02 August 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Consumer Non-Durables | +0.96% | Colgate-Palmolive (CL) Acquires Three Manufacturing Plants from Red Collar Pet Foods for $700M Colgate-Palmolive Company (CL US) |

| Retail Trade | +0.87% | Amazon launches same-day delivery from some brick-and-mortar retail brands Coupang Inc (CPNG US) |

| Consumer Durables | +0.83% | Auto sales show positive trends in July as global chip headwinds ease Ford Motor Company (F US) |

Top Sector Losers

| Sector | Loss | Related News |

| Energy Minerals | -1.95% | Oil prices slip as weak manufacturing data stokes recession fears Pioneer Natural Resources Co (PXD US) |

| Non-Energy Minerals | -1.29% | Chilean authorities investigate mysterious large sinkhole near copper mine Freeport-McMoRan Inc (FCX US) |

| Industrial Services | -0.99% | U.S. manufacturing slows modestly; excess inventories a major concern Baker Hughes Co (BKR US) |

- Pinterest Inc (PINS) Shares rose 2.62% yesterday and jumped 21.51% in after-market trading after it announced disappointing financial results and gave guidance that missed Wall Street expectations, but user numbers were better than expected. The company turned in earnings, excluding one-time items, of 11 US cents a share or US$666M in revenue, while analysts had forecast it to earn 18 US cents a share on almost US$667M in sales. Pinterest said in a statement that it expects its third-quarter sales “will grow mid-single digits on a year percentage basis.” Pinterest also said it sees expenses growing, and forecast operating expenses will grow in the low double digits on a quarter-over-quarter basis.

- Boeing Co (BA US) Shares rose 6.13% yesterday after the company received preliminary US regulatory clearance to restart deliveries of its 787 Dreamliner aircraft, paving the way for the end to a drought that drained cash and dented the planemaker’s reputation for quality.

- American Airlines Group Inc (AAL US) Shares rose 4.16% yesterday as the airline sector went up. There was no company-specific news. The move was driven by the plunge in crude oil prices, and hence jet fuel prices would fall accordingly.

- Freeport-McMoRan Inc (FCX US) Shares dropped 4.98% yesterday. There was no company-specific news. The ISM Manufacturing PMI edged lower to 52.8 in July of 2022 from 53 in June, beating market forecasts of 52. The reading pointed to a 26th straight month of rising factory activity but the weakest rate since June of 2020, as new order rates continue to contract although supplier deliveries improved and prices softened to levels not seen in two years.

- Royal Caribbean Cruises Ltd (RCL US) Shares fell 7.54% on news of a new private offering of debt, as the company attempts to rework its balance sheet after being forced to scramble for funds during the pandemic shutdown. The new offering involves US$900M of senior convertible notes due 2025. The cruise operator said this will replace some of its existing near-term maturities with longer-term ones.

Singapore

- Jumbo Group (JUMBO SP) surged 9.8% after SAC Capital initiated on the stock with a BUY rating and a TP of S$0.38. JUMBO is expected to be propelled by optimism on a sales rebound driven by pent-up domestic demand and tourist arrivals. There are expectations that with the reopening of the economy and removal of border restrictions, there is a strong pent-up demand for dining-out and an increase in tourists visits. Other upside factors listed include an enlargement of the footprint of Jumbo Seafood and other brands in Asia through the franchise model as well as a potential to raise prices in an inflationary environment

- Raffles Medical (RFMD SP) gained 4.4% after it reported earnings of $59.7 million for the 1H22, 51.3% YoY higher. Earnings per share (EPS) stood 51.2% higher at 3.19 cents for the 1HFY2022 on a fully diluted basis. Revenue for the half-year period increased by 11.2% YoY to $382.3 million. This was attributable to the higher revenue from the healthcare division, which increased on the back of higher local and foreign patients seeking treatment in Singapore. At the same time, this was offset by the decrease in its hospital services revenue as there was a lower number of polymerase chain reaction (PCR) diagnostic tests carried out during the period.

- NIO (NIO SP) jumped 7.9% after China announced plans to extend a tax incentive for electric vehicle purchases beyond the December sunset date as the government tries to expand the market for EVs, an area where domestic manufacturers hold an advantage. The State Council, China’s cabinet decided last week to continue the acquisition tax exemption for new energy vehicles, a catch-all term for various types of electrified cars. The State Council did not specify the length of the extension, but “it could be for another year,” an industry group executive said.

