7 April 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

Market Movers

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Tobacco | +3.0% | Philip Morris: Buy this 5.5% Yielding Dividend Aristocrat Now Before Everyone Else Does Philip Morris International Inc (PM US) |

| Managed Health Care | +2.5% | UnitedHealth, Change Healthcare extend closure of merger deal by 9 months UnitedHealth Group Inc (UNH US) |

| Pharmaceuticals: Major | +2.5% | Eli Lilly price target raised at Morgan Stanley on robust product outlook Eli Lilly (LLY US) |

Top Sector Losers

| Sector | Loss | Related News |

| Hotels/Resorts/Cruise Lines | -4.4% | Why Royal Caribbean, Carnival, and Norwegian Cruise Stocks All Just Crashed Carnival Corp (CCL US) |

| Packaged software | -3.5% | Global Bond Selloff Deepens as Fed Steps Up Tightening Rhetoric Microsoft Corp (MSFT US) |

| Motor Vehicles | -3.4% | Ford’s first-quarter sales fell 17% as the automaker battled a chip shortage Ford Motors (F US) |

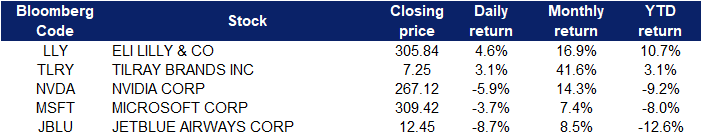

- Eli Lilly & Co (LLY US) shares rose 4.6% yesterday after Morgan Stanley named Eli Lilly a top pick. The investment firm said Eli Lilly had the “most robust new product cycle” outlook in the industry.

- Tilray Inc (TLRY US) shares rose 3.1% yesterday after reporting an unexpected profit in its latest quarter. Tilray also announced a deal with supermarket chain Whole Foods, which will sell the hemp powders produced by the company’s Manitoba Harvest subsidiary.

- Nvidia Corp (NVDA US) and Microsoft Corp (MSFT US) shares lost 5.9% and 3.7% respectively yesterday. Brainard, who is awaiting Senate confirmation to become Fed vice chair, said on Tuesday that the central bank “will continue tightening monetary policy methodically” and will start “to reduce the balance sheet at a rapid pace as soon as our May meeting.” Swaps markets anticipate the Fed will start increasing rates by more than a quarter percentage point at a time, with greater than 80% odds of a half-point move priced in for the May meeting. Overall, around 2.22 percentage points of additional hikes are priced in for the next six meetings through December, up from 2.13 on Monday.

- JetBlue Airways Corp (JBLU US) shares fell another 8.7% yesterday, as investors weighed the airline’s $3.6 billion cash offer to take over rival Spirit Airlines. The move also comes after Raymond James downgraded JetBlue to market perform from outperform.

Singapore

- Place Holdings Ltd (THEPLACE SP) shares rose 6% yesterday. The Place Holdings recently announced that it has entered into a non-binding memorandum of understanding (MOU) with Stellar Lifestyle, a business arm of SMRT Corporation, to jointly collaborate to shape the future of digital media and tap new opportunities in the digital economy. Stellar Lifestyle is the largest managing agent of retail and advertising spaces in Singapore’s rail network. As part of the collaboration, both parties aim to build Singapore’s first Sky Screen, a suspended video screen. The Sky Screen is envisaged to be a new attraction in Singapore that will be integrated with smart digital technology system and immersive media, boosting new business vibrancy and creating new possibilities in digital media solutions.

- Samudera Shipping Line Ltd (SAMU SP) shares rose 5.1% yesterday. The company announced on Tuesday that the approval on the proposed adoption of the share buyback mandate will be sought at the company’s EGM held on 27 April 2022.

- Geo Energy Resources Ltd (GERL SP) and Golden Energy & Resources Ltd (GER SP) shares rose 2% and 0.9% respectively yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, rebounded from their lowest level in a month to around $300 a tonne, buoyed by European Union plans for an embargo on Russian coal following mounting evidence of war crimes committed by its forces on the outskirts of Kyiv.

