russian supplies Exxon Mobil Corp (XOM US) |

| Oil & Gas Production | +0.9% | Oil prices rebound higher on looming EU ban on Russian supplies ConocoPhillips (COP US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -6.8% | Lucid CEO concerned about chip supplies from China due to COVID-19 Lucid Group Inc (LCID US) |

| Telecommunications Equipment | -5% | Nasdaq ends down 3.2% as US stocks slump after inflation data Apple Inc (AAPL US) |

| Internet Retail | -3.9% | Nasdaq ends down 3.2% as US stocks slump after inflation data Amazon.com Inc (AMZN US) |

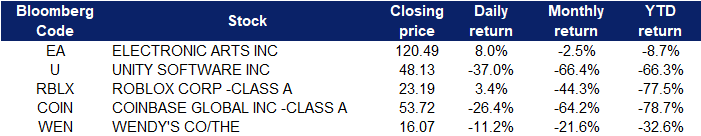

- Electronic Arts (EA US) shares jumped 8% after the company posted its recent earnings and announced it will end its partnership with FIFA. MoffettNathanson analysts recommended shares of Electronic Arts because of the company’s stable foundation to weather market volatility ahead.

- Unity Software (U US) shares plunged 37% after the company posted revenue below expectations. Unity Software reported $320 million in revenue in the first quarter, while analysts surveyed by Refinitiv expected $322 million.

- Roblox (RBLX US) shares jumped 3.4% despite weaker-than-expected quarterly results. Roblox reported a loss of 27 cents in its most recent quarter, compared with a loss of 21 cents expected by analysts polled by Refinitiv. Revenue came in at $631.2 million, compared with the $645 million consensus estimate from Refinitiv.

- Coinbase (COIN US) shares sank 26.4% after the company reported first-quarter revenue below expectations. Coinbase posted revenue of $1.17 billion versus the Refinitiv consensus estimate of $1.48 billion. The company said lower crypto asset prices and market volatility impacted first-quarter results.

- Wendy’s (WEN US) shares sank 11.2% after the company missed its first-quarter estimates on the top and bottom lines. The company reported an adjusted 17 cents in per-share earnings on $489 million of revenue. Analysts surveyed by Refinitiv had pencilled in 18 cents per share on $497 million of revenue. U.S. sales growth was just 2.4% despite a rising number of total restaurants, and the margins at company-operated restaurants declined.

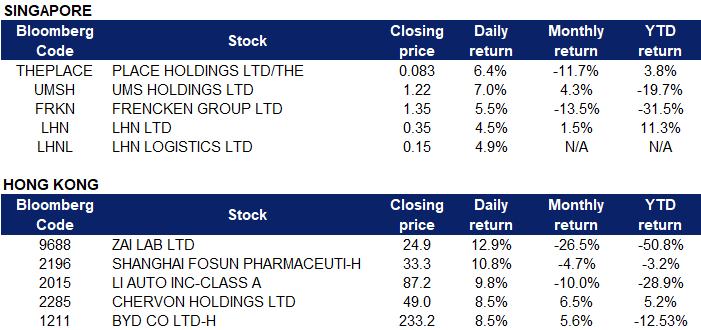

Singapore

- The Place Holdings Ltd (THEPLACE SP) shares rose 6.4% yesterday. The Place Holdings has proposed buying a 51% stake each in 2 companies that are involved in the operations of an LED sky screen in Beijing, China, for an aggregate consideration of around S$47 million. The company has entered into sale and purchase agreements for a 51% stake in Sun Xin Investment for S$26.5 million, and a 51% stake in Sun Oriental for S$20.5 million.

- UMS Holdings Ltd (UMSH SP) shares rose 7% yesterday. UMS Holdings’ net profit for the first quarter ended Mar 31, 2022 rose 26% year on year to S$19.4 million from S$15.4 million previously. In its bourse filing on Tuesday (May 10), the group noted that its sales surge for the quarter was driven by the sustained increase in semiconductor demand and the consolidation of sales from JEP Holdings – which became a subsidiary of the group from Q2 2021 – bringing on board a new revenue stream from the aerospace business. As a result, fellow peer in the semicon space, Frencken Group Ltd (FRKN SP) shares rose 5.5% yesterday.