- Oil plays such as Rex International (REXI SP), and RH PetroGas (RHP SP) declined 3.9% and 6.7% respectively after Oil prices dropped about 4% on Monday as weak manufacturing data in several countries weighed on the demand outlook while investors braced for this week’s meeting of OPEC and its producer allies on supply. Factories across the United States, Europe and Asia struggled for momentum in July as flagging global demand and China’s strict COVID-19 restrictions slowed production, surveys showed on Monday, likely adding to fears of economies sliding into recession.

- Ascendas India Trust (AIT SP) gained 3.5% as it posted a S$0.0428 distribution per unit (DPU) for 1H22, up 2% YoY, thanks to an increase in occupancy in major tech parks. Total property income for the half-year came in at S$103.3 million, up 8% YoY. This was driven by contributions from the aVance 6 building in Hyderabad, Building Q1 in Aurum Q Parc, Arshiya Warehouse 7, and the industrial facility in Mahindra World City, Chennai. a-iTrust also enjoyed higher utilities and car park income. The trust’s portfolio occupancy increased to 90 per cent, backed by significant leases signed in International Tech Park Chennai (ITPC) and International Tech Park Bangalore (ITPB).

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Automobiles & Components | +1.95% | Chinese premier stresses promoting effective investment, consumption Geely Automobile Holdings Ltd (175 HK) |

Electronic Component | +1.52% | China’s factory activity posts shock contraction in July despite economic rebound Sunny Optical Technology (Group) Co. Ltd (2382 HK) |

Alcoholic Drinks & Tobacco | +1.36% | Heineken posts strong first-half, shelves 2023 margin target Tsingtao Brewery Co Ltd (168 HK) |

Top Sector Losers

Sector | Loss | Related News |

Property Management & Agency | -2.95% | Evergrande Debt Setback Drags China Developers to Five-Month Low Country Garden Services Holdings Co Ltd (6098 HK) |

Electricity Supply | -2.32% | China’s Rebound Remains Fragile as Factories, Property Slump China Power International Development Limited (2380 HK) |

Medicine | -2.08% | New China CDC chief has a key mission: pushing on with the zero-Covid policy China Resources Pharmaceutical Group Ltd (3320 HK) |

- Geely Automobile Holdings Ltd (175 HK) Shares jumped 12.90% yesterday. Great Wall Motor Company Limited (2333 HK) Share jumped 10.02% yesterday. NIO Inc (9866 HK) Shares rose 8.28% yesterday. Xpeng Inc (9868 HK) Shares rose 6.74% yesterday. Li Auto Inc (2015 HK) Shares rose 6.34% yesterday. Automobile sector jumped after an executive meeting of the State Council hosted by Premier Li Keqiang last Friday revealed that China will continue its policy of exempting new energy vehicles from purchase taxes. The electric vehicle purchase tax exemption, which was launched in 2014, allowed most consumers who purchase green vehicles to save about RMB 10,000 (around $1,500). The incentive applied to purchases involving battery electric vehicles and fuel-cell vehicles. The policy initially expired at the end of 2017, but it was extended to the end of 2020. In March 2020, however, China opted to extend the NEV purchase tax exemption program to the end of 2022 instead. And as could be seen in the recent government meeting, the program has been extended once more.

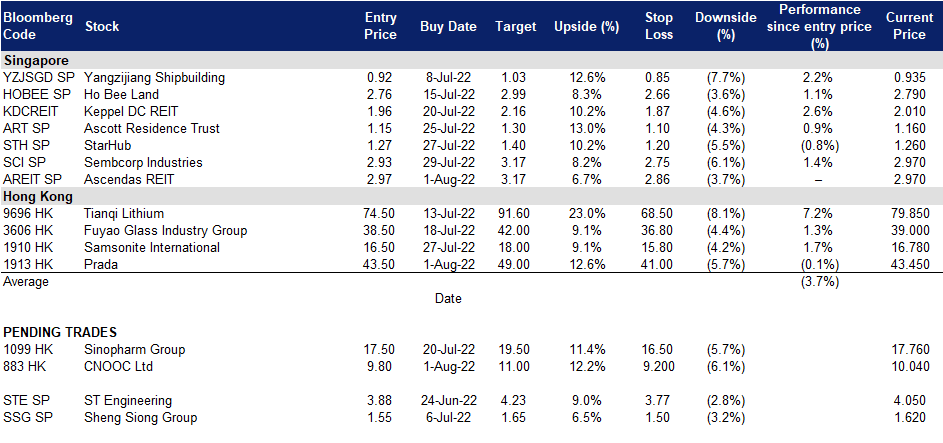

Trading Dashboard Update: Add Ascendas REIT (AREIT SP) at S$2.97 and Prada (1913 HK) at HK$43.5. Cut loss on Yanlord Land Group (YLLG SP) at HK$1.03.