12 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Drugstore Chains | +0.36% | Consumers Want a More Connected, Personal Health Care Experience, New CVS Health Study Reveals CVS Health Corp(CVS US) |

| Electric Utilities | +0.26% | Duke and TECO add more self-healing technology to prevent power outages Duke Energy Corp (DUK US) |

| Oil Refining/Marketing | +0.13% | Why crude released from U.S. oil reserves may have ended up being exported overseas Marathon Petroleum Corp (MPC US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -5.01% | Musk’s Tesla stock sale windfall dwarfs Twitter loss Tesla Inc (TSLA US) |

| Internet Retail | -4.81% | China Tech Stocks Sink as Alibaba, Tencent Suffer Fresh Fines Alibaba Group Holding Ltd (BABA US) |

| Internet Software/Services | -3.47% | Twitter says Musk’s request to terminate the deal is invalid Twitter Inc(TWTR US) |

- Twitter Inc (TWTR US) shares dropped 11.3% after Elon Musk walked away from his $44 billion deal to buy Twitter. Musk alleged that Twitter under-reported the number of spam bots on the platform. The two parties are likely set for a protracted court battle, and Musk could also be faced with paying a $1 billion breakup fee.

- Nio Inc (NIO US) shares slid 9.0% as China appears to be battling another wave of Covid-19. Reuters reported that multiple Chinese cities have imposed new health restrictions. The automaker also announced that it has formed a committee to investigate allegations made against Nio by a short-seller last month.

- Shares of Wynn Resorts Ltd (WYNN US) and Las Vegas Sands Corp (LVS US) dove 6.5% and 6.3%, respectively, after Macao ushered in a week-long shutdown as it grapples with a Covid-19 outbreak. Monday marked the first time in more than two years that Macao has shut down all of its casinos.

- Meta Platforms Inc (META US) stock dropped 4.7% after Needham downgraded it to underperform from hold. The firm pointed to Meta’s heavy investments into the metaverse, which may take too long to pay off.

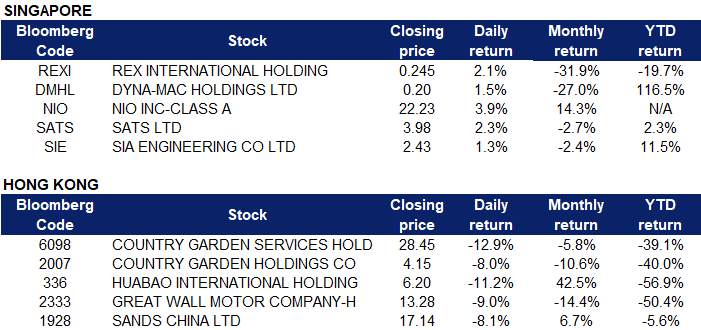

Singapore

- Rex International Holding Ltd (REXI SP) and Dyna-Mac Holdings Ltd (DMHL SP) shares rose 2.1% and 1.5% respectively on Friday. Oil prices rose about 2 per cent in volatile trade on Friday but were still heading for a weekly decline as investors worried about a potential recession-driven demand downturn even as global fuel supplies remained tight. Brent crude futures rose $2.37, or 2.3 per cent, to settle at $107.02 a barrel. U.S. West Texas Intermediate crude rose $2.06, or 2 per cent, to settle at $104.79 a barrel.

- NIO Inc (NIO SP) shares rose 3.9% on Friday. Some news out of Beijing had EV stocks flying higher as the fairweather government has reiterated its support for the domestic automarket. The Chinese government is looking to extend subsidies for consumers who buy domestically made new-energy vehicles, which gave Nio and its peers a boost. Investors were also pleased that despite ongoing COVID-19 concerns, there has been no announcement made about a potential lockdown in the Anhui Province where Nio has its main production facilities.