- LHN Ltd (LHN SP) and LHN Logistics Ltd (LHNL SP) shares rose 4.5% and 4.9% respectively yesterday. On Monday, LHN announced that the Group expects to record a higher net profit before tax for 1H22 of no less than approximately S$34 million as compared to the six months ended 31 March 2021 of approximately S$18.3 million. The higher net profit before tax for 1H22 arises mainly from the Space Optimisation Business due to (i) gains from subleases; (ii) higher fair value gains on the Group’s and joint ventures’ investment properties; and (iii) increase in profit from the Group’s co-living business under residential properties. LHN will be announcing its 1H22 results on 12 May 2022.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Public Transport | +3.98% | Kwoon Chung Bus Holdings Ltd (306 HK) |

Alcoholic Drinks & Tobacco | +2.77% | Budweiser Brewing Company APAC Limited (1876 HK) |

Biotechnology | +2.05% | Moderna mounts defense in COVID-19 vaccine patent feud with Arbutus, Genevant Zai Lab Ltd (9688 HK) |

Top Sector Losers

Sector | Loss | Related News |

Conglomerates | -1.49% | As Hong Kong Relaxes COVID Rules The Luxury Market Gains Momentum Fosun International Limited (656 HK) |

Petroleum & Gases | -0.91% | Fears Of An Economic Slowdown Drag Oil Prices Lower United Energy Group Ltd (467 HK) |

Telecomm. Services | -0.86% | China Telecom Americas Leads Secure Global Connectivity With MANRS-Conformant Networks HKBN Ltd (1310 HK) |

- Zai Lab Ltd (9688 HK) Shares jumped by 19.4% yesterday after the company announced its 1Q22 results. Revenue jumped by 132.4% YoY to US$46.7mn. Net loss attributable to the company shareholders narrowed by 64.6% YoY to US$82.4mn. The drop in losses was due mainly to no prepayment resulting from the new authorization of drugs.

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd (2196 HK) Shares rose 10.8% yesterday. Vaccine developer BioNTech has extended by six months to October a Phase II clinical trial of its COVID-19 vaccine in China, a registry of such trials showed. The vaccine, based on messenger RNA (mRNA) technology, is one of the most widely used worldwide against COVID-19, but has yet to receive an approval in China, which has relied only on domestically developed vaccine.

- Li Auto Inc (2015 HK) Shares rose 9.8% yesterday after the company announced its 1Q22 results. Revenue jumped by 167.5% YoY to RMB9.6bn. Net loss narrowed to RMB10.9mn compared to RMB360mn during the same period last year. The delivery of the model ONE in 1Q22 jumped by 152.1% YoY to 31,716 units. The company estimated the delivery in 2Q22 to be 21,000 – 24,000 units, up 19.5% – 36.6% YoY. Accordingly, the revenue in 2Q22 is expected to be RMB6.2bn – RMB7.0bn, up 22.3% YoY to 39.8% YoY.

- Chervon Holdings Ltd (2285 HK) Shares rose 8.5% yesterday. BYD Company Limited (1211 HK) Share rose 8.5% yesterday. There was no company-specific news from both stocks. The EV sector rebounded due mainly to the better than expected results from Li Auto.

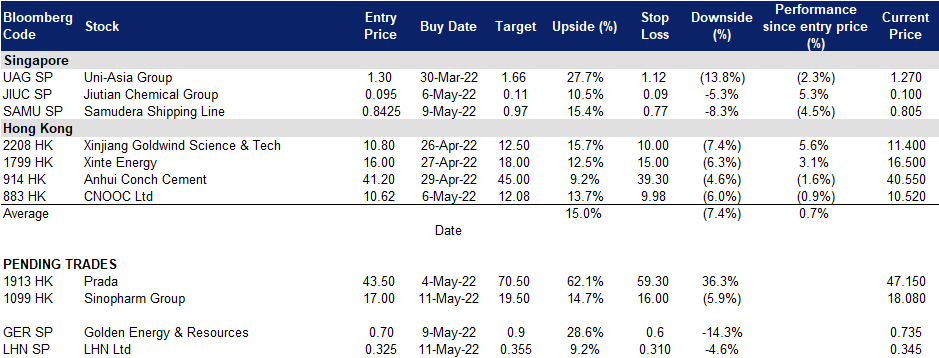

Trading Dashboard Update: Take profit on Singtel (ST SP) at S$2.83.