1 March 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +5.2% | Goldman: Only Demand Destruction Can Keep Oil Prices From Rising Occidental Petroleum (OXY US) |

| Aerospace & Defence | +4.0% | Defence stocks climb as Germany boosts military spending Lockheed Martin (LMT US) |

| Coal | +2.5% | China sees biggest growth in energy and coal use since 2011 Peabody Energy (BTU US) |

Top Sector Losers

| Sector | Loss | Related News |

| Airlines | -3.0% | No-fly zones, canceled flights: How Russia’s invasion of Ukraine is disrupting air travel Southwest Airlines (LUV US) |

| Major Banks | -2.5% | Global banks lose juicy fees as China junk bond drought drags on JP Morgan Chase (JPM US) |

| REITS | -1.6% | Why REIT ETF investors shouldn’t fret over rising interest rates Simon Property Group (SPG US) |

- Renewable Energy Corp (REGI US) shares surged 40.4% yesterday. Chevron said on Monday it would buy biodiesel maker Renewable Energy Group in an all-cash deal valued at $3.15 billion as the oil major looks to boost its clean-energy business. Chevron will pay $61.5 for each share of Renewable Energy, representing a premium of over 40% to the company’s last closing price. Chevron has set a target to cut operational emissions to net zero by 2050 and in September pledged to invest $10 billion to reduce its carbon emissions footprint through 2028, with about $3 billion earmarked for renewable fuels.

- First Horizon Corp (FHN US) shares surged 28.7% yesterday, following news that the company will be acquired by TD in an all-cash deal worth $13.4 billion, or $25 per share, a move that will allow the Canadian banking giant to expand its footprint in the southeastern part of the U.S.

- Occidental Petroleum Corp (OXY US) shares jumped 12.9% yesterday. Occidental Petroleum Corp is buying back $2.5 billion of its bonds as the junk-rated company seeks to cut debt after reporting better-than-expected earnings with rising crude prices. The oil producer launched a tender offer Monday to repurchase 15 tranches of notes with maturities ranging from 2023 to 2049. Some of its targeted bonds gained. The $663 million of 4.1% unsecured notes due in 2047 vaulted 5 cents to 92.5 cents on the dollar Monday morning, according to data compiled by Bloomberg.

- Tesla Inc (TSLA US) shares rose 7.5% yesterday. Panasonic Corp said on Monday (Feb 28) it will begin mass production of a new lithium-ion battery for Tesla Inc before the end of March at a plant in Japan. Unveiled by the Japanese company in October, the 4680 format (46 millimetres wide and 80 millimetres tall) battery is around five times bigger than those currently supplied to Tesla, meaning the US electric vehicle (EV) maker will be able to lower production costs. The new powerpack is also expected to improve vehicle range, which could help Tesla lure more drivers to EVs.

- Block Inc (SQ US) shares extended their rally and rose 6.4% yesterday, after surging 26.1% on Friday. Last week, the company reported earnings and revenue that beat analysts’ expectations for its latest quarter. Total revenue hit $4.08 billion in the quarter from $3.16 billion a year earlier, while “gross profit” jumped 47% to $1.18 billion, the company said. It also issued upbeat guidance for the current quarter and the full year, citing growing success in its consumer business, Cash App.

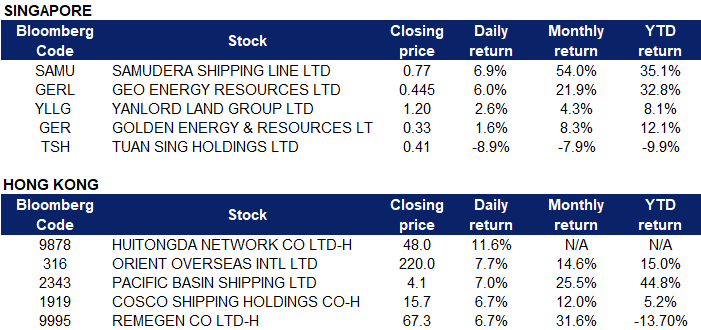

Singapore

- Samudera Shipping Line Ltd (SAMU SP) shares extended their rally and rose 6.9% yesterday, after surging 25.2% on Friday. The company posted a net profit of US$128.6 million for the full year ended Dec 31, 2021, from US$7.2 million the year before due to better performance from its container shipping segment as a result of higher freight rates. With the severe congestion at ports around the world, Samudera is expecting upward pressure on freight rates as well as robust demand for shipping services given the gradual reopening of economies globally. The board has a special dividend of 12.75 Singapore cents , higher than the 0.30 cent special dividend declared the previous year. A final dividend of 0.75 cent was also proposed, unchanged from the corresponding period the previous year.

- Geo Energy Resources Ltd (GER SP) extended their rally and rose 6% yesterday, after gaining 6.3% on Friday. Geo Energy Resources reported a record 2021. Driven by the increase in sales volume and high ASP, Geo Energy achieved its highest ever revenue and net profits in FY2021. Revenue doubled YoY to US$641.9 million in 2021. Net profit from operations of US$179.1 million was a turnaround from the net loss from operations of US$11.5 million in 2020, excluding the gain on repurchases of USD bonds. Geo Energy rewarded shareholders with a final dividend of 5 cents, after paying out an interim dividend of 4 cents, taking the dividend payout ratio to 52%.