- SATS LTD (SATS SP) and SIA Engineering Co Ltd (SIE SP) shares rose 2.3% and 1.3% respectively on Friday. Singapore Airlines has unveiled plans to increase services to points across Japan and restore its Indian network to pre-pandemic levels in the coming months. The airline will also add more flights to Los Angeles and Paris by December 2022, and continue with its direct services to Vancouver. The network expansion is in response to strong demand for air travel, and will offer customers more flexibility and options in the Northern Winter operating season (30 October 2022 to 25 March 2023). Together with other adjustments to the SIA and Scoot network, the SIA Group capacity is projected to be at around 81% of pre-pandemic levels by December 2022.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Soft Drinks |

+2.90% |

NA Nongfu Spring Co Ltd (9633 HK) |

|

Household Appliances |

+0.99% |

China’s bumper data week will set tone for economic stimulus Hisense Home Appliances Group Co Ltd (921 HK) |

|

Textile & Apparels |

+0.85% |

Chinese textile industry suffers profit erosion, orders flow to Vietnam, India ANTA Sports Products Ltd (2020 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Property Management & Agency |

-3.22% |

A-Living Smart City Services Co., Ltd (3319 HK) |

|

E-Commerce & Internet Services |

-2.02% |

Hong Kong’s Hang Seng index falls around 3% as heavyweights Tencent, Alibaba plunge Meituan (3690 HK) |

|

Automobiles & Components |

-2.00% |

China industry body cuts 2022 auto sales growth forecast to 3% Great Wall Motor Company Limited (2333 HK) |

- Country Garden Services Holdings Co Ltd (6098 HK) and Country Garden Holdings Co Ltd (2007 HK) shares fell 12.9% and 8.0% respectively yesterday. On July 11, property stocks were generally under pressure as the Shenzhen Stock Exchange issued an announcement stating that the Hang Seng Composite Large Cap Index, Mid Cap Index and Small Cap Index have implemented constituent stock adjustments, removing many leading real estate and property stocks.

- Huabao International Holdings Limited (0336 HK) shares fell 11.2% yesterday. On the news, it was learned from the official website of the State Intellectual Property Office that on July 6, six departments issued a notice that it is strictly prohibited for any unit or individual to use the name of the Chinese People’s Liberation Army and the Armed Police Force to conduct commercial marketing in any form. Online and offline sales of “military” brand tobacco and alcohol are strictly prohibited.

- Great Wall Motor Co Ltd (2333 HK) shares fell 9.0% yesterday. According to the Daiwa Development Research Report , total sales in June increased by 0.52% year-on-year to 101,200 units, which was lower than the 41% year-on-year growth of the overall passenger car market.

- Sands China Ltd (1928 HK) shares fell 8.1% yesterday. Sands China Ltd announced on July 11, 2022, the company entered into a loan agreement with LVS (the company’s controlling shareholder Las Vegas Sands Corp.). LVS has provided the company with a subordinated unsecured term loan amounting to US$1 billion on July 11, 2022, which shall be repaid on July 11, 2028.

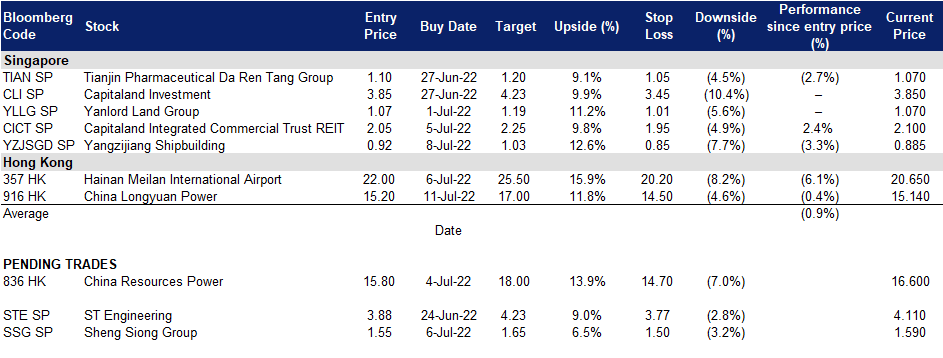

Trading Dashboard Update: Add Yangzijiang Shipping (YZJSGD) at S$0.92 and China Longyuan Power (916 HK) at HK$15.2.