- Golden Agri-Resources Ltd (GGR SP) shares rose 1.7% yesterday. Malaysian palm oil futures consolidated above the MYR 5,800-a-tonne level, rebounding from a six-week low around MYR 5,450 as crude oil steadied and investors assessed signs of firm export demand. Malaysia’s palm oil exports in March rose between 6.7% and 7.4% from the prior month as shipments to China and India picked up, according to data by cargo surveyors. Still, recently, prices have been under pressure amid a higher global palm production outlook, mainly from Indonesia and Malaysia.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Medicine | +1.25% | China Kintor’s COVID drug candidate cuts hospital, death risk in trial Kintor Pharmaceutical Ltd (9939 HK) |

| Chemical Products | +1.07% | China books biggest deal for U.S. corn since May 2021 Theme International Holdings Ltd. (990 HK) |

| Biotechnology | +0.93% | WHO panel sees potential benefits of traditional Chinese medicine in Covid-19 treatment Zai Lab Ltd. (2925 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Coal | -2.35% | Asia’s Coal Price Jumps as EU’s Russia Ban Adds Supply Risks Yancoal Australia Ltd (3668 HK) |

| Automobiles & Components | -2.35% | China’s zero-Covid strategy hampers auto output in Shanghai Great Wall Motor Co Ltd. (2333 HK) |

| Commercial Vehicle | -2.19% | Shanghai’s ‘grim’ Covid outbreak threatens more global supply chain disruption Zhuzhou CRRC Times Electric Co., Ltd.(3898 HK) |

- Kintor Pharmaceutical Ltd (9939 HK) shares surged 106.4% yesterday after saying its pill was highly effective in reducing the risk of hospitalisation or deaths related to Covid-19, raising the prospect of a first homegrown antiviral treatment. If results hold, the drug would become the first Covid-19 antiviral oral drug developed by a Chinese firm, adding to antiviral treatments available from Pfizer Inc. and Merck & Co Inc. China approved Pfizer’s Paxlovid in February and has been using it to treat patients in the current outbreak as daily cases exceed 20,000 this week amid omicron’s spread in Shanghai.

- Yuexiu Property Co Ltd (123 HK) shares rose 7.3% yesterday. The “2022 China’s Top 100 Real Estate Enterprises” list was released yesterday and Yuexiu Real Estate jumped to the 13th place, up 29 places YoY. The evaluation index system analyses the stability of the enterprise, in-depth inspection and review of the actual operation of the company’s land acquisition, sales, project construction, etc., and selects stable and strong companies.

- Inner Mongolia Yitai Coal Company Ltd (3948 HK) shares rose 6.7% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, rebounded from their lowest level in a month to around $300 a tonne, buoyed by European Union plans for an embargo on Russian coal following mounting evidence of war crimes committed by its forces on the outskirts of Kyiv.

- China Overseas Land & Investment Ltd (688 HK) shares rose 5.8% yesterday. Recently, the company’s management said that it will continue to actively carry out mergers and acquisitions this year. Zhang Zhichao, CEO of the company, said that from January to March this year, the company’s total investment has exceeded 20 billion. Now that the entire market is in the process of recovery, investment opportunities are still relatively lucrative and the company is making efforts in mergers and acquisitions.

- Zhuzhou Crrc Times Electric Co Ltd (3898 HK) shares lost 7.5% yesterday. Morgan Stanley issued a report saying that the company’s fourth-quarter results were in line with expectations, however the decline in gross profit margin dragged down profitability. The bank cut its net profit forecast from 2022 to 2023 by 22%-23%, and also cut the target price by 37% from HK$72 to HK$45, taking into account 2021 results and higher equity risk premium. The bank is however long-term bullish on the company given its technological advantages and significant progress in new energy vehicle penetration IGBT business, and maintains its “overweight” rating.

Trading Dashboard

Trading Dashboard Update: Add BYD (1211 HK) at HK$238. Cut loss on COSCO shipping (1919 HK) at HK$13.8.

(Click to enlarge image)

Related Posts: