11 August 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Investment Managers | +4.47% | Mocked by Everyone, Stock Rally Sits at Cusp of a Chart Landmark Blackstone Inc (BX US) |

| Semiconductors | +4.34% | Wall Street rally lifts Nasdaq 20% from low as inflation fears ebb NVIDIA Corp (NVDA US) |

| Financial Publishing/Services | +4.25% | US: Wall St opens higher as bets on big rate hikes ease after inflation data S&P Global Inc (SPGI US) |

- Coinbase Global Inc (COIN US) jumped 7.4% despite the company reporting a wider-than-expected loss late Tuesday and a decline in volumes in the most recent quarter. The rally coincided with a move higher in bitcoin after a key inflation reading showed a better-than-expected slowdown in rising prices.

- Twitter Inc (TWTR US) climbed 3.7% after Elon Musk disclosed the sale of nearly $7 billion in Tesla shares in the past few days. Investors are uncertain whether a Delaware Chancery court will force Musk to follow through on his deal to buy Twitter for $44 billion. Shares of Tesla gained more than 2.5%.

- Fox Corp (FOX US) rose 3.3% even after Fox missed estimates on the top and bottom lines in the latest quarter. Earnings per share came in 1 cent below estimates.

- Unity Software Inc (U US) jumped 10.4% after Unity reported an adjusted loss of 18 cents per share, three cents better than estimates, according to Refinitiv. Unity’s revenue and guidance were lower than expected. The stock is now trading within 10% of $58.85 per share, which is the price offered by AppLovin in a nonbinding merger proposal earlier this week.

- Wendy’s Co/The (WEN US) fell 1.8% after reporting a revenue miss. U.S. same-restaurant sales rose 2.3% — less than analysts had estimated — as consumers spent more cautiously. Wendy’s earnings in the latest quarter topped estimates, however.

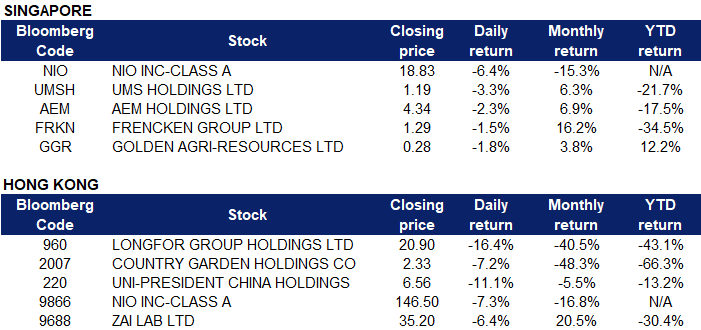

Singapore

- Nio Inc (NIO SP) fell 6.4% yesterday. NIO stock tracked the weakness across the major Wall Street indices, triggered by a sharp sell-off in the tech-intensive Nasdaq Composite Index after Micron Technology Inc became the latest chipmaker to warn about slowing demand and fanning economic concerns. Markets also refrained from placing bets on riskier assets ahead of Wednesday’s critical US inflation data. The main driver, however, behind NIO stock’s slump was the news that Advisor Group Holdings Inc. lessened its position in shares of Nio Inc by 1.5% during Q1, according to its most recent Form 13F filing with the Securities & Exchange Commission.

- UMS Holdings Ltd (UMSH SP), AEM Holdings Ltd (AEM SP) and Frencken Group Ltd (FRKN SP) fell 3.3%, 2.3% and 1.5% yesterday respectively. Micron Technology became the latest chipmaker to warn about slowing demand, triggering concern the industry is heading into a painful downturn. Investors are growing increasingly skittish the notoriously cyclical industry is hurtling toward a prolonged slump after years of widespread shortages that led to heavy investments in capacity. Highlighting the speed with which demand is evaporating, Micron said orders have deteriorated since the company last gave an update just over a month ago. While the personal computer market had already been in a slump, the weakness in demand is now spreading widely.