- Yanlord Land Group Ltd (YLLG SP) shares gained 2.6% yesterday. The company posted a net profit of 1.83 billion yuan (S$394.4 million) for the second half of the financial year ended Dec 31, 2021, down 13% YoY from 2.1 billion yuan. The net profit drop was despite revenue increasing 46% YoY to 21.64 billion yuan, from 14.8 billion yuan. In its results on Sunday (Feb 27), the property developer said this was due to the decrease in other operating income and other gains, as well as fair value gain on investment property. The increase in administrative expenses was also a factor.

- Tuan Sing Holdings Ltd (TSH SP) shares lost 8.9% yesterday. The company recorded a net loss of S$17.1 million for the 6 months ended Dec 31, 2021 on Friday (Feb 25), from a net profit of S$52.4 million it recorded a year earlier. This comes as the property group recorded a fair value loss of S$3.3 million, down from a fair value gain of S$42 million a year ago due to the absence of fair value gain from Robinson Point office building on Robinson Road, which the group sold in June 2021. The group’s revenue fell 3% to S$101.4 million from S$105 million in the same period a year ago. “Despite the further cooling measures announced by the government in 2021, the group expects buying sentiments in the residential market to continue to be fuelled by ample liquidity amidst dwindling stock, although higher construction costs and the tight manpower situation may continue to impact margin and construction schedule,” the group said.

- Golden Energy & Resources Ltd (GERL SP) shares gained 1.6% yesterday. Golden Energy and Resources will place up to an aggregate of 285 million new ordinary shares at an issue price of S$0.305 to raise approximately S$86.9 million. The placement price represents a discount of approximately 4.7% to the volume weighted average price of S$0.3199 per ordinary share on Friday. Assuming the proposed placement is fully subscribed, the company’s issued shares will rise to 2,638,100,380, with the placement shares accounting for 10.8% of the enlarged issued and paid-up share capital of the company.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Coal | +1.47% | China sees biggest growth in energy and coal use since 2011 China Shenhua Energy Company Limited (1088 HK) |

| Diversified Food & Beverage | +0.52% | NA Want Want China Holdings Limited (151 HK) |

| Nonferrous Metal | +0.38% | US uranium producers begin preparations CGN Mining Co Ltd (1164 HK |

Top Sector Losers

| Sector | Loss | Related News |

| Airline Services | -3.14% | Asian airlines spared from Russia-Europe airspace closures Boc Aviation Ltd (2588 HK) |

| Machinery & Equipment | -2.63% | China’s machinery industry to maintain steady growth in 2022 Zoomlion Heavy Industry Science and Technology Co., Ltd. (1157 HK) |

| Marine & Harbour Services | -2.48% | Oil shipping costs soar for key routes following invasion and sanctions Orient Overseas International Ltd (316 HK) |

- Huitongda Network Co Ltd (9878 HK) shares rose 11.6% yesterday. On February 18, one of China’s top 500 companies, Huitongda Network, was listed on the Hong Kong Stock Exchange. Recently, Jiuguijiu and representatives of Huitongda signed a strategic cooperation agreement. Liu Xiaoliang, general manager of the Huitongda, said that the cooperation involves integrating industrial Internet of things (IoT) with Jiuguijiu’s traditional liquor channels. The cooperation with Jiuguijiu will be a new starting point for Huitongda’s marketing reform.

- Orient Overseas International Ltd (316 HK), Pacific Basin Shipping Limited (2343 HK), COSCO SHIPPING Holdings Co Ltd (1919 HK). Shipping sector shares rose collectively yesterday. Shares rose 7.7%, 7% and 6.7% respectively yesterday. Bank of America Securities issued a research report and rated a BUY rating on Pacific Basin Shipping and the target price was raised from HK$6.1 to HK$6.7. The report mentioned that the company’s management expressed confidence that freight rates are in a seasonal recovery, and the market freight rates are expected to be strong in the coming months. Regarding Russia and Ukraine, management stated that only 2-3% of shipments were affected.

- RemeGen Co Ltd (9995 HK) shares extended their rally and rose 6.7% yesterday. Last week, Daiwa reiterated its BUY rating on Remegen as the bank’s preferred stock in biotechnology, saying that it is still confident in its overseas development and believes that the company is seriously undervalued. However, Daiwa lowered its forecast for the company’s full-year overseas revenue by 20%, and lowered its target price from HK$130 to HK$114.

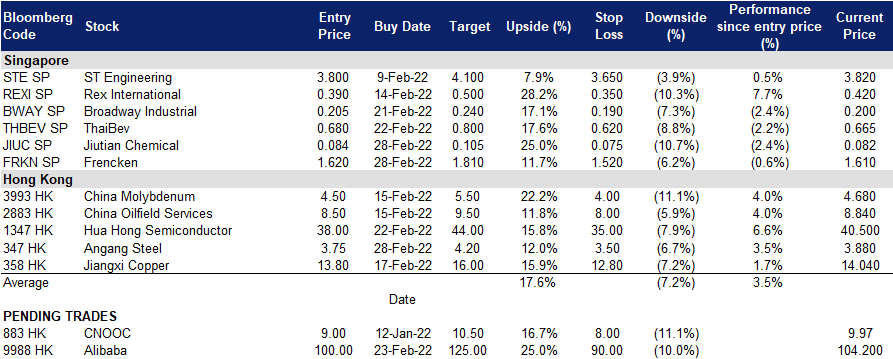

Trading Dashboard

Trading Dashboard Update: Take profit on First Resources (FR SP) at S$1.90. Add Jiutian Chemical (JIUC SP) at S$0.084 and Frencken (FRKN SP) at S$1.62. Add Angang Steel (347 HK) at HK$3.75. Cut loss on Ping An Insurance (2318 HK) at HK$60.

(Click to enlarge image)

Related Posts: