11 October 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Insurance Brokers/Services | +1.44% | N/A Marsh & McLennan Companies Inc (MMC US) |

| Food: Specialty/Candy | +1.31% | Hershey (HSY) Gains As Market Dips: What You Should Know Hershey Co (HSY US) |

| Property/Casualty Insurance | +0.99% | Progressive: Shares Trending Higher Into Earnings, Profitability Seen Improving Progressive Corp (PGR US) |

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -3.08% | Nasdaq registers lowest close since July 2020; chips stocks fall NVIDIA Corp (NVDA US) |

| Packaged Software | -2.54% | Nasdaq closes at 2-year low on Monday, hurt by slumping chip stocks Microsoft Corp (MSFT US) |

| Oil & Gas Production | -2.40% | Oil Edges Lower as Slowdown Concerns Eat Into OPEC-Driven Gains Occidental Petroleum Corp (OXY US) |

- Ford Motor Co (F US) and General Motors Co (GM US) fell 6.9% and 4.0% respectively, after UBS downgraded both stocks. The firm lowered Ford to a sell rating from neutral and cut GM to a neutral from a buy. The auto industry is moving toward vehicle oversupply following three years of unprecedented pricing power, UBS said.

- Shares of hotel and casino companies were the top decliners in the S&P 500, with Wynn Resorts Ltd (WYNN US) down 12.2% and Las Vegas Sands Corp (LVS US) losing 7.6%. The moves came as Chinese cities reimposed Covid lockdowns thanks to a spike in daily cases over a weeklong holiday.

- Rivian Automotive Inc (RIVN US) dropped 7.3% after the company said it will recall nearly all of its vehicles due to a possible issue of a loose fastener that could make a driver lose steering control.

Singapore

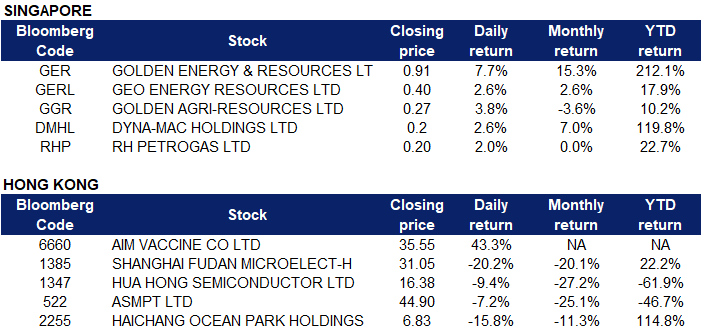

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares rose 7.7% and 2.6% yesterday respectively. The seaborne metallurgical coal market is entering the fourth quarter on firmer footing, as weather-related disruptions stoke supply worries while year-end restocking demand from India and China keeps prices supported after a volatile Q3.

- Golden Agri-Resources Ltd (GGR SP) shares climbed 3.8%. Malaysia on Friday forecast crude palm oil price would average RM4,300 (US$928.93) per tonne in 2023, down from RM5,000 this year. That is higher than the last 10-year average of RM2,685, as the supply of global edible oils and fats is expected to remain tight, according to Malaysia’s Economic Outlook report (Economic Report 2022/2023) released together with the 2023 budget. Malaysia is the world’s second-largest producer of crude palm oil.

- Dyna-Mac Holdings Ltd (DMHL SP) and RH PetroGas Ltd (RHP SP) shares increased by 2.6% and 2.0% yesterday respectively. Oil prices jumped about 4% to a five-week high on Friday, lifted again by an OPEC+ decision last week to make its largest supply cut since 2020 despite concern about a possible recession and rising interest rates. Oil prices slipped on Monday (Oct 10), easing off five-week highs, as the market took profits following strong gains last week.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Telecomm. Services | +0.96% | US, China already gunning for 6G military supremacy China Mobile Ltd (941 HK) |

Top Sector Losers

Sector | Loss | Related News |

Airline Services | -4.41% | Cathay Pacific Airways Ltd (293 HK) |

Semiconductors | -4.10% | Global Chip Stocks Tumble as Biden Expands Technology Curbs Semiconductor Manufacturing International Corp (981 HK) |

Biotechnology | -3.68% | Wuxi Biologics Cayman Inc (2269 HK) |

- AIM Vaccine Co Ltd (6660HK) Shares jumped 43.3% on the third day of its debut on HKEX, and its market cap arrived at HK$30bn. The company is the largest private vaccine enterprise that principally engages in the research and development, manufacturing and sales of vaccines. The Company’s vaccine candidates include messenger RNA (mRNA) coronavirus disease 2019 (COVID-19) vaccine, inactivated COVID-19 vaccine, broad-spectrum COVID-19 vaccine, PCV13, PPSV23 and MCV4. In terms of 2021 approved lot release volume(excluding COVID-19 vaccines), AIM accounted for a 7.4% market share in the PRC. In terms of 2021 sales revenue (excluding COVID-19 vaccines), AIM accounted for a 2.1% market share in the PRC.

- Shanghai Fudan Microelectronics Group Co Ltd (1385 HK), Hua Hong Semiconductor Ltd (1347 HK) and ASMPT Ltd (522 HK) Shares fell 20.2%, 9.4% and 7.2% yesterday respectively, affected by the sluggish demand for chips and the decline in prices, a number of chip manufacturers such as AMD, Samsung, and Micron have lowered their performance guidance and reduced capital expenditures. Among them, AMD announced preliminary financial results for the third quarter, which is expected to be about $5.6 billion in revenue in the quarter, far less than the $6.7 billion previously expected by the company and the market. U.S. chip stocks fell again on Friday, with the Philadelphia Semiconductor Index tumbling 6.1% and AMD closing down 13.9%. In addition, the US Department of Commerce issued a new export ban on the semiconductor manufacturing industry including restrictions on the export of some types of chips used in artificial intelligence and supercomputing, and also tighter rules on the sale of semiconductor equipment to any Chinese company.

- Haichang Ocean Park Holdings Ltd (2255 HK) Shares plummeted 15.8% yesterday after it was announced that the board of directors recommended that the existing issued and unissued shares of the company’s share capital with a par value of US$0.0001 per share be subdivided into 2 subdivided shares of US$0.00005 each.

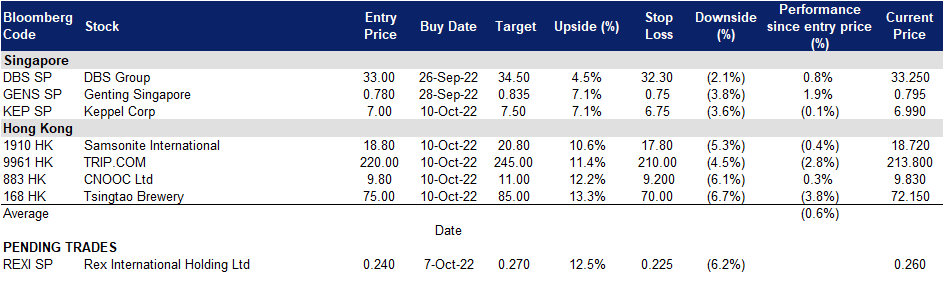

Trading Dashboard Update: Add Keppel Corp (KEP SP) at S$7.00, Samsonite International (1910 HK) at HK$18.8, TRIP.com (9961 HK) at HK$220, CNOOC (883 HK) at HK$9.8, and Tsingtao Brewery (168 HK) at HK$75.0.