- Golden Agri-Resources Ltd (GGR SP) fell 1.8% yesterday. Fundamentals in the palm oil complex continue to be clouded by rising supplies from rival Indonesia and weak export demand from Malaysia. The world’s top producer will allow exporters to ship nine times the amount sold domestically under the rule, up from seven times previously, attempting to clear the current high palm oil stockpiles and boost exports. Weak export demand from Malaysia is adding to the bearish outlook.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Petroleum & Gases | +2.08% | Oil settles lower as halted Russian pipeline flows appear temporary, demand fears rise CNOOC Ltd (883 HK) |

Telecomm. Services | +0.23% | U.S. accuses Chinese company of helping ZTE hide business with Iran China Mobile Ltd (941 HK) |

Precious Metal | +0.21% | Gold prices subdued as investors await US inflation data China Gold International Resources Corp. Ltd (2099 HK) |

Top Sector Losers

Sector | Loss | Related News |

Automobiles & Components | -2.54% | Nation releases first draft of rules on self-driving vehicles in public NIO Inc (9866 HK) |

Biotechnology | -2.53% | China Urged Not to Be ‘War Weary’ Amid More Covid Lockdowns WuXi Biologics (Cayman) Inc (2269 HK) |

Electronic Component | -2.28% | Hong Kong’s Hang Seng drops 2% as Asia markets slip; China’s inflation rises Sunny Optical Technology (Group) Co. Ltd (2382 HK) |

- Longfor Group Holdings Ltd (0960 HK) and Country Garden Holdings Co Ltd (2007 HK) shares fell 16.4% and 7.2% yesterday respectively. The property sector was among the top losers, after UBS downgraded major developers Country Garden, Longfor Group, as well as property management companies Country Garden Services and Jinke Smart Services to “neutral” from “buy”.

- Uni-President China Holdings Ltd (0220 HK) shares fell 11.1% yesterday. On August 9, Uni-President China released its semi-annual report. In the first half of 2022, its revenue increased by 7.2% year-on-year. However, the gross profit margin decreased by 4.7 percentage points compared with the same period last year, and the net profit attributable to equity holders of the company was 614 million yuan, a decrease of 27.5% compared with the same period last year. These were caused by the increase in the price of bulk raw materials, international oil prices and the increase in transportation costs due to the epidemic.

- NIO Inc (9866 HK) shares fell 7.3% yesterday. NIO stock tracked the weakness across the major Wall Street indices, triggered by a sharp sell-off in the tech-intensive Nasdaq Composite Index after Micron Technology Inc became the latest chipmaker to warn about slowing demand and fanning economic concerns. Markets also refrained from placing bets on riskier assets ahead of Wednesday’s critical US inflation data. The main driver, however, behind NIO stock’s slump was the news that Advisor Group Holdings Inc. lessened its position in shares of Nio Inc by 1.5% during Q1, according to its most recent Form 13F filing with the Securities & Exchange Commission.

- Zai Lab Ltd (9688 HK) shares fell 6.4% yesterday. The group announced its second-quarter results, the total revenue was approximately US$48.176 million, a year-on-year increase of 30.43%. The net loss was approximately US$138 million, a decrease of approximately 15.55% year-on-year. Net loss per common share was $0.14 and net loss per ADS was $1.44. The lower net loss in the second quarter was primarily due to the lack of new authorizations to introduce advances, partially offset by an increase in foreign exchange losses of $42.2 million. Foreign exchange adjustments were made to non-cash accruals.

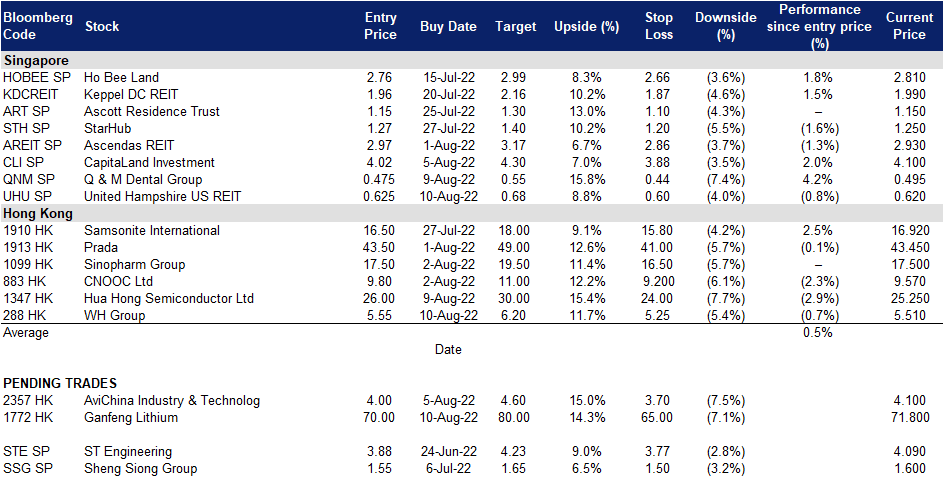

Trading Dashboard Update: Add United Hampshire US REIT (UHU SP) at S$0.625 and WH Group (288 HK) at HK$5.